Very few traders know about this unique market phenomenon. Those who do could capture short term option returns – of up to 320%. How it works is simple: if a stock crosses one red line the setup is “armed” And, if it crosses the second red line? We get an explosive move.

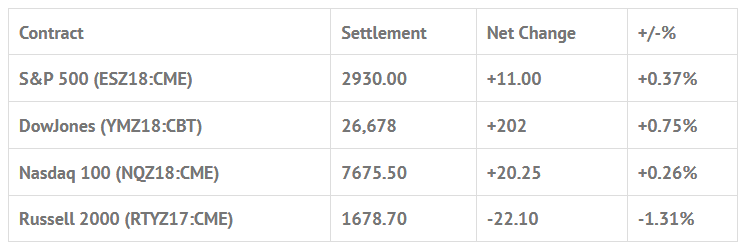

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp +1.06%, Hang Seng -2.38%, Nikkei +0.10%

- In Europe 12 out of 13 markets are trading lower: CAC -0.63%, DAX -0.64%, FTSE -0.35%

- Fair Value: S&P +4.62, NASDAQ +25.78, Dow +11.67

- Total Volume: 1.23mil ESZ & 214 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Redbook 8:55 AM ET, Randal Quarles Speaks 10:00 AM ET, a 4-Week Bill Auction 11:30 AM ET, and Jerome Powell Speaks 12:00 PM ET.

S&P 500 Futures: Tariff Rip And Then The DIP

After rallying up to 2937.75 in the overnight session on news of the U.S. trade deal with Canada, the S&P 500 futures opened Monday’s regular trading hours at 2933.75, up +14.75 handles. The morning low at 2932.75 was printed right after the open, and was followed by a string of buy programs that catapulted the ES up to 2942.00 just after 9:30, as the Nasdaq futures hit new all time highs.

The late morning trade saw the S&P’s trail lower until the opening range was breached, and printed a late morning low of 2931.25 just before the noon hour, completing a MrTopStep 10 handle rule. From there, the ES traded back up to the 2935.25 around 12:30 CT, and then began to fade down to new lows late in the session. As the MiM came alive and started showing $350 million to sell, the ES printed another new low at 2922.50 before trading up to 2929.50 on the 3:00 cash close, and settling the day at 2929.75, up +10.75 handles or +0.37%.

In the end, the day was consistent with the prior three, bullish early on the open then sell off late morning early afternoon, but closing off the low of day.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.