What to do? This is not as an innocuous question as one might think. For most American families, who have to balance their living standards to their income, they face this conundrum each and every month. Today, more than ever, the walk to the end of the driveway has become a dreaded thing as bills loom large in the dark crevices of the mailbox.

What to do?

In a continuation of last week’s discussion on consumer debt, the conundrum exists because there is not enough money to cover the costs of the current living standard.

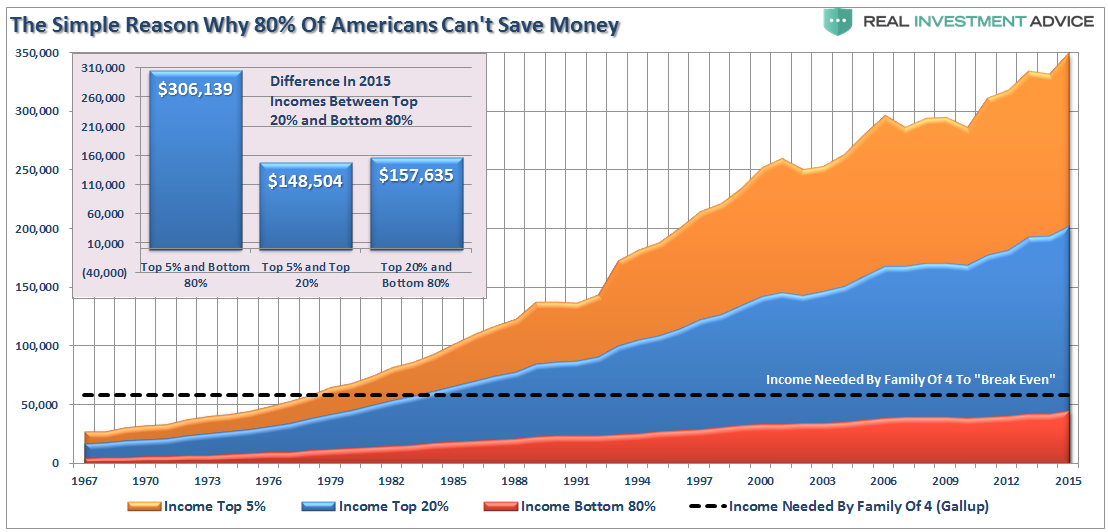

“The average family of four have few choices available to them as discretionary spending becomes problematic for the bottom 80% of the population whose wage growth hasn’t kept up with the standard of living.”

The burden of debt that was accumulated during the credit boom can’t simply be disposed of. Many can’t sell their house because they can’t qualify to buy a new one and the cost to rent are now higher than current mortgage payments in many places. There is no ability to substantially increase disposable incomes because of deflationary wage pressures, and despite the mainstream spin on recent statistical economic improvements, the burdens on the average American family are increasing.

