So far, the Q2 earnings season has seen quarterly releases from 38.5% of the construction companies in the S&P 500 cohort. According to the latest Earnings Trend, 80% of the companies have surpassed earnings as well as revenue estimates. Total earnings of these construction companies increased 8.3% and total revenues rose 14.6%.

Overall, construction companies seem to be on solid ground. The construction sector’s earnings are expected to increase 15.8% in Q2 compared with 9% in the earlier quarter. Revenues are also expected to improve 8.4% (6.8% growth in Q1).

Positives such as an improving economy, modest wage growth, low unemployment levels and positive consumer confidence raise optimism about the sector’s performance in 2017. As such, demand for companies’ products should also increase, thereby driving revenues.

So far, some of the leading companies in the construction sector have reported their Q2 results. PulteGroup Inc.’s (NYSE:PHM) second-quarter 2017 adjusted earnings of 47 cents per share beat the Zacks Consensus Estimate by 4.4%. Also, quarterly earnings reflected a solid 27% year over year jump. PulteGroup’s total revenues of $2.02 billion missed the Zacks Consensus Estimate by a meager 0.5%. Revenues, however, increased 12.3% year over year, owing to a rise in the number of homes delivered.

NVR, Inc. (NYSE:NVR) , one of the country’s largest homebuilding and mortgage-banking companies, reported second-quarter 2017 earnings of $35.19 per share, surpassing the Zacks Consensus Estimate by 22.9%. The reported figure also rose 60% from the year-ago profit level. Total revenues (Homebuilding & Mortgage Banking fees) increased 11% year over year.

Let us take a look at how the following construction companies are placed ahead of their quarterly release on Jul 27.

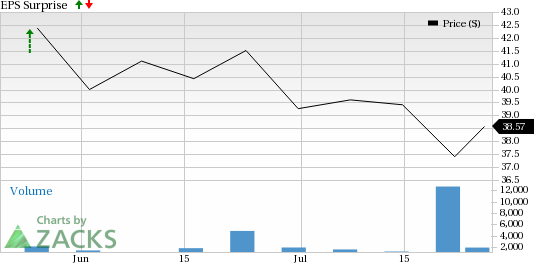

Masco Corporation (NYSE:MAS) is slated to release its second-quarter 2017 results on Jul 27, 2017, before the market opens.

Last quarter, the company delivered a positive earnings surprise of 17.14%. The company surpassed estimates in two of the trailing four quarters, with an average beat of 3.53%.

Currently, the company has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate is pegged at 60 cents.

Also, Masco carries a Zacks Rank #2 (Buy). Our proven model does not conclusively show an earnings beat for this company this quarter, as a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) to beat estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

For the second quarter, the Zacks Consensus Estimate for earnings is pegged at 60 cents a share, reflecting an increase of 29.8% year over year, while the consensus for revenues stands at $2.07 billion, implying 3.5% year-over-year growth (read more: Can Masco Spring a Surprise this Earnings Season?).

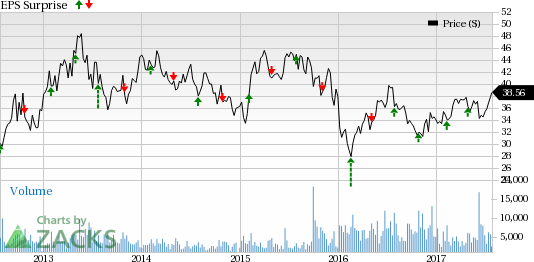

Eagle Materials Inc. (NYSE:EXP) is slated to release its first-quarter fiscal 2018 results on Jul 27, 2017, before the market opens.

Last quarter, Eagle Materials delivered a positive earnings surprise of 2.33%. The company currently holds a Zacks Rank #3 and an Earnings ESP of 0.00%. You can see the complete list of today’s Zacks #1 Rank stocks here. Our proven model does not conclusively show an earnings beat for Eagle Materials this quarter.

For the fiscal first quarter, the Zacks Consensus Estimate for earnings is pegged at $1.17 a share, reflecting an increase of 25.5% year over year, while the consensus for revenues stands at $368.8 million, implying 24% year-over-year growth.

Floor & Decor Holdings, Inc. FND will release its second-quarter fiscal 2017 results after market close.

Last quarter, the company delivered a positive earnings surprise of 30.00%.

Currently, the company has an Earnings ESP of 0.00%, as both the Most Accurate estimate and the Zacks Consensus Estimate is pegged at 20 cents. Also, Floor & Decor carries a Zacks Rank #2. Hence, our proven model does not conclusively show an earnings beat for this company.

For the fiscal second quarter, the Zacks Consensus Estimate for earnings is pegged at 20 cents, while the consensus for revenues is at $338.6 million.

CalAtlantic Group, Inc. (NYSE:CAA) is set to report second-quarter 2017 results after market close.

Last quarter, CalAtlantic delivered a positive earnings surprise of 14.81%. In fact, CalAtlantic surpassed estimates in each of the trailing four quarters, with an average beat of 13.00%.

Our proven model does not conclusively show an earnings beat for CalAtlantic this quarter, as it has an Earnings ESP of 0.00% and a Zacks Rank #3.

For the second quarter, the Zacks Consensus Estimate for earnings is pegged at 78 cents, reflecting a decrease of 10.9% year over year, while the consensus for revenues stands at $1.62 billion, implying 2.7% year-over-year growth.

EMCOR Group, Inc. (NYSE:EME) is set to report second-quarter 2017 results.

Last quarter, EMCOR delivered a positive earnings surprise of 29.41%. The stock has surpassed estimates in three of the trailing four quarters, with an average positive surprise of 15.45%.

Currently, the company has an Earnings ESP of 0.00%, as both the Most Accurate estimate and the Zacks Consensus Estimate is pegged at 80 cents. The stock carries a Zacks Rank #3.

Our proven model does not conclusively show an earnings beat for EMCOR this quarter, as it has an Earnings ESP of 0.00% and a Zacks Rank #3.

For the second quarter, the Zacks Consensus Estimate of 80 cents per share reflects a decrease of 15.4% from the year-ago quarter. Also, analysts polled by Zacks expect revenue of $1.88 billion for the quarter, representing a 3% downside from the prior-year quarter.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Masco Corporation (MAS): Free Stock Analysis Report

Eagle Materials Inc (EXP): Free Stock Analysis Report

EMCOR Group, Inc. (EME): Free Stock Analysis Report

PulteGroup, Inc. (PHM): Free Stock Analysis Report

NVR, Inc. (NVR): Free Stock Analysis Report

CalAtlantic Group, Inc. (CAA): Free Stock Analysis Report

Original post

Zacks Investment Research