We’re less than a month into Donald Trump’s presidency. But Trump anxiety is already running wild.

Before the 45th president took office, his critics often heard the same counterargument. “Calm down, he’s not really going to build a wall at Mexico’s expense or ban Muslims from the country.”

But since Trump came to power in January, he has made it clear that these controversial stances were not just campaign rhetoric. A flurry of executive orders has put the wall and immigration restriction projects in motion. They’ve ignited protests around the country as well as great uncertainty in financial markets. That’s bad news for many investors. But it’s great news for gold prices.

The yellow metal is coming off of a less-than-stellar year. Gold prices fell in the second half of 2016, pushed down by rising interest rates and a global equity rally. The metal is often used as a hedge or safe-haven investment. And until recently, there wasn’t much perceived risk to hedge against.

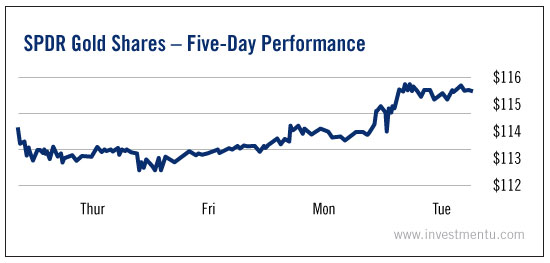

But as President Trump hits the ground running with his bold executive orders, investors are starting to get nervous. That’s why gold has gained for three straight days.

Let’s see why gold prices have recovered so sharply -- and why they could potentially go a lot higher.

How Trump Anxiety Helps Gold Prices

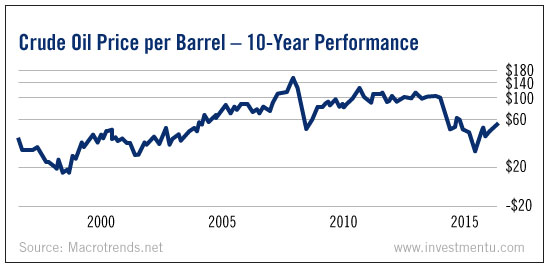

Why is Trump-related nervousness good for gold prices? One reason has nothing to do with Trump or gold specifically. In general, political uncertainty pushes up commodity prices. When trade relationships between nations are strained, investors fear disruptions to the supply of raw materials.

Oil provides a recent historical example of this. It experienced quite a bull run in the early 2000s, as the implications of 9/11 and the war in Iraq weighed on commodity investors.

Another factor linking gold prices and Trump anxiety is the U.S. dollar. The president has put a spotlight on our country’s lack of competitiveness in international trade. And to that end, Trump has suggested that the dollar is “too strong.”

Trump wouldn’t be the first president to try to weaken the dollar for economic reasons. His most recent predecessor appointed Janet Yellen. And her policies of low-interest lending and quantitative easing were intended to inflate the money supply and help exporters.

But Trump’s comment came as a bit of a shock, given the recent bull market for the dollar. Outside of the country, U.S. currency and U.S. bonds are hedge assets that compete with gold. A strong dollar (like we have now) tends to push down gold prices. A weak dollar (like Trump wants) tends to push them up.

How To Invest

Before we name any ETFs, we should caution you that it’s too early to say whether these trends will continue. If there’s one thing that’s predictable about Trump, it’s his unpredictability.

The president could slow down his use of executive authority. He could soften his protectionist stance on trade. Or he could reverse course on the dollar. Who knows?

But if he doesn’t, then Trump anxiety could be particularly lucrative for gold miners. They tend to be especially sensitive to potential changes in the supply of the shiny stuff, since they’re the ones pulling it out of the ground.

The VanEck Vectors Gold Miners ETF (NYSE:GDX) and the Sprott Gold Miners ETF (NYSE:SGDM) have done pretty well in the last year, despite a decline after the interest-rate hike.

It might seem counterintuitive to suggest that there’s an upside to gold when the Dow is at all-time highs. But then again, a few months ago it would’ve seemed counterintuitive to suggest that Donald Trump would be the next president of the United States.

Unless Trump takes a more conciliatory tone in his future actions, Trump anxiety will continue to affect financial markets. That will be bad news for many investors. But by giving your portfolio some exposure to gold prices, you can profit from it.

Thoughts on this article?