We issued an updated research report on Corcept Therapeutics Inc. (NASDAQ:CORT) on Jul 12.

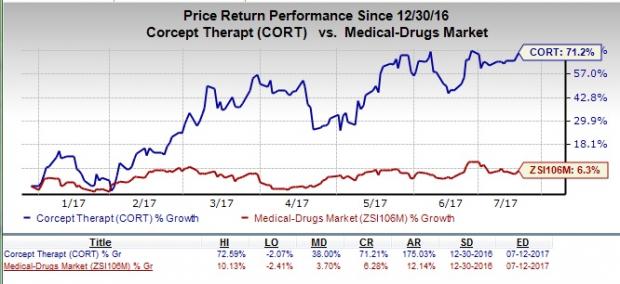

Corcept’s shares have surged 71.2% year to date, comparing favorably with the Zacks classified Medical-Drugs industry’s gain of 6.3%.

Currently, the company is striving to commercialize Korlym (mifepristone) successfully by deploying medical liaisons and sales representatives. In fact, Korlym is its only marketed drug, which is approved for the treatment of patients with Cushing's syndrome.

Notably, about 10–15 of every 1 million people are newly diagnosed with Cushing’s syndrome each year, resulting into more than 3,000 new patients annually in the U.S. Therefore, we believe increased awareness among physicians and patients about the drug and expanded sales efforts should boost sales, going forward.

Corcept is currently working on developing the drug for additional indications. It is conducting a phase I/II safety and efficacy study on Korlym in combination with Eisai Co., Ltd.’s anti-cancer drug, Halaven, for the treatment of triple-negative breast cancer (TNBC). Enrolment in the study is complete and the company announced encouraging data in Dec 2016.

We expect a successful label expansion of Korlym to boost the top line significantly, as the disease represents huge potential with as many as 40,000 women in the U.S. being diagnosed every year.

Moreover, the University of Chicago is conducting a phase II study on Korlym, in combination with Pfizer’s (NYSE:PFE) Xtandi, for the treatment of metastatic, castration-resistant prostate cancer. The institution also plans to conduct a phase II study on Korlym, in combination with Celgene’s (NASDAQ:CELG) Abraxane, for the treatment of patients with TNBC.

Importantly, apart from Korlym, Corcept is also evaluating CORT125134 for Cushing’s syndrome and a range of solid tumors. Early data on the candidate for Cushing’s syndrome has been quite promising. The company has begun dosing patients in a phase I/II study on CORT125134, in combination with Abraxane, for the treatment of a range of solid-tumor cancers. The possible target indications include triple-negative breast cancer, ovarian cancer, pancreatic cancer and sarcoma. The company expects open expansion cohorts by the end of 2017.

Additionally, the company has three promising preclinical candidates - CORT118335 (metabolic disorders), CORT122928 (alcohol withdrawal) and CORT125281 (castration-resistant prostate cancer, triple negative breast cancer, and ovarian cancer) – which are expected to enter the clinic in 2017.

Also, during its first quarter 2017 earnings release, the company raised its 2017 revenue guidance. Now, Corcept projects revenues to be in the range of $125 million to $135 million more than its prior expectation of $120 million to $130 million.

Zacks Rank & Stocks to Consider

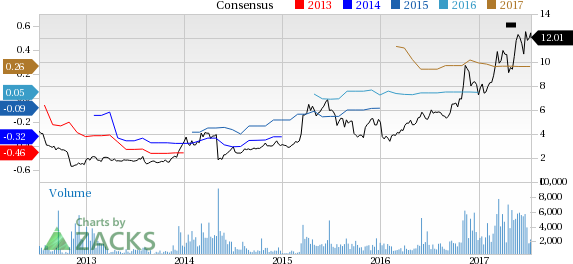

Corcept currently carries a Zacks Rank #3 (Hold). A better-ranked health care stock in the same space is Enzo Biochem, Inc. (NYSE:ENZ) sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enzo Biochem’s loss per share estimates narrowed from 12 cents to 7 cents for 2017 and from 11 cents to 3 cents for 2018, over the last 30 days. The company delivered positive earnings surprises in all the trailing four quarters, with an average beat of 55.83%. The share price of the company has increased 63.7% year to date.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market. Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Pfizer, Inc. (PFE): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Original post

Zacks Investment Research