Consumer staples stocks have always been known for their relatively low volatility and conservative nature. It’s one of the reasons they are such a prominent aspect of many retirement portfolios and continue to serve as a reassuring equity allocation for countless investors.

These companies are typified by their mature business models and inelastic consumer trends. Think grocery stores, beverage companies, consumer goods, tobacco stocks, and drug store chains. They sell products that are constantly in demand no matter what the overall economy is doing. For this primary reason, they are considered more stable than speculative or growth-oriented stocks.

The largest exchange-traded fund that tracks this sector is the Consumer Staples Select Sector SPDR (NYSE:XLP). This market-cap weighted index fund owns 34 large-cap consumer stocks from within the broader S&P 500 Index. Top holdings include well-known names such as Procter & Gamble Company (NYSE:PG) and the Coca-Cola Company (NYSE:KO).

The relatively small number of holdings, combined with the market-cap weighted nature of this fund, means that the top 10 stocks make up most of the portfolio exposure. XLP charges an expense ratio of 0.14% and has total assets exceeding $8.7 billion.

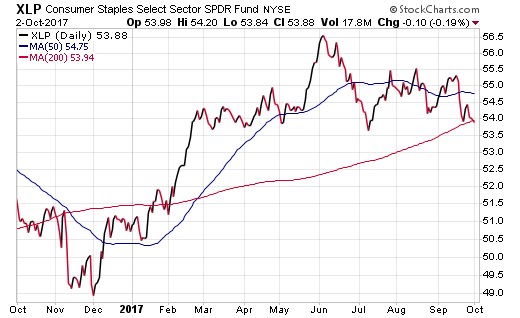

A look at the chart below shows how this fund peaked in June and has been on a rollercoaster ride lower ever since. XLP is now testing its 200-day moving average (smooth red line) and may ultimately breach this long-term trend line to the downside.

Market technicians may become cautious of consumer stocks if a break of this indicator does occur. The interesting nature of XLP is how it has diverged from the strength of broad-based benchmarks such as the SPDR S&P 500 ETF (NYSE:SPY), which recently hit fresh all-time highs. XLP has gained just 6.41% through the first three quarters of 2017 compared to nearly 14% for SPY.

From a sentiment perspective, this divergence may also signal a shift in investor risk preference this year. Consumer staples stocks may be viewed as too ponderous and conservative to be worthy of growth in the current market environment. Instead, many investors are flocking to thematic plays in technology, healthcare, or even industrial defense stocks. These momentum-driven sectors have experienced double digit growth this year amid an extremely low-volatility environment.

Fund flows also show a mixed picture in consumer staples as well. According to data from ETF.com, XLP has attracted just $291 million in fresh new assets this year despite hundreds of billions flowing into ETF coffers. Recent weeks have been marked by consistent outflows as prices slowly deteriorate.

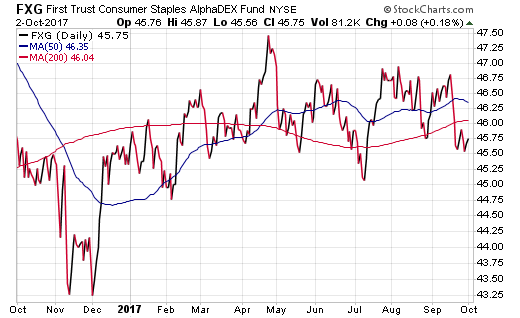

It’s interesting to note that XLP isn’t the only fund in this sector that is struggling. The First Trust Consumer Staples AlphaDEX Fund (NYSE:FXG) is barely clinging to positive territory for the year. FXG is an enhanced index that screens for quality factors with a broader pool of publicly traded stocks eligible for portfolio inclusion.

A thought-provoking occurrence about the appetite for consumer staples stocks is how they may ultimately become more favorable during a market downturn. These companies often experience an uptick in relative momentum, similar to bonds, when risk aversion becomes a primary motivational factor.

The Bottom Line

Underlying sector divergences within the broad market are a fluid and ever-changing phenomenon. This may simply be a short pause in the construct of another push higher or a warning sign of an over-extended market. No matter how you interpret the data, keeping a close eye on the relative strength of these ETFs can help align your portfolio strategy with the current market trends.

Disclosure: FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.