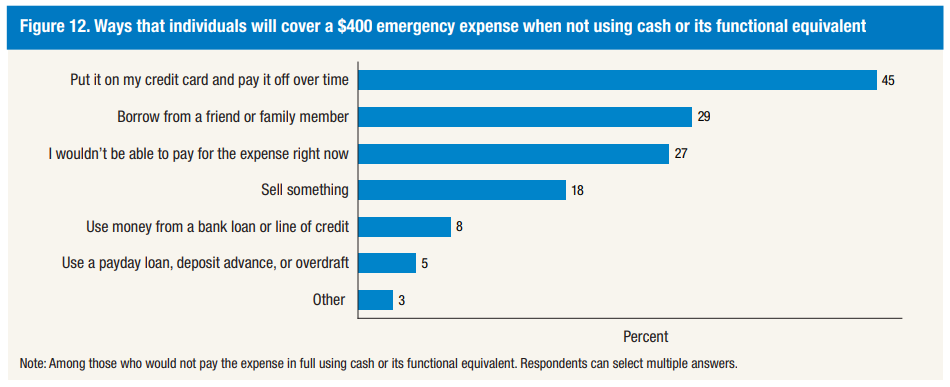

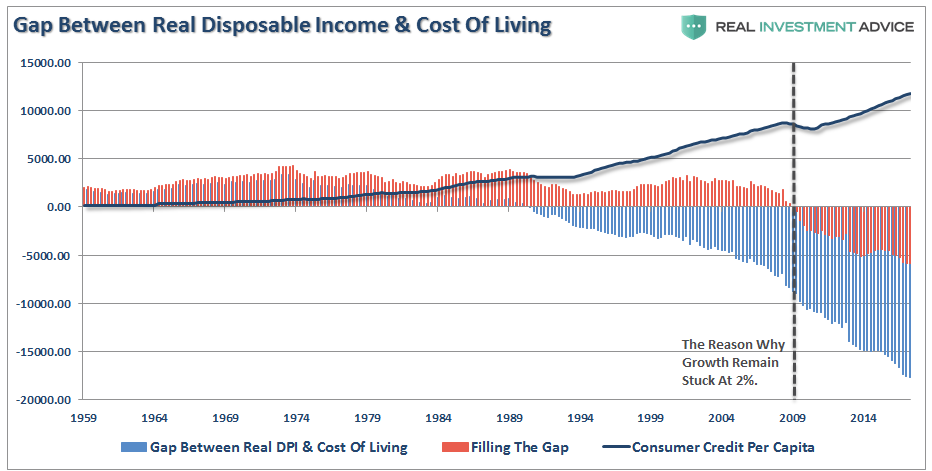

Nothing brought this to light more than the recent release of the Fed’s Report on “The Economic Well-Being Of U.S. Households.” The overarching problem can be summed up in one chart:

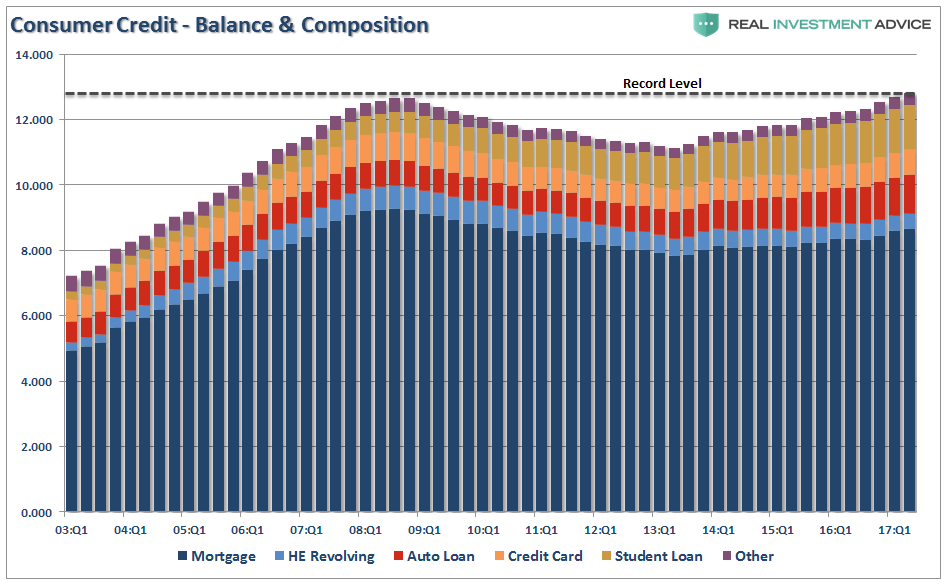

Of course, the recent rise in consumer credit to all-time highs supports that analysis.

