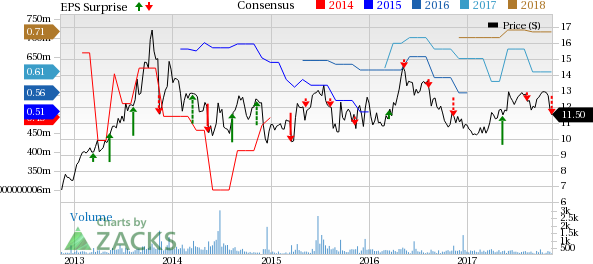

Consolidated Water Co. Ltd. (NASDAQ:CWCO) reported third-quarter 2017 earnings of 11 cents per share, lagging the Zacks Consensus Estimate of 14 cents by 21.4%.

Total Revenues

In the quarter under review, Consolidated Water’s total revenues were $16.6 million, surpassing the Zacks Consensus Estimate of $15.0 million by 10.7%. Reported revenues were also higher than the year-ago figure of $14.4 million by 15.2%.

The year-over-year increase in revenues was primarily due to higher contribution from retail, bulk and manufacturing segments, which was marginally offset by lower revenues from the services segment.

Segment Details

Retail Water Operations revenues in the third quarter were up 1.8% year over year to $5.6 million.

Bulk Water Operations revenues increased 6.8% year over year to $7.9 million.

Manufacturing revenues were $3 million, up 117.4% year over year.

Services Operations revenues of $0.11 million were down from the year-ago figure of $0.12 million by 11.6%.

Highlights of the Release

In the third quarter, total cost of revenues increased 21.1% year over year to $10.26 million, mainly due to higher cost of revenues in Manufacturing and Bulk Water Operations.

Consolidated Water’s gross profit in the third quarter was $6.30 million, up 6.6% from the prior-year quarter.

Moreover, the company incurred general and administrative expenses of $4.89 million, up 7.9% year over year.

Financial Update

As of Sep 30, 2017, Consolidated Water’s cash and cash equivalents were $46.9 million, up from $39.3 million as of Dec 31, 2016.

Cash used in operating activities in the first nine months of 2017 was $0.6 million compared with $2.4 million in the year-ago period.

Zacks Rank

Consolidated Water currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of the Peers

Earnings from its peers in the third quarter were mixed. American States Water Company (NYSE:AWR) missed the Zacks Consensus Estimate while American Water Works Company’s (NYSE:AWK) earnings were on par and Global Water Resource Inc. (NASDAQ:GWRS) surpassed the same.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

American Water Works (AWK): Free Stock Analysis Report

Consolidated Water Co. Ltd. (CWCO): Free Stock Analysis Report

American States Water Company (AWR): Free Stock Analysis Report

Global Water Resources, Inc. (GWRS): Free Stock Analysis Report

Original post

Zacks Investment Research