The bears retook initiative yesterday, twisting the hands of weak longs. Where is the usual buy-the-dip mentality, and all the complacency that is part and parcel of bull markets? It's not just stocks that are at autumn crossroads, and attract extensive comments and discussions (thank you all the commenters!).

If you didn't know, I'm active and present throughout the day at investing.com (just enter my name into the search box there, and it'll offer me as the author – select an article, and check out what you're missing) , one of the sites where free versions of Stock Trading Alerts are featured daily. I'm there, interacting with my audience. I am discussing this topic today given the key juncture stocks are at.

These comments are so important that they can't go into the From the Readers' Mailbag section. Instead, I'm featuring them (marked as C) before the technical part of today's analysis.

Here are a few quotes in response to yesterday's "Correction Or Reversal? Cast Your Votes" article.

Market-Related Comments

C: Correction, reversal comes closer to elections. It just feels like a three-day bleed!

A: I'm still of the opinion that it's a sharp short-term correction, that the bull remains intact, that this is not a reversal. It's a sharp correction to scare the bulls out, and will bring in fresh blood to the bull run before October uncertainties strike in earnest. Media are talking prospects of a contested election, possibility of a Trump landslide before, you know, all those mail-in ballots come in trickling. Given what we have seen as regards rioting so far, having a clear winner right away would be the best present for the country and its stock market.

C: 3307 sp cash will be the target zone. But if cash gets below 3280 then probably 3206-3050 may be seen.

A: I agree with your assessment, but see those figures as applying not to cash, but to futures. And indeed, we saw the daily chart's 50-day moving average (3305) hold in the overnight trading.

C: AU showed the same institutional buying pattern as well on Friday. Considering the extent of this correction, I will say this is our last up before heading into the real correction starting early October. We have also not seen the Institutional liquidity swap usually seen on a trend reversal either. Further strengthening a last bull run. Patience is definitely a virtue to get the most profit out of this great opportunity.

A: Exactly, the advance-decline line behavior on Friday revealed accumulation. This was a sharp selloff as tech momentarily collapsed under its own weight. I agree that the table is set for stocks to recover.

C: The bottom of the Bollinger Bands is 330. A break below that would bring 320 into play; and in the most extreme case, 300. While 300 would arguably invalidate Monica's thesis, I think a bounce off 320 could still leave the bull intact if there is follow-through. Support is strong there and even stronger at 300, though if we reach the latter, I might suggest reevaluating where things could head in the coming months.

A: These SPY values are quite in tune with where I have drawn the line for the new stock upleg hypothesis. Look at yesterday's SPY volume drying up – I think we have seen the local low. The most probable scenario remains a renewed upswing before the real October storms arrive.

C: You were mistaken Monica, however. You said such a sharp correction will not come before October. And here we are. From the way it looks, this could be a reversal.

A: I called for a rather shallow correction in September, and this is what we got right at the start of the month instead. Higher volatility is here, and earlier than I thought judging by the 2016 precedent. That doesn't take away from the very real possibility of seeing a similarly sharp (or sharper) downside move in October.

The point is to be adaptive in adjusting one's views, to account for new realities. The great strategist Helmuth von Moltke the Elder said: “No plan survives contact with the enemy.” Very true, and applicable to trading as well.

The key takeaways are that thus far, the bull run is alive and well, that we have seen a correction and not a reversal, and that the worst of the downside is in all likelihood in the rear view mirror.

S&P 500 in the Short-Run

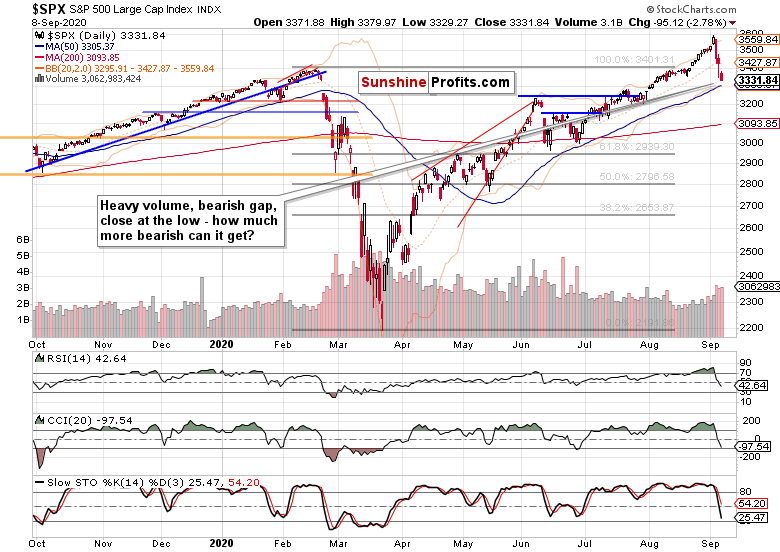

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com):

A perfectly bearish chart at first glance, and the caption just asks what else could the bears wish for? The 50-day moving average is near, and I doubt that the sellers would be able to take prices there right now. In October, that would be another story for another day.