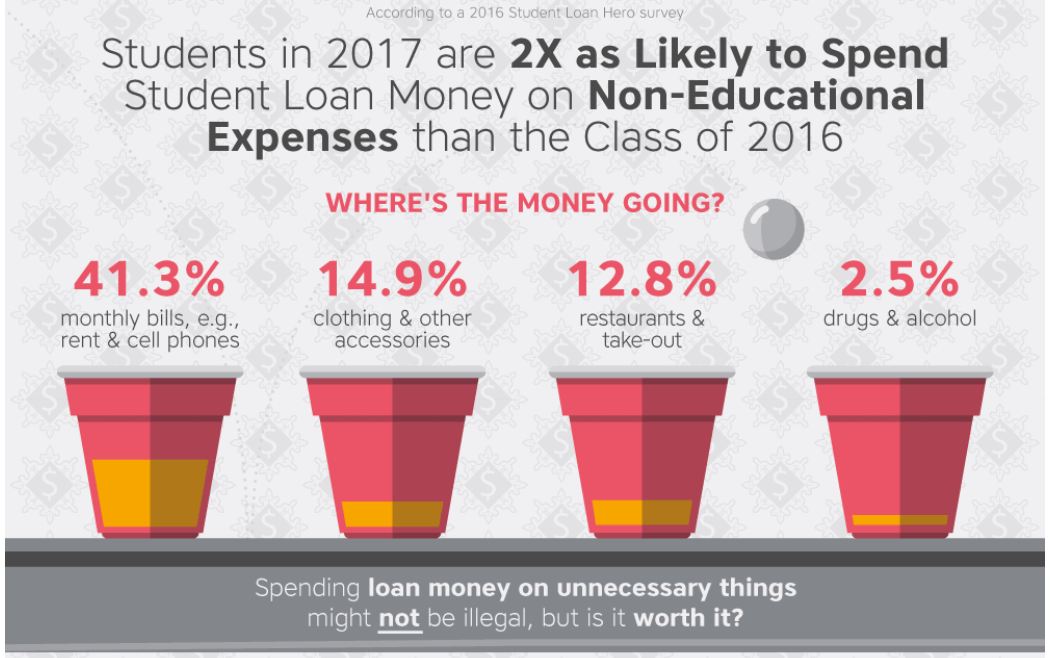

Don’t be fooled by the rise in “student loan” debt either. That is NOT representative of a mass hoard of individuals all clamoring into classrooms across the country to garner the benefits of higher education. According to a 2016 Student Loan Hero survey, individuals have other plans for student loan funds which are easy to acquire.

Or as Bloomberg noted in their survey, 1-in-5 American students will use their student loans to pay for expenses such as vacations, dining out and entertainment. To wit:

“Texas A&M graduate Eric Hazard recalls the excitement of student loan refund day.

‘Checks were celebrated across the campus as almost like a bonus for being a college kid. [Students] would go directly to the bank to cash it. I bought electronics for my dorm room and drinks. You know you have to pay it back, but you don’t have a timeline in your mind about what that was going to look like. I just knew it would happen later.'”

