You can almost hear the announcer for the movie trailer;

“In a world stricken by financial crisis, a country plagued by spiraling deficits and cities on the verge of collapse – a war is being waged; gauntlet’s thrown down and at the heart of it all; two dead white guys battling over the fate of the economy.”

While I am not so sure it would actually make a great movie to watch – it is the ongoing saga we will continue to witness unfold over the next decade. While the video below is entertaining, it does lay out the key differences between Keynesian and Austrian economic theories.

Just last week, the Federal Reserve released a report which forms the basis of the semi-annual testimony Ms. Yellen will give to Congress this week. There was much in this report which suggests the models the Federal Reserve continues to use are at best flawed and, at worst, broken.

For decades, ivory tower economists have heaped high praise on Keynesian policies as they have encouraged Governments to drive deeper into debt with the expectation of reviving economic growth.

The problem is – it hasn’t worked.

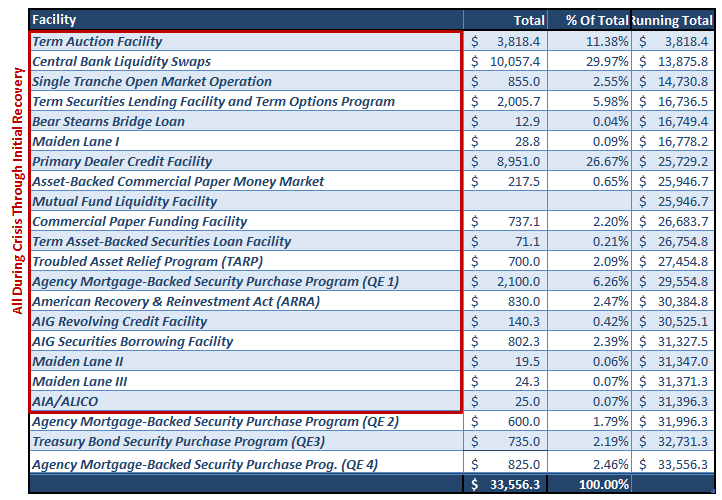

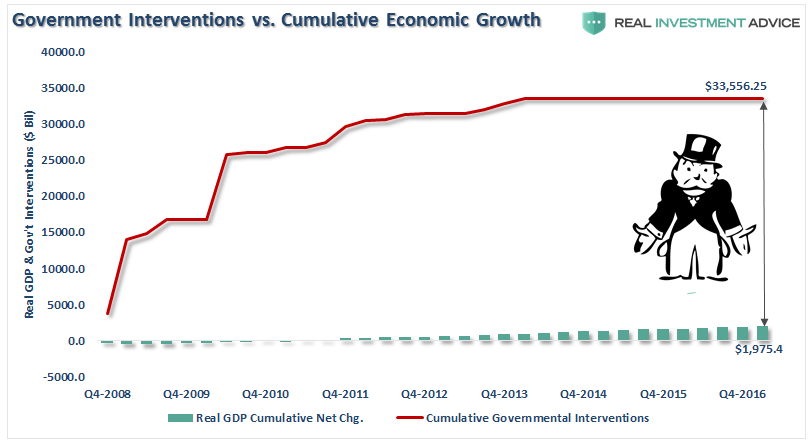

Here’s proof. Following the financial crisis, the Government and the Federal Reserve decided it was prudent to inject more than $33 Trillion in debt-laden injections into the economy believing such would stimulate an economic resurgence. Here is a listing of all the programs.

Unfortunately, the results have been disappointing at best, considering it took almost $17 Billion for every $1 of cumulative economic growth.

Keynes contended that “a general glut would occur when aggregate demand for goods was insufficient, leading to an economic downturn resulting in losses of potential output due to unnecessarily high unemployment, which results from the defensive (or reactive) decisions of the producers.” In other words, when there is a lack of demand from consumers due to high unemployment then the contraction in demand would, therefore, force producers to take defensive, or react, actions to reduce output.

In such a situation, Keynesian economics states that government policies could be used to increase aggregate demand, thus increasing economic activity and reducing unemployment and deflation. Investment by government injects income, which results in more spending in the general economy, which in turn stimulates more production and investment involving still more income and spending and so forth. The initial stimulation starts a cascade of events, whose total increase in economic activity is a multiple of the original investment.