My thoughts from last Friday on the upswing attempt are still valid today:

… the bulls will have to prove that it wouldn't turn out as a dead-cat bounce.

The Credit Markets’ Point Of View

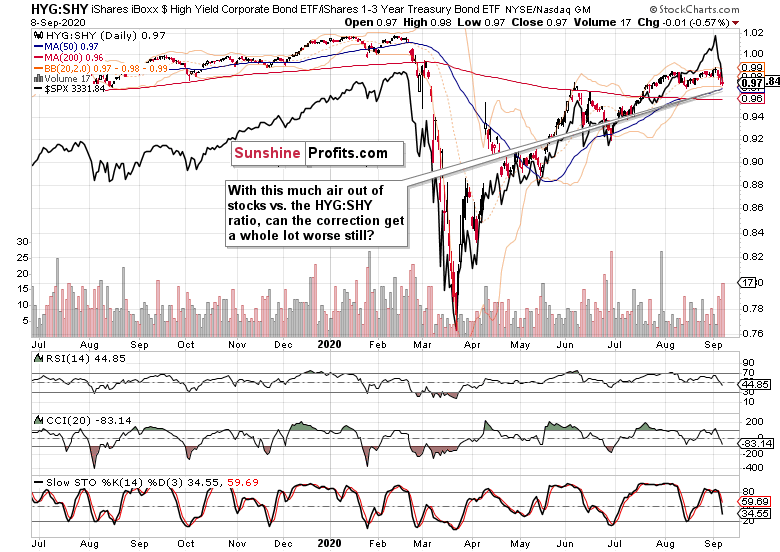

Yes, high-yield corporate bonds (HYG ETF (NYSE:HYG)) declined, but not before putting up a fight first. And I think the upper knot highlights the very real possibility that a local bottom has been reached yesterday. Sign of accumulation.

The caption says it all. Relative to the high-yield corporate bonds to short-term Treasuries (HYG:SHY) ratio's daily performance, stocks are at short-term rock bottom comparative valuations. They don't seem to have much more room to decline vis-à-vis the key credit market ratio (unless the latter takes a dive, that is – but I don't see that as probable).

Treasuries, Gold And The Dollar

Long-dated Treasuries (TLT ETF (NASDAQ:TLT)) are not on an upswing. Quite to the contrary, they've been going rather sideways recently, which mirrors the economic recovery story (rising yields are in favor of it), and the increased inflation expectations also help drive yields down.

The key point is that there is no stampede into these debt safe-haven instruments.

The liquidity squeeze indicator, the king of metals, is holding up pretty well. No, gold is not facing a margin call, and I view its latest candle as a sign of accumulation during the still bullish shape of the consolidation that I talked yesterday:

… it's my opinion that (gold) would attempt to extend the early summer gains once the floor in the U.S. dollar probes lower values again. This might take time though, as I look for USDX to spike higher first – quite a few bullish divergences have formed there, and will likely play out over the coming weeks.

And indeed, these divergences are getting resolved with greenback's upswing. Just as it has helped take oil to the cleaners, other risk-on assets are suffering too. But if the dollar were serious about its rebound (i.e. it would have serious legs), Treasuries and various yield spreads would be rising alongside, which I don't see happening right now.

The dollar putting up an appearance of a fight, is the Occam's razor style, simplest logical conclusion for the coming weeks. Unless the Democrats raise up a notch their existing calls for Joe Biden not to concede defeat under any circumstances, unless rioting ramps up, unless the Fed takes away the punch bowl and, finally, unless Americans happily march into another lockdown that who knows when it would really end and on what terms (Cuomo's conditions serve as a great, sorry, terrible example), the stock bull run can go on in September before meeting the October headwinds.

Summary

Summing up, today's article is well worth the read in its entirety, but suffice to say that the bulls have the opportunity to retake initiative, and prove that this correction is over in terms of prices at least. With rejuvenated spirits, they can recover from the setback suffered, and push somewhat higher before elections start to bite.

All essays, research and information found above represent analyses and opinions of Monica Kingsley and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Monica Kingsley and her associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Ms. Kingsley is not a Registered Securities Advisor. By reading Monica Kingsley’s reports you fully agree that she will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Monica Kingsley, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.