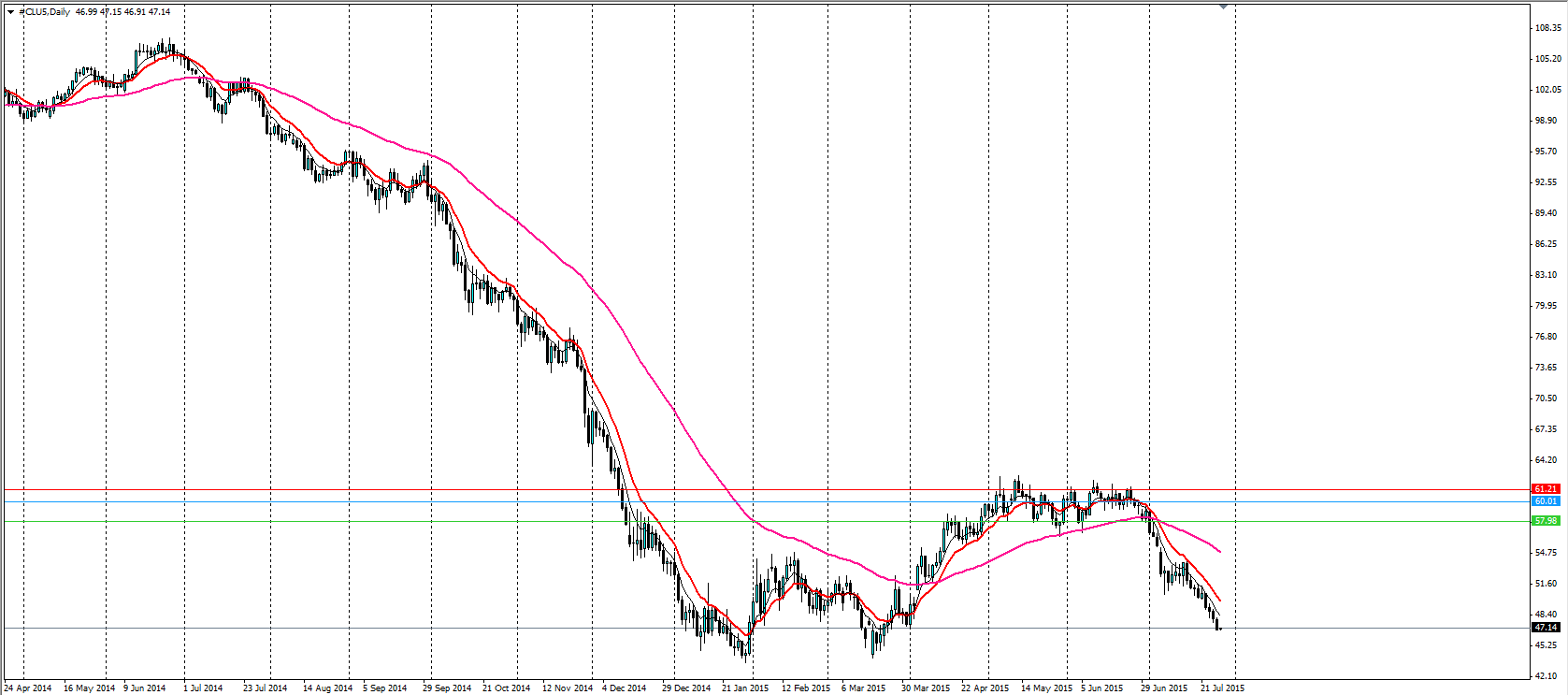

Crude oil prices managed to touch a four-month low as concerns over a supply imbalance, along with China’s stock market crash, weighed upon the commodity. There continues to be mounting concern over slowing demand within China and the global crude oil glut that just will not abate.

In particular, WTI crude futures have been hit hard with the release of a rig report that showed producers activating 21 oil rigs last week. This increase represents the largest single rally in production activity for over a year.

The sharp decline of Chinese equities, by over 8%, is also weighing heavily upon the commodity as there are concerns as to whether the rout will affect the world’s biggest energy consumer’s appetite for black gold. However, crude oil’s losses have been cushioned somewhat by the weaker US dollar. Subsequently, commodities denominated in the greenback have found increased demand as the currency has depreciated.

What is concerning is that the imbalance within the global crude oil market is still continuing and although price has adjusted lower, a stable equilibrium is yet to be reached. The full effect of the lower prices is yet to be felt through much of the oil producing world. In fact, major producers in the Middle East are still pumping over 2% in excess of current demand. Considering the growing glut of crude supply, oil prices have only one direction to go, down.

Despite the growing concerns, Brent has managed to remain above the $50 a barrel level, whilst WTI crude is facing pressure at the $47.00 handle. This is significantly higher than forward analysis would have suggested some months back. However, whilst this excessive supply issue remains in frame, oil prices must move lower to establish stable price equilibrium.

Most analysts tend to view the WTI prices as currently over-valued given the fundamentals and modelling has shown that the commodity may fall at least another $10 a barrel before Christmas. In support of this analysis is the fact that most hedge fund managers and traders are net short the commodity.

The next few months are going to be critical for oil prices and it is hard to see much in the way of upside for them. This is especially salient given the coming seasonal weakness as the US bids goodbye to the bullish summer months. This fact, coupled with the continuing global oversupply, provides plenty of fuel to the case for weaker crude prices.

Subsequently, I reiterate my medium term forecast for WTI futures to trade within the $37.00 - $42.00 a barrel range during the latter part of 2015.