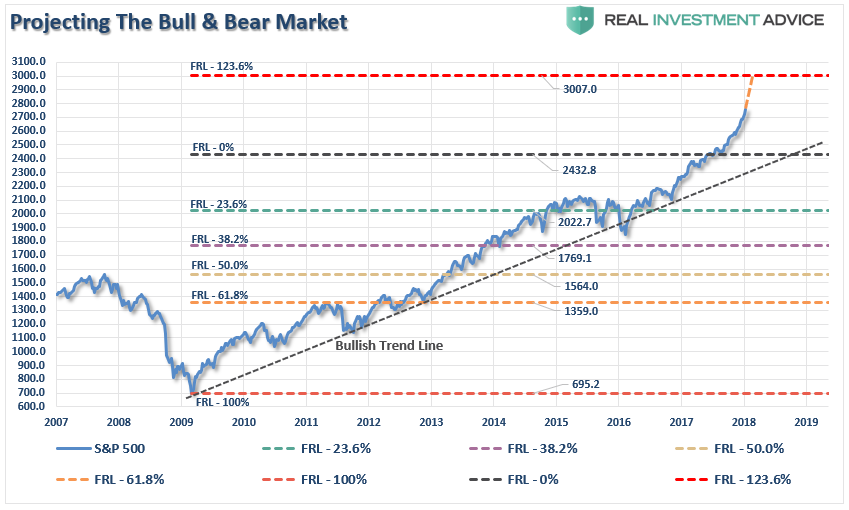

Over the past 18-months or so, I have written several articles on the potential for a “market melt-up,” which I updated in last week’s post “Market Bulls Target S&P 3000.”

“With investors now betting on a sharp rise in earnings to reduce the current levels of overvaluation, there seems to be little in the way of the next major milestones for 30,000 on the Dow and 3000 on the S&P 500.”

Note: For more on earnings and expectations read this past weekend’s newsletter.

I made the point specifically that “bull-runs” are a one-way trip.

Throughout history, overbought, excessively extended, overly optimistic bull markets have NEVER ended by going “sideways.”

Not surprisingly that article elicited quite a few emails and comments asking “what would be the ‘pin’ that pricks the current bubble.”

The true answer is I don’t know exactly what the catalyst will be.

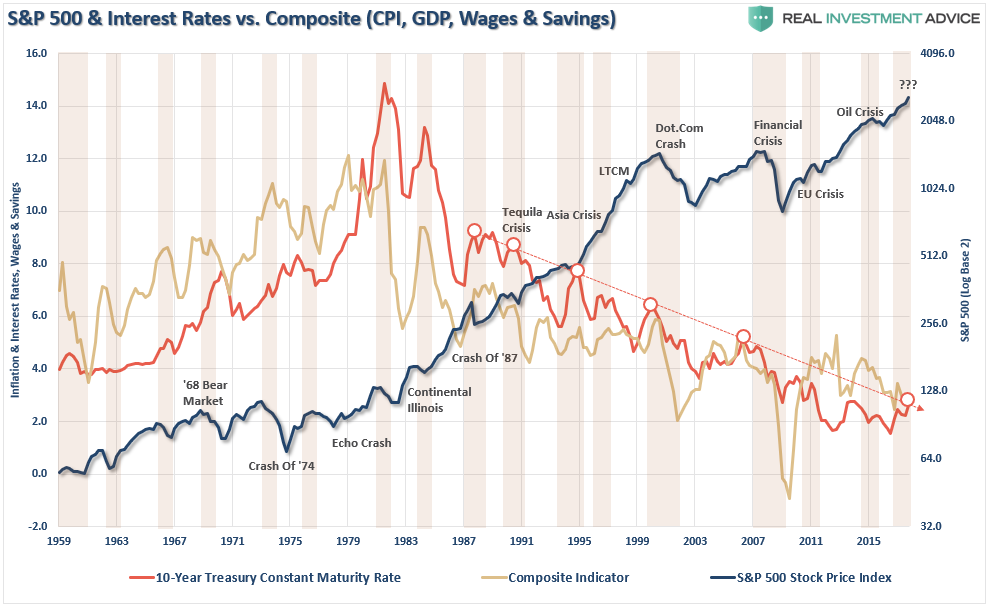

However, while much of the media is currently suggesting that interest rates are about to surge higher due to economic growth and inflationary pressure, I disagree.