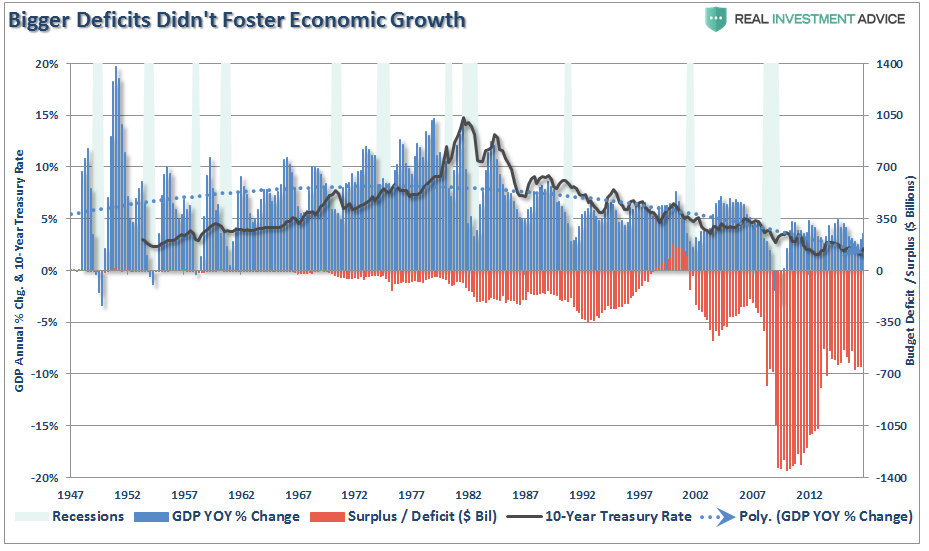

Unfortunately, as shown below, monetary interventions and the Keynesian economic theory of deficit spending has failed to produce a rising trend of economic growth.

What changed?

The Breaking Point & The Death Of Keynes

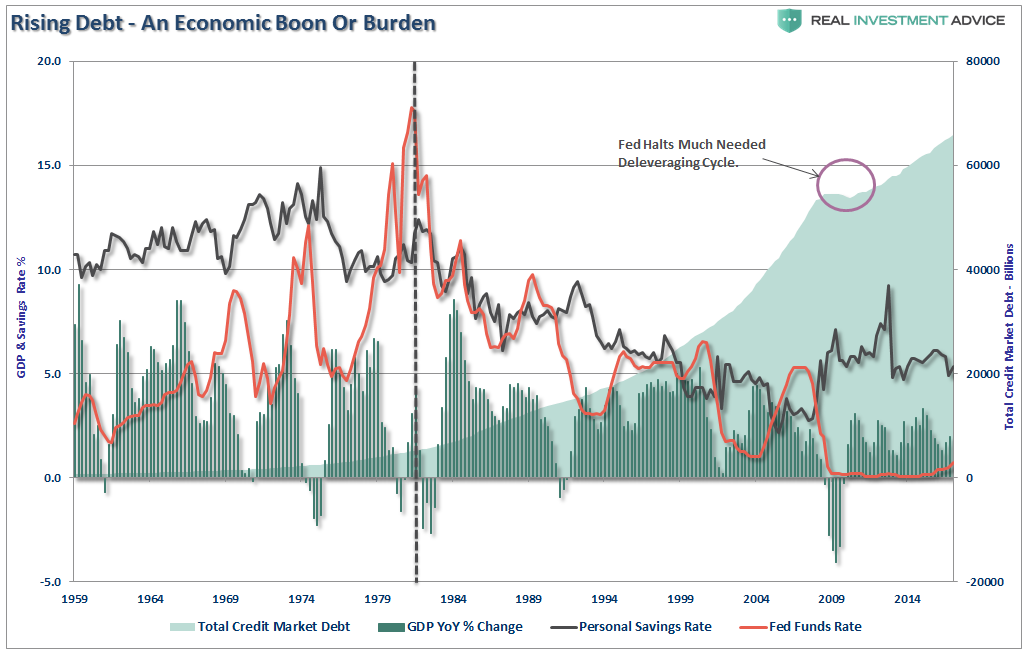

Take a look at the chart above. Beginning in the 1950’s, and continuing through the late 1970’s, interest rates were in a generally rising trend along with economic growth. Consequently, despite recessions, budget deficits were non-existent allowing for the productive use of capital. When the economy went through its natural and inevitable slowdowns, or recessions, the Federal Reserve could lower interest rates which in turn would incentivize producers to borrow at cheaper rates, refinance activities, etc. which spurred production and ultimately hiring and consumption.

