Corcept Therapeutics Incorporated (NASDAQ:CORT) reported third-quarter 2019 earnings of 22 cents per share, surpassing the Zacks Consensus Estimate of 19 cents and also the year ago quarter’s figure of 14 cents.

Additionally, earnings included the impact of stock-based compensation and the utilization of deferred tax assets. Taking this into account, adjusted earnings came in at 31 cents per share compared with 22 cents in the year-ago quarter.

Moreover, revenues in the reported quarter rose 26.6% from the prior-year period to $81.5 million, primarily backed by higher sales and the strong uptake of Corcept’s Cushing’s syndrome drug Korlym. Sales also beat the Zacks Consensus Estimate of $78 million.

Research and development expenses increased 20.6% to $22.8 million. Selling, general and administrative expenses also escalated 13.6% to $24.2 million.

Shares of Corcept were up 8.7% in after-hours trading following the company’s release of better-than-expected results. In fact, the stock has rallied 9.3% so far this year, outperforming the industry’s growth of 3.7%.

2019 Guidance

Corcept narrowed the lower end of its revenue guidance for 2019. The company now expects the same in the range of $300-$315 million compared with the previous view of $285-$315 million.

Pipeline Update

Corcept’s lead candidate relacorilant is being evaluated in the phase III GRACE study to treat Cushing’s syndrome. Dosing is currently ongoing in the above-mentioned study at sites across the United States, Canada and Europe.

Earlier, Cushing’s syndrome patients in a phase II study exhibited meaningful improvements in glucose control and hypertension. The GRACE study is being conducted to confirm relacorilant’s positive phase II results and provide the basis for its approval in the United States and Europe. The company plans to submit a new drug application (NDA) for relacorilant in the fourth quarter of 2021.

Corcept plans to commence a placebo-controlled study of relacorilant in the first quarter of 2020 in patients whose Cushing’s syndrome is caused by adrenal adenoma.

This apart, a phase II study on relacorilant and Celgene's (NASDAQ:CELG) Abraxane is currently underway for the treatment of ovarian cancer. Enrolment of patients in the same is on. Corcept also plans to start a phase III study on the same combo for metastatic pancreatic cancer and is seeking an FDA guidance regarding the fastest path to approval for that indication.

Along with the earnings release, Corcept announced that the European Commission has granted relacorilant an orphan drug designation for treating pancreatic cancer.

Corcept also announced positive top-line results from the phase Ib study on another candidate called miricorilant for the reduction of weight-gain caused by antipsychotic. Data from the study showed that at the first dose level, healthy patients who received the combo of Eli Lily’s (NYSE:LLY) Zyprexa (olanzapine) and miricorilant gained less weight compared to those who received olanzapine + placebo.

Moreover, markers of liver damage increased with less intensity in patients receiving miricorilant than those dosed with olanzapine. Five patients treated with olanzapine alone were unable to complete the study due to elevated liver enzymes while one patient experienced the same in the miricorilant group.

Corcept is also advancing miricorilant as a treatment for NASH, a serious and widespread liver disorder, and plans to initiate a double-blind, placebo-controlled phase II study in 2020.

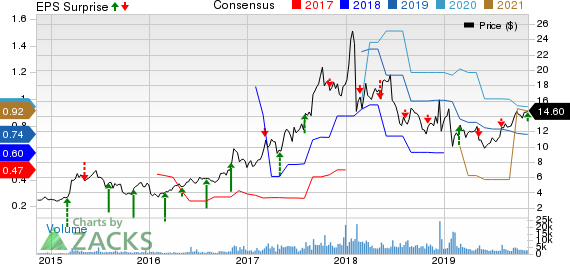

Corcept Therapeutics Incorporated Price, Consensus and EPS Surprise

Zacks Rank and Key Pick

Corcept currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the same sector is Trillium Therapeutics Inc. (NASDAQ:TRIL) , which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Trillium’s loss per share estimates have been narrowed 1.5% for 2019 and 38.5% for 2020 over the past 60 days.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Eli Lilly and Company (LLY): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Trillium Therapeutics Inc. (TRIL): Free Stock Analysis Report

Original post

Zacks Investment Research