Coty Inc. (NYSE:COTY) posted fourth-quarter fiscal 2017 results, wherein while earnings lagged the Zacks Consensus Estimate, revenues beat the same.

The company posted break-even adjusted earnings in the quarter, lagging the Zacks Consensus Estimate of 9 cents. Adjusted earnings also declined from the year-ago earnings of 13 cents due to a decline in adjusted operating income related to higher marketing spending and higher interest expense.

Quarter in Detail

The company generated revenues of $2.24 billion in the fourth quarter beating the Zacks Consensus Estimate of $2.17 billion by 3.1%. Revenues surged 108.4% from the prior-year quarter, driven by the positive contribution from the acquisitions of ghd and Younique. On a constant currency basis, revenues increased 5%.

Excluding acquisition impact, net revenues of the combined company of Legacy-Coty and P&G Beauty Business declined 3% on a constant currency basis. This reflects the benefit of approximately 1% from pre-shipments to customers prior to the termination of transition services for Europe under the Transition Services Agreement (TSA) signed on July 1.

Adjusted gross margin expanded 420 basis points to 62.1% in the fourth quarter driven by the addition of the higher gross margin P&G Beauty and Younique businesses. However, adjusted operating margin contracted 480 basis points to 4.0% in the quarter due to higher marketing investment to support the momentum in the business as well as higher fixed costs.

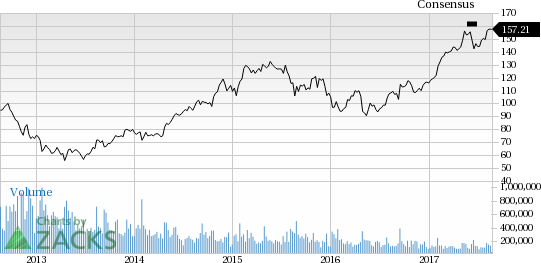

Notably, Coty’s shares have been underperforming for quite some time now. The stock has increased 3.9% in the last six months in comparison to the industry, which gained 13.5%. The industry is part of the top 26% of the Zacks Classified industries (70 out of the 265).

Fiscal 2017 Results

The company posted adjusted earnings of 63 cents in fiscal 2017, missing the Zacks Consensus Estimate of 75 cents by 16%. Adjusted earnings also declined 54% from the year-ago earnings.

Revenues reported were $7.650 billion in fiscal 2017, beating the Zacks Consensus Estimate of $7.58 billion by 0.9%. Revenues also surged 76% compared to Legacy-Coty net revenues in the prior year, driven by the positive contribution from the acquisitions of ghd and Younique. The acquisition of Brazilian product line Hypermarcas S.A. (February 2016) also provided an impetus to the growth. On a constant currency basis, revenues of the combines company grew 1%. Excluding the positive impact of acquisitions, the combined company organic net revenues declined 5% on a constant currency basis due to flat performance in Professional Beauty, a modest decline in Luxury, and continued underlying challenges in Consumer Beauty.

Segment Details

Luxury: Luxury net revenues grew 61% to $648.0 million on a reported basis. Revenues grew 5% organically, supported by strong performance at Hugo Boss, Gucci, Chloe and philosophy brands. Adjusted operating income for Luxury declined 66% to $10.0 million in the quarter.

Consumer Beauty: Consumer Beauty increased 85% to $1.126 billion on a reported basis and declined 10% organically, reflecting continued pressure on COVERGIRL, Clairol, and Sally Hansen. Adjusted operating income for Consumer Beauty increased 37% to $64.9 million.

Professional: Professional Beauty net revenues of $467.3 million increased from $63.6 million in the prior year and increased 3% organically, driven by growth in Wella and System Professional and moderating declines in OPI brand. Adjusted operating income for Professional declined 14% to $15.2 million compared with Legacy-Coty in the prior-year period.

Other Financial Updates

Coty ended fiscal 2017 with cash and cash equivalents of $535.4 million, total debt of $7.2 billion, and total shareholders’ equity of $9.3 billion.

Net cash provided by operating activities was $757.5 million compared to $501.4 million for Legacy-Coty in the prior year reflecting improved working capital for the combined company, partly offset by an increase in cash acquisition related and restructuring costs. Free cash flow in fiscal 2017 of $325.2 million decreased from $351.3 million in the prior year, reflecting a significant increase in capital expenditures associated with the P&G Beauty Business integration.

The company also paid a quarterly dividend of 12.5 cents per share for a total of $93.4 million in June.

Zacks Rank & Key Picks

Coty currently carries a Zacks Rank #3 (Hold).

Investors interested in the same sector may consider some better-ranked stocks such as Estée Lauder Companies, Inc. (NYSE:EL) , Nu Skin Enterprises, Inc. (NYSE:NUS) and Constellation Brands, Inc. (NYSE:STZ) . While Estee Lauder sports a Zacks Rank #1 (Strong Buy), Nu Skin and Constellation Brands both carry a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estée Lauder has an average positive earnings surprise of 13.7% over the last four quarters. It has a long-term earnings growth rate of 11.8%.

Nu Skin has an average positive earnings surprise of 10.8% over the last four quarters. It has a long-term earnings growth rate of 8.7%.

Constellation Brands has an average positive earnings surprise of 11.7% over the last four quarters. It has a long-term earnings growth rate of 18.2%.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Constellation Brands Inc (STZ): Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS): Free Stock Analysis Report

Coty Inc. (COTY): Free Stock Analysis Report

Estee Lauder Companies, Inc. (The) (EL): Free Stock Analysis Report

Original post

Zacks Investment Research