Investing.com’s stocks of the week

Over the years Copper has been viewed as a leading global indicator for economic conditions and often stock-market performance. The chart below takes a peek at year-to-date performance of Copper ETF (NYSE:JJC), Freeport-McMoran (NYSE:FCX) and the S&P 500, showing weak performance in the Copper sector, with the opposite happening in the S&P 500.

So far in 2014, ole Doc Copper IS NOT a very good leading indicator for the S&P 500.

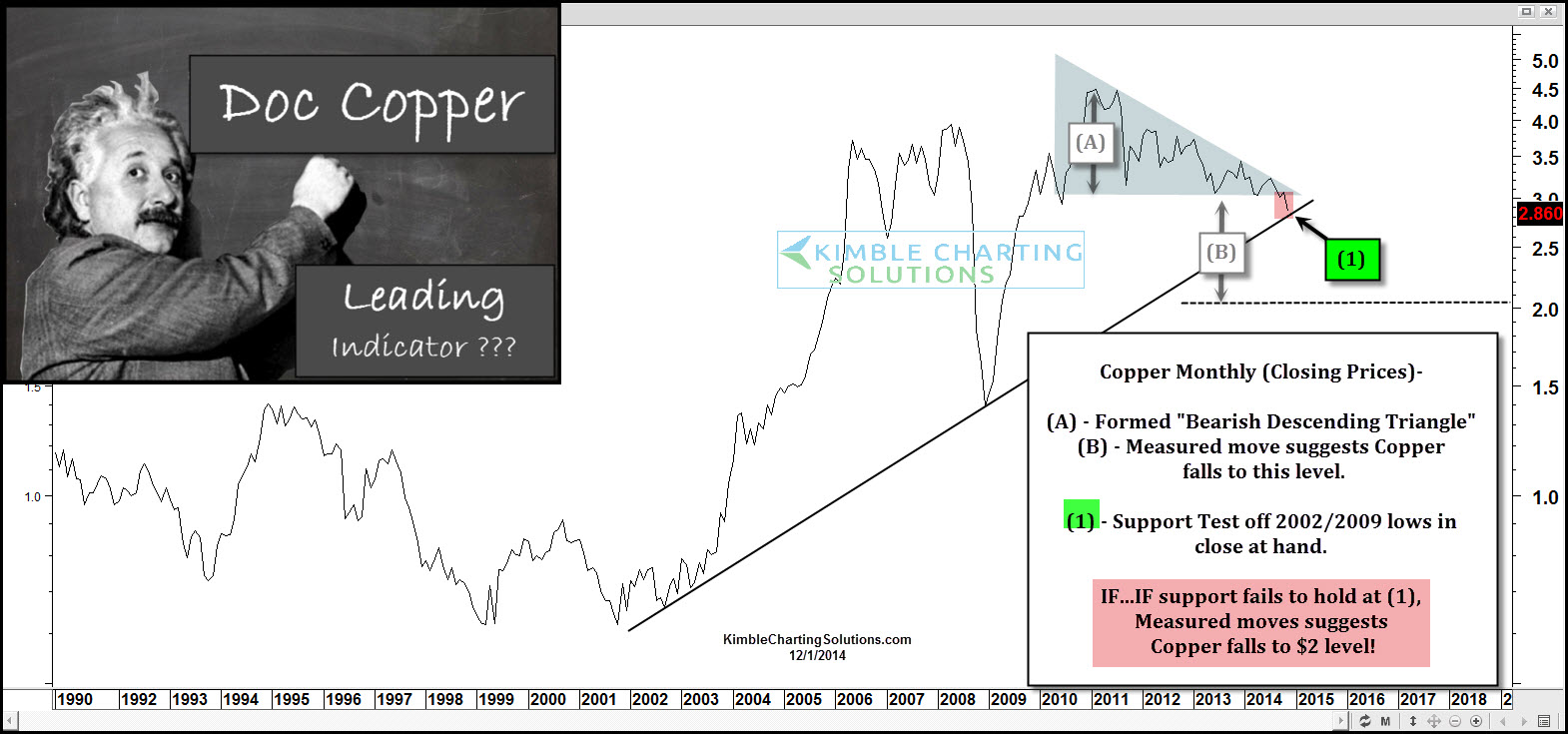

The top chart reflects that Copper looks to have formed a "Bearish Descending Triangle." Two-thirds of the time, such patterns suggest a decline in prices will take place, with the decline (B) being the height of the pattern (A). If that happens, the pattern suggests Copper will fall at least to the $2 zone -- about 30% below current prices.

In my humble opinion, the most important issue at hand is that Copper is testing long-term support at (1) and support is support until broken. Line (1) is based upon the lows in 2002 and 2009. Keep in mind, these dates represent times when the S&P was also at/near lows.

What Copper does at (1) should have a large impact on the future prices of Copper and if it does break support, it could impact the S&P 500 too.

Stay tuned, what Copper does here could have a big impact on the broad markets and portfolio construction.