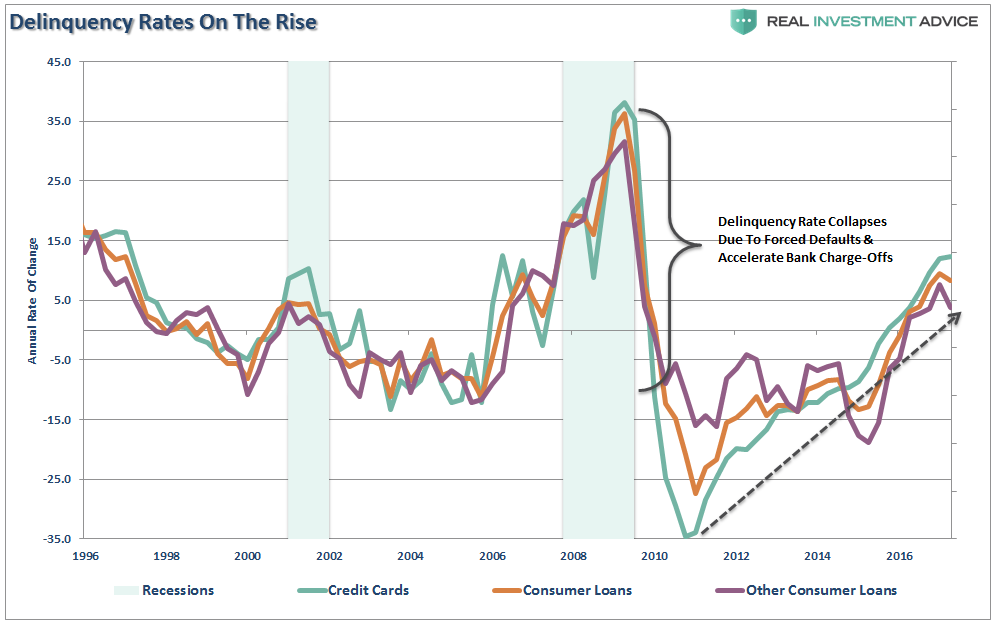

Of course, the problem comes when the bills come due. Can you spell “d-e-l-i-q-u-e-n-c-y.”

So, therein lies the “Great American Consumer Conundrum.” If 70% of the economy is driven by personal consumption, what happens when consumers simply hit the wall?

There is a limit.

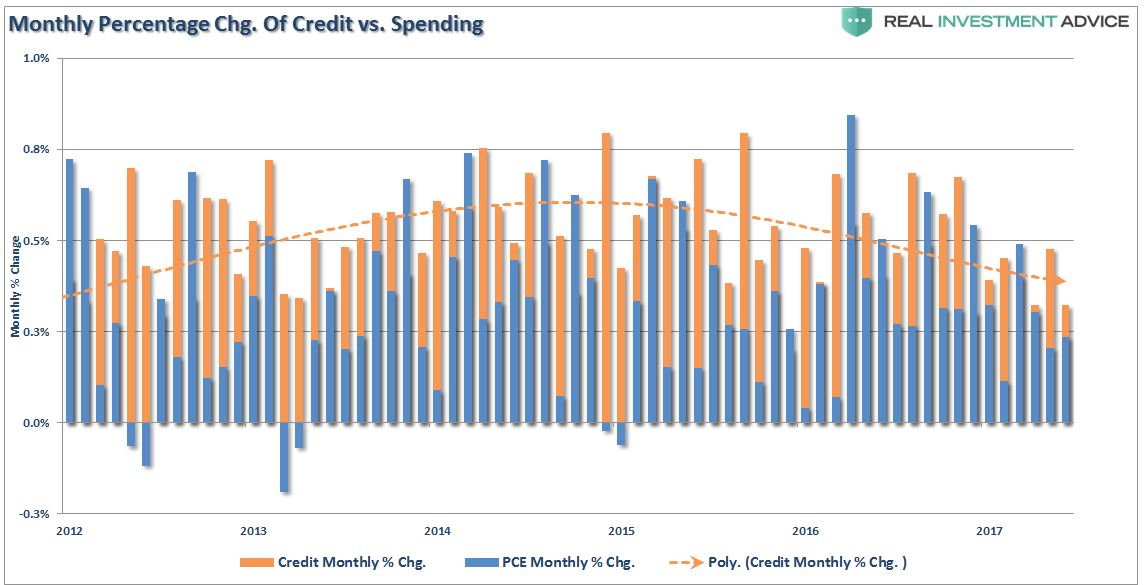

Under more normal circumstances rising consumer credit would mean more consumption. The rise in consumption should, in theory, led to stronger rates of economic growth. I say, in theory, only because the data doesn’t support the claim.

