During the session on Thursday, the biggest announcement that we see is the Core CPI numbers coming out of America. With that being the case, we believe that most of the focus will be on the stock market in the United States, as well as the US dollar in general.

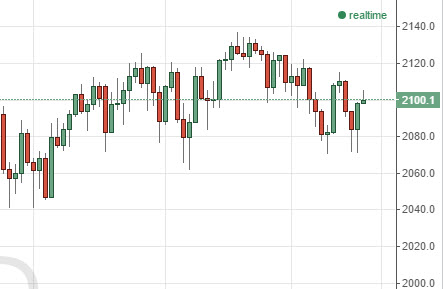

Because of this, we pay special attention to the S&P 500, which had a fairly quiet session before the FOMC announcement. We believe that the market has a proclivity to go higher anyway, so we are buyers of calls every time that the market pulls back. With that, we remain very bullish overall.

Silver markets continue to bounce around, and offer very little in the way of return. However, we believe in the longer-term story when it comes to silver, and therefore are buyers of calls and for that matter, physical silver. In the meantime though, we believe that the market will continue to be attracted to the $16 level. So we will simply buy calls if we drop, or puts if we rise.

Looking at the EUR/USD pair, we continue to be stuck between the 1.11 level on the bottom, and the 1.14 level on the top. We believe that the market ultimately goes higher though, so we certainly prefer buying calls.