The bulls opened on a strong note Monday, and relentlessly headed higher since. As such a strong showing has changed the stock landscape, let’s examine the current balance of forces and the clues for upcoming moves.

We’ll start today’s analysis with the daily chart examination (charts courtesy of http://stockcharts.com).

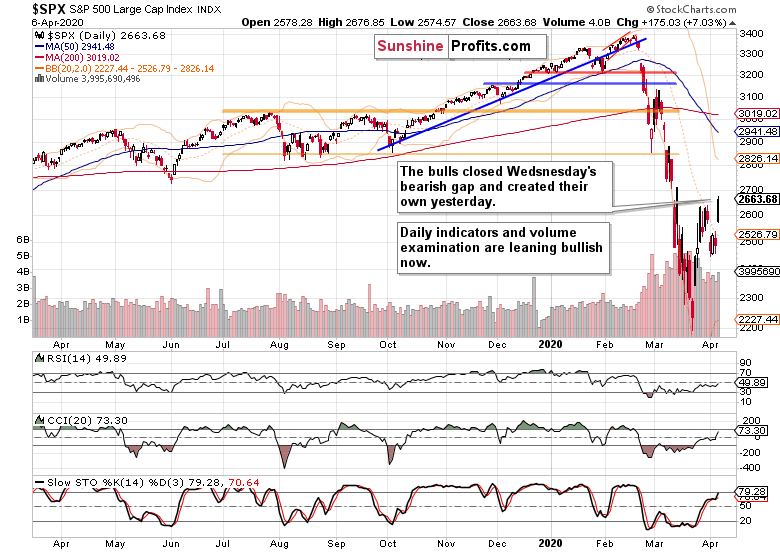

Stocks broke out of their consolidation, and it was not to the downside despite the preceding indications. Last week