Market Brief

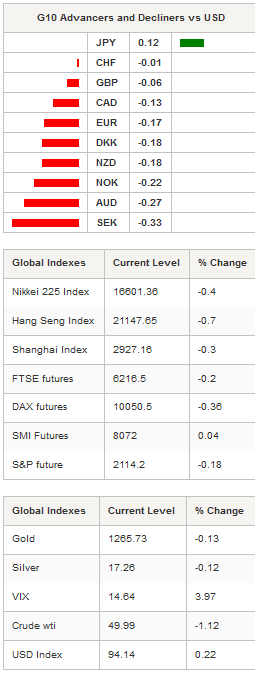

Asian equity markets declined for a second straight day as commodities fell on the back of lingering growth and fed policy. The reality of the magnitude of the UK referendum on EU membership and FOMC meeting is beginning to hit investors. We anticipate sentiment to remain weak and ranges to consolidate. Developed markets’ interest rates continue to dominate conversation as rates positioned lower on event fears. UK, German and Japanese 10-year bond yields fell to a historical low. 10yr JGB yields fell to -0.155% and investors now have to go out 20 years on Swiss government bonds to secure a positive return. The Nikkei and Hang Seng declined -0.60% while the Shanghai composite remained closed for the Dragon Boat festival. Notably, MSCI will decide on whether to include China’s A shares in the index on 15th June. The USD strengthened against most G10 and EM currencies, as the DXY rose to 94.21. The AUD/USD reversed yesterday’s gains from 0.7505 to 0.7407 as commodities sold off (despite reports that Chinese demand for crude is on the rise). USD/JPY held near the top of the 106.85 to 107.30 range on short covering, yet with Fed next week and Brexit fears high, traders are vigilant for a quick reversal. Finally, USD/SEK exhibited a strongly bullish, engulfing pattern on the daily charts, suggesting further upside. In emerging Asian markets, KRW and MYR led the decliners against the USD. Weakness in commodities was led by oil and metals as Brent declined to $51.61, despite solid demand and supply disruption worries, potentially suggesting a $52.86 peak.

Japan reports indicate that producer prices increased 0.2% m/m in May, above an expected read of 0.0% (-0.4% prior read). Export prices came in flat on a monthly basis, but -4.5% y/y, import prices rose 0.3% m/m, putting the yearly read at a massive -13.1%. Clearly this significant deflation will not make for a happy BoJ. However, we do not expect the BoJ to now meaningfully adjust monetary policy next week (higher probability of a July easing and fiscal measures). As data continues to disappoint (highlighted by the collapse of machine tool orders) policy makers, we are inching towards a fiscal version of “helicopter money”. Due to impending desperate action by Japanese policymakers we favour a long gold, short JPY to harness this opportunity.

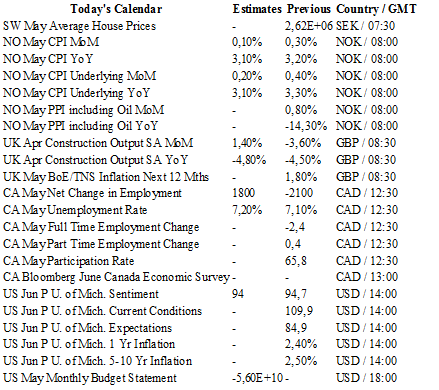

Today traders are expected to see UK construction output, France manufacturing production, the Canadian employment report and US Michigan Sentiment index. With the Fed policy decision, BoJ monetary policy meeting and China real activity data looming next week, we anticipate liquidity conditions to thin and ranges to contract.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1479

CURRENT: 1.1361

S 1: 1.1137

S 2: 1.1058

GBP/USD

R 2: 1.4969

R 1: 1.4770

CURRENT: 1.4515

S 1: 1.4300

S 2: 1.4132

USD/JPY

R 2: 109.14

R 1: 107.89

CURRENT: 107.53

S 1: 106.25

S 2: 105.55

USD/CHF

R 2: 0.9956

R 1: 0.9920

CURRENT: 0.9706

S 1: 0.9652

S 2: 0.9444