Copper rose out of the depths of a sell off during the financial crisis of 2009 to new all time highs in 2011. All was well.

But then a funny thing happened. It pulled back and consolidated. Many attributed that to the weakness in China and perhaps that played a role. But lately that relationship has unwound as the Chinese Market is rocketing higher while Copper sells off.

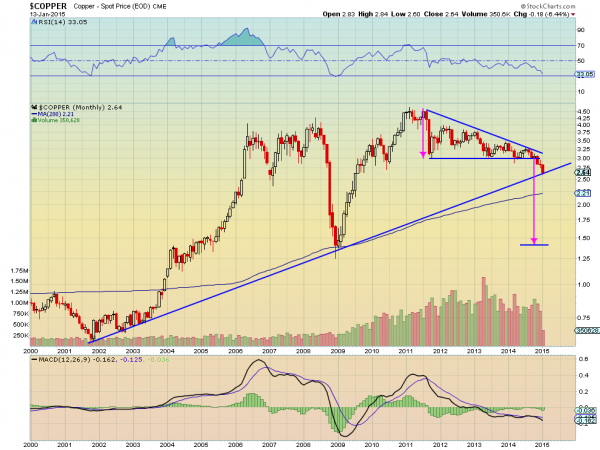

Time to stop making excuses for Copper (iPath DJ-UBS Copper Subindex TR (NYSE:JJC) and just look at it by itself. The chart below tells a chilling story. Not only is Copper breaking lower on a longer term basis, it is on the cusp of a move back to those 2009 lows.

There are four important levels to watch in this chart. First is the 13 year rising trendline as support. Copper is sitting on this level right now. But with the falling and bearish momentum indicators RSI and MACD, the downside is still favored.

The next level is the 200 month SMA. This is currently at 2.21 or about 16% below the current price. In the 15 year history of this chart, the price above this moving average has indicated a bullish environment. It held as support in 2009. When the price broke above it in 2004, that marks the beginning of the 10 year bull run. A move below the 200 month SMA would turn the picture bearish long term.

The next level is a technical one. The initial move lower in 2011 marked the wide end of a descending triangle. And when the price fell out of that triangle in October 2014 it triggered a price target lower, of 1.40.

Finally, consider the 2009 low at 1.25. This is also the center of the consolidation area from 2004 and over 50% below the current price. That should provide plenty of levels for quite some time. If Copper moves below these levels, it will be big trouble for commodities.

The level that would flip this view on its head would be a move back above the 3.00 level. Not a retest and fail, but rather a solid break above and hold there. Until then lean lower in Copper.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.