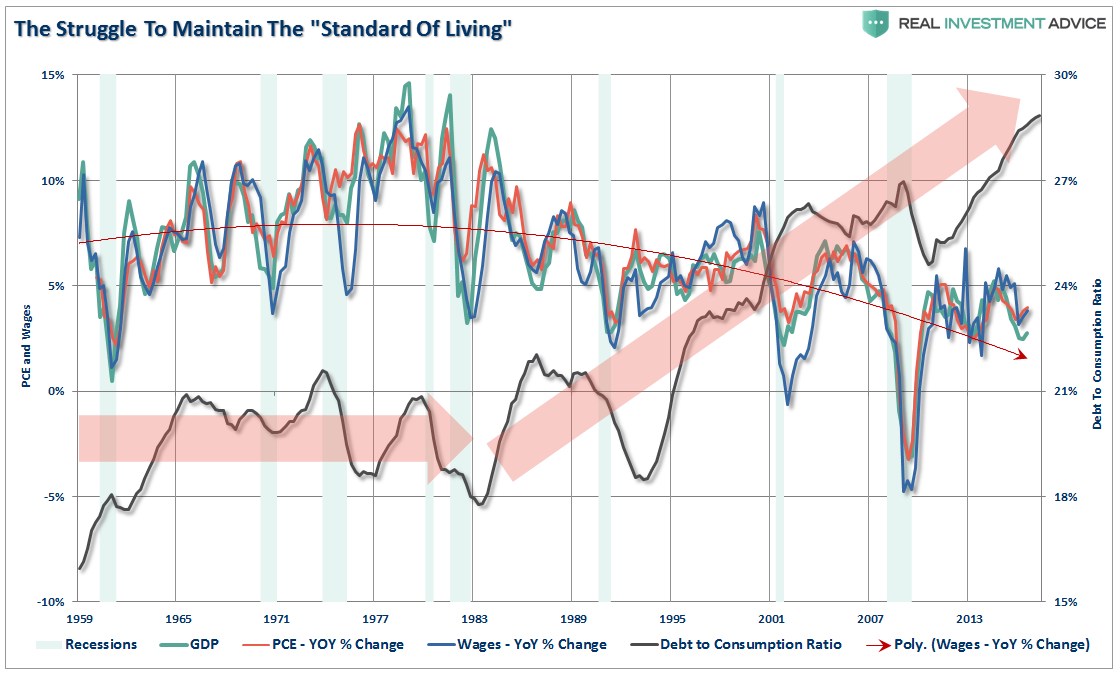

Prior to 1980, when the amount of debt used to support consumption was fairly stagnant, the economy, wages, and personal consumption expanded. However, as I noted previously, that all changed with financial deregulation in the early 80’s which fostered three generations of debt driven excesses.

In the past, if they wanted to expand their consumption beyond the constraint of incomes they turned to credit in order to leverage their consumptive purchasing power. Steadily declining interest rates and lax lending standards put excess credit in the hands of every American. (Seriously, my dog Jake got a Visa in 1999 with a $5000 credit limit) This is why during the 80’s and 90’s, as the ease of credit permeated its way through the system, the standard of living seemingly rose in America even while economic growth rate slowed in America along with incomes.

Therefore, as the gap between the “desired” living standard and disposable income expanded it led to a decrease in the personal savings rates and increase in leverage. It is a simple function of math. But the following chart shows why this has likely come to the inevitable conclusion, and why tax cuts and reforms are unlikely to spur higher rates of economic growth.

Beginning in 2009, the gap between the real disposable incomes and the cost of living was no longer able to be filled by credit expansion. In other words, as opposed to prior 1980, the situation is quite different and a harbinger of potentially bigger problems ahead. The consumer is no longer turning to credit to leverage UP consumption – they are turning to credit to maintain their current living needs.

There are currently clear signs of stress emerging from credit. Commercial lending has taken a sharp dive as delinquencies have risen. These are signs of both a late stage economic expansion and a weakening environment.

As incomes remain weak, the real-world inflationary pressures of food, energy, medical and utilities have consumed more of discretionary incomes. This is why dependency on social support systems now comprise a record level of disposable incomes.