However, beginning in 1980 the trend changed with what I have called the “Breaking Point.” It’s hard to identify the exact culprit which ranged from the Reagan Administration’s launch into massive deficit spending, deregulation, exportation of manufacturing, a shift to a serviced based economy, or a myriad of other possibilities or even a combination of all of them. Whatever the specific reason; the policies that have been followed since the “breaking point” have continued to work at odds with the “American Dream,” and economic models.

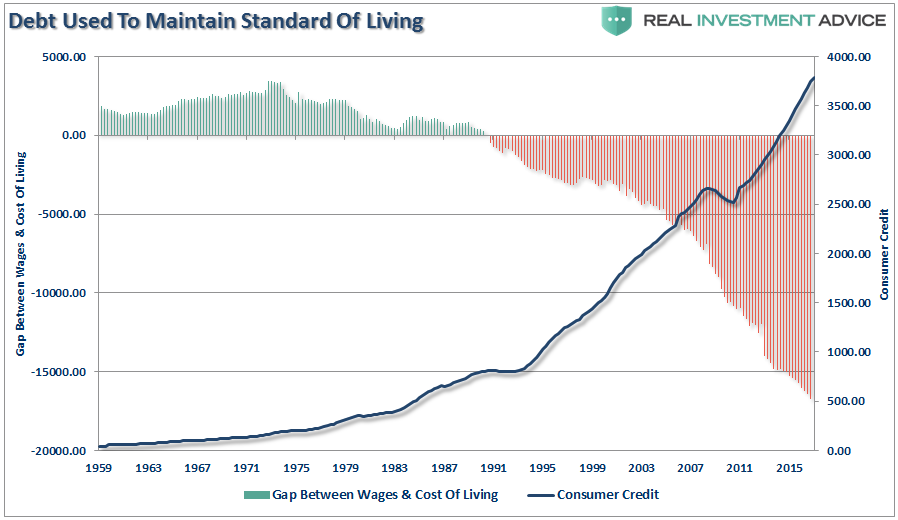

As the banking system was deregulated, the financial system was unleashed upon the unsuspecting American public. As interest rates fell, the average American discovered the world of financial engineering, easy money, and the wealth creation ability through the use of leverage. However, what we didn’t realize then, and are slowly coming to grips with today, is that financial engineering has a very negative side effect – it deteriorated our economic prosperity.

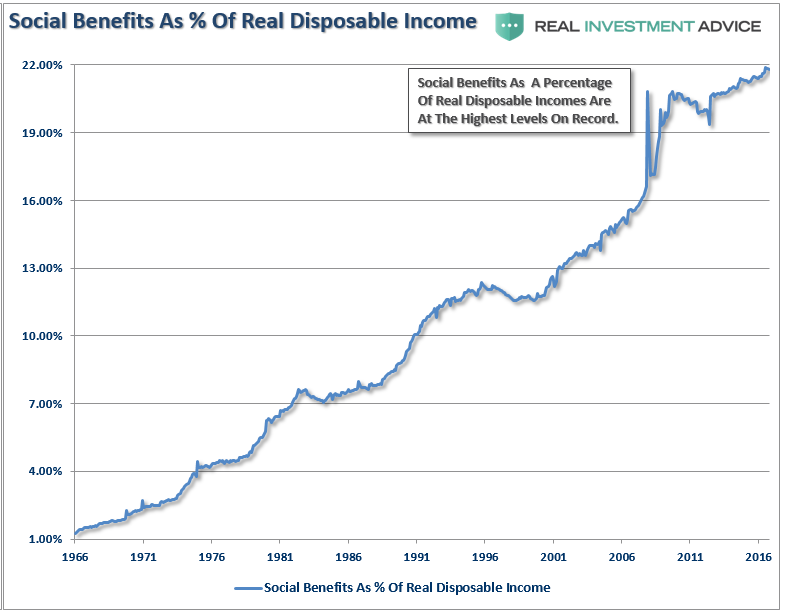

Furthermore, this also explains why the dependency on social welfare programs is at the highest level in history.

As the use of leverage crept through the system, it slowly chipped away at savings and productive investment. Without savings, consumers can’t consume, producers can’t produce and the economy grinds to a halt.

Regardless of the specific cause, each interest rate reduction that was used from that point forward to stimulate economic growth did, in fact, lead to a recovery in the economy; just not at levels as strong as they were in the previous cycle. Therefore, each cycle led to lower interest rates and economic growth slowed and as a result of consumers and producers turning to credit and savings to finance the shortfall which in turn led to lower productive investment. It was like an undetectable cancer slowing building in the system.