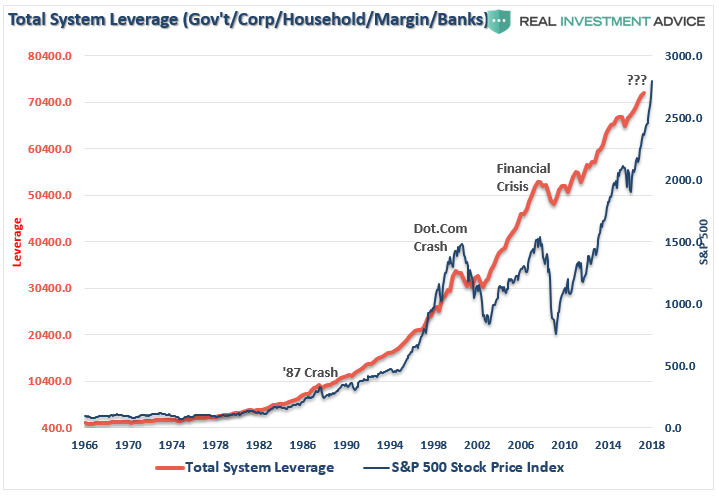

Economic growth is “governed” by the level of debt and deficits as I discussed this past weekend. Tax cuts only make that problem worse in the long-term. But as shown above, it isn’t JUST the government that is heavily leveraged – it is every single facet of the economy.

Debt has exploded.

(The chart below shows the combined totals of Government, Corporate, Household, Margin and Bank debt – in BILLIONS.)

Which leads us to our chart of the day.

Chart Of The Day (COTD)

Each time rates have “spiked” in the past it has generally preceded a mild to severe market correction.

However, when the economy is as heavily leveraged as it is today, higher borrowing costs rapidly slow economic growth as rising interest burdens divert capital from consumption. As I laid out previously, interest rates impact everything.

“1) The Federal Reserve has been buying bonds for the last 9- years in an attempt to push interest rates lower to support the economy. The recovery in economic growth is still dependent on massive levels of domestic and global interventions. Sharply rising rates will immediately curtail that growth as rising borrowing costs slows consumption.

2) The Federal Reserve currently runs the world’s largest hedge fund with over $4 Trillion in assets. Long Term Capital Mgmt. which managed only $100 billion at the time nearly brought the economy to its knees when rising interest rates caused it to collapse. The Fed is 45x that size.

3) Rising interest rates will immediately kill the housing market, not to mention the loss of the mortgage interest deduction if the GOP tax bill passes, taking that small contribution to the economy away. People buy payments, not houses, and rising rates mean higher payments.

4) An increase in interest rates means higher borrowing costs which lead to lower profit margins for corporations. This will negatively impact the stock market given that a bulk of the “share buybacks” have been completed through the issuance of debt.

5) One of the main arguments of stock bulls over the last 9-years has been the stocks are cheap based on low interest rates. When rates rise the market becomes overvalued very quickly.

6) The massive derivatives market will be negatively impacted leading to another potential credit crisis as interest rate spread derivatives go bust.

7) As rates increase so does the variable rate interest payments on credit cards. With the consumer are being impacted by stagnant wages, higher credit card payments will lead to a rapid contraction in income and rising defaults. (Which are already happening as we speak)

8) Rising defaults on debt service will negatively impact banks which are still not adequately capitalized and still burdened by large levels of bad debts.

9) Commodities, which are very sensitive to the direction and strength of the global economy, will plunge in price as recession sets in.

10) The deficit/GDP ratio will begin to soar as borrowing costs rise sharply. The many forecasts for lower future deficits will crumble as new forecasts begin to propel higher.

I could go on but you get the idea.”

Since interest rates affect “payments,” increases in rates quickly have negative impacts on consumption, housing, and investment which ultimately deters economic growth.

With “expectations” currently “off the charts,” literally, it will ultimately be the level of interest rates which triggers some “credit event” that starts the “great unwinding.”

It has happened every time in history.

Given the current demographics, debt, pension and valuation headwinds, ten-year rates much above 2.6% are going to start to trigger an economic decoupling. Defaults and delinquencies are already on the rise and higher rates will only lead to an acceleration.

The problem with most of the forecasts for the end of the bond bubble is the assumption that we are only talking about the isolated case of a shifting of asset classes between stocks and bonds. However, the issue of rising borrowing costs spreads through the entire financial ecosystem like a virus. The rise and fall of stock prices have very little to do with the average American and their participation in the domestic economy.

Interest rates, however, are an entirely different matter.

Could rates go higher from here first? Absolutely.

But bonds will likely once again spend another decade, or so, outperforming stocks.