Before the last January ’18, February ’18 plunge in the equity markets. the SP 500 peaked on January 26th, 2018 at 2,872 – 2,873. With Friday night’s close at 2,945, the total gain for the SP 500 (excluding dividends) is 2.5% from that January ’18 peak.

That is a paltry return for the benchmark since January ’18, despite the YTD return on the SP 500 of roughly 17%.

The SP 500 has basically gone nowhere for 16 months.

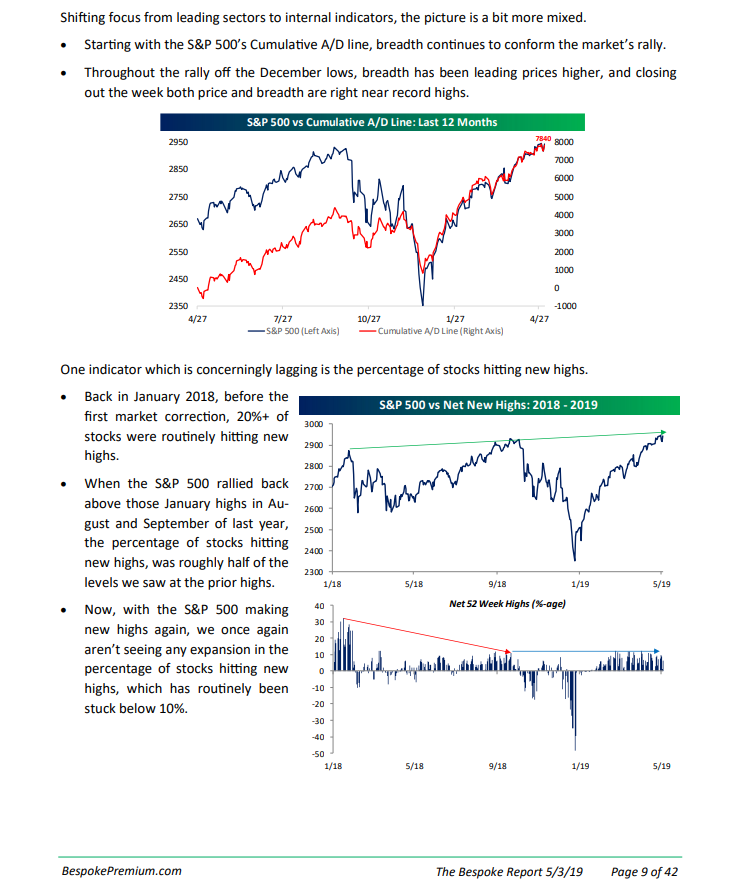

Does that mean a longer-term top could be forming for the SP 500? It could. Jeff Miller asked the same question this weekend. The Dash’s conclusion would seem to lead investors to conclude a longer-term top isn’t yet forming for the SP 500, and because of Bespoke’s market breadth data, I would concur that the SP 500 is probably correcting through time, rather than price.

Here are the YTD returns for Corporate High-Grade and Corporate High-Yield asset classes since the end of March ’19:

Corp High-Grade:

- 5/3/19: 5.54%

- 4/26/19: 5.71%

- 4/19/19: 5.34%

- 3/29/19: 5.14%

Corp High-Yield:

- 5/03/19: 8.80%

- 4/26/19: 8.66%

- 4/19/19: 8.44%

- 3/29/19: 7.26%

Summary/conclusion: Corporate High-Grade and High-Yield credit markets as well as market breadth data, continue to support higher SP 500 prices and valuation, not to mention what I think will be improved SP 500 earnings data as we move through 2019.

I like the fact that high-grade and high-yield credit spreads continue to slowly tighten and total returns continue to improve after 2017 and 2018, which Charlie Bilello of Pension Partners called the worst two years for the bond markets since 1980 and 1981, the days when interest rates were 12% – 15% and mortgage rates were 10% – 11%.

Sharp-eyed investors will note that despite the 22.5% return for the SP 500 in calendar 2017, the HYG or the corporate high-yield ETF proxy returned 6% that calendar year, so the YTD return for the HYG in 2019 is already higher than in 2017.

Credit spreads can widen and the SP 500 may not react as negatively to it, but with credit spreads behaving well, as they are currently, I do think it bodes well for expected returns for the rest of 2019.

A weaker dollar would help too. Even with Friday’s strong payroll number and the ADP number from Wednesday, the DXY or dollar index sold off Friday as the day progressed. The 97 – 98 level is critical for the DXY.