The “Breaking Point” in 1980 was the beginning of the end of the Keynesian economic model.

Hayek Might Have It Right

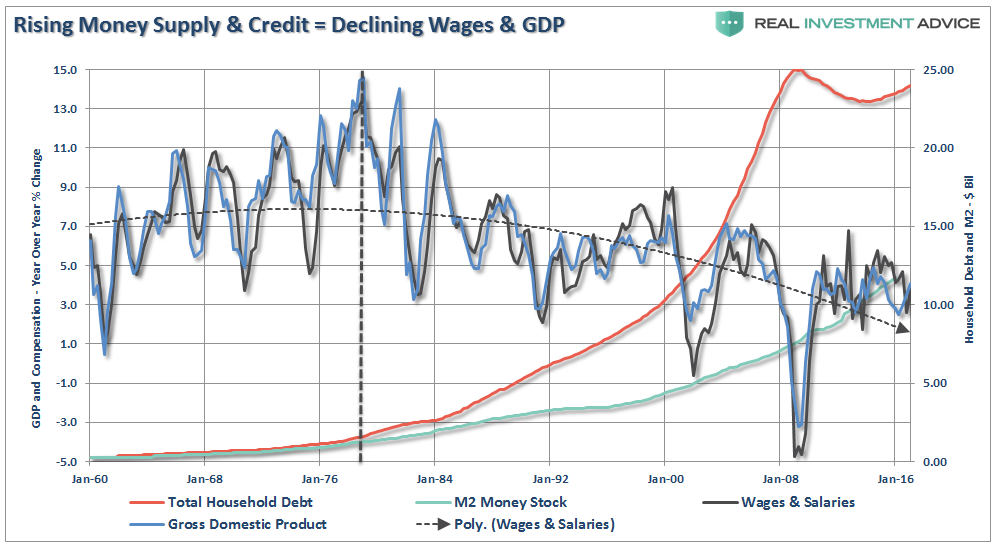

The proponents of Austrian economics believe that a sustained period of low interest rates and excessive credit creation results in a volatile and unstable imbalance between saving and investment. In other words, low interest rates tend to stimulate borrowing from the banking system which in turn leads, as one would expect, to the expansion of credit. This expansion of credit then, in turn, creates an expansion of the supply of money.

Therefore, as one would ultimately expect, the credit-sourced boom becomes unsustainable as artificially stimulated borrowing seeks out diminishing investment opportunities. Finally, the credit-sourced boom results in widespread malinvestments. When the exponential credit creation can no longer be sustained a “credit contraction” occurs which ultimately shrinks the money supply and the markets finally “clear” which then causes resources to be reallocated back towards more efficient uses.

Unfortunately, as is clearly shown in both charts above, this has hardly been the case.

Time To Wake Up

For the last 30 years, each Administration, along with the Federal Reserve, have continued to operate under Keynesian monetary and fiscal policies believing the model worked. The reality, however, has been most of the aggregate growth in the economy has been financed by deficit spending, credit expansion and a reduction in savings. In turn, this reduced productive investment in the economy and the output of the economy slowed. As the economy slowed and wages fell the consumer was forced to take on more leverage which also decreased savings. As a result of the increased leverage more of their income was needed to service the debt.

Secondly, most of the government spending programs redistribute income from workers to the unemployed. This, Keynesians argue, increases the welfare of many hurt by the recession. What their models ignore, however, is the reduced productivity that follows a shift of resources toward redistribution and away from productive investment.

All of these issues have weighed on the overall prosperity of the economy. What is most telling is the inability for the current economists, who maintain our monetary and fiscal policies, to realize the problem of trying to “cure a debt problem with more debt.”

This is why the policies that have been enacted previously have all failed, be it “cash for clunkers” to “Quantitative Easing”, because each intervention either dragged future consumption forward or stimulated asset markets. Dragging future consumption forward leaves a “void” in the future that has to be continually filled, and creating an artificial wealth effect decreases savings which could, and should have been, used for productive investment.

The Keynesian view that “more money in people’s pockets” will drive up consumer spending, with a boost to GDP being the end result, has been clearly wrong. It hasn’t happened in 30 years.

The Keynesian model died in 1980. It’s time for those driving both monetary and fiscal policy to wake up and smell the burning of the dollar. We are at war with ourselves and the games being played out by Washington to maintain the status quo is slowing creating the next crisis that won’t be fixed with another monetary bailout.