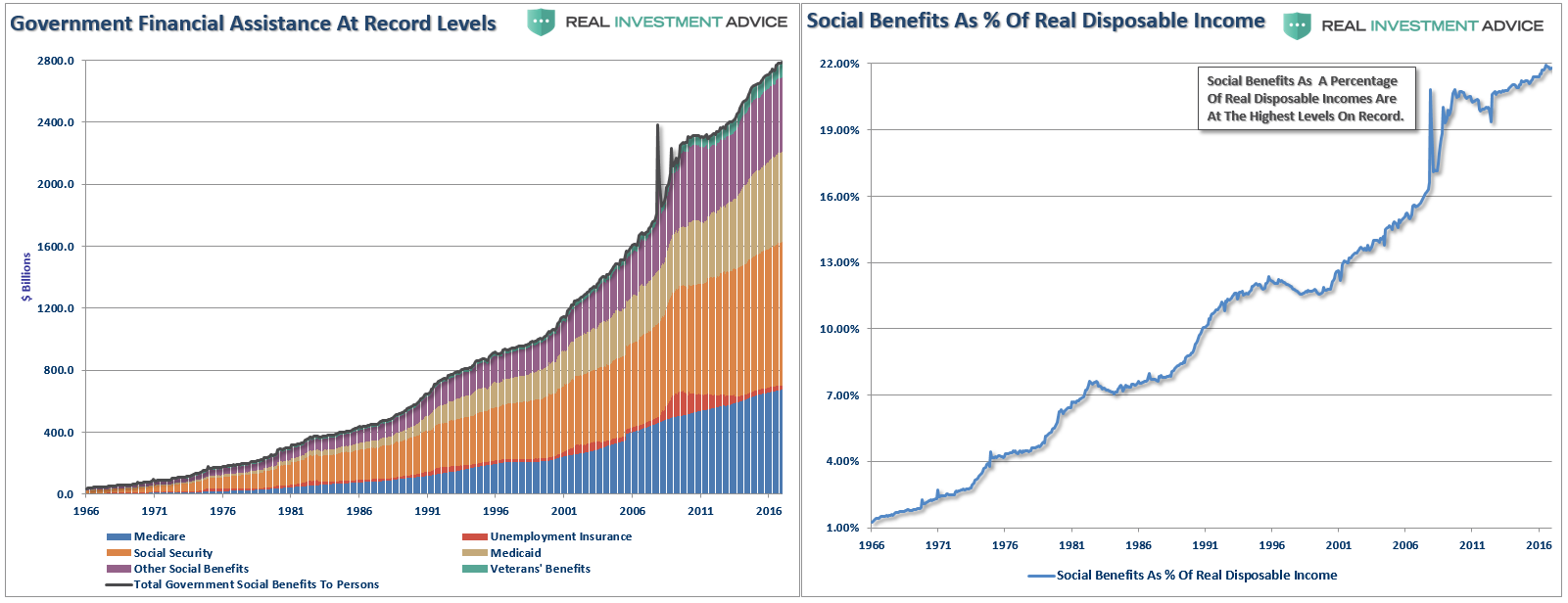

“Without government largesse, many individuals would literally be living on the street. The chart above shows all the government “welfare” programs and current levels to date. The black line represents the sum of the underlying sub-components. While unemployment insurance has tapered off after its sharp rise post the financial crisis, social security, Medicaid, Veterans’ benefits and other social benefits have continued to rise.

Importantly, for the average person, these social benefits are critical to their survival as they make up more than 22% of real disposable personal incomes. With 1/5 of incomes dependent on government transfers, it is not surprising that the economy continues to struggle as recycled tax dollars used for consumption purposes have virtually no impact on the overall economy.”

It is hard to make the claim that the economy is on the verge of recovery with statistics like that. Of course, it is the real reason why after 9-years of “emergency measures” from Central Banks globally, they are still using “emergency measures” despite claiming monetary policy victory.

It isn’t just about the “baby boomers,” either. Millennials are haunted by the same problems, with 40%-ish unemployed, or underemployed, and living back home with parents. In turn, parents are now part of the “sandwich generation” that are caught between taking care of kids and elderly parents. The rise in medical costs and healthcare goes unabated consuming more of their incomes.

Hopefully, the recent upticks in the economic data are more than just the temporary “restocking cycles” we have seen repeatedly over the last 8-years. Hopefully, the current Administration will achieve some part of their legislative agenda to help boost economic growth. Hopefully, international economies can continue their growth trends as they account for 40% of corporate profits. Hopefully, an economic cycle that is already the 3rd longest in history with the lowest annual growth rate, can continue indefinitely into the future.

But that is an awful lot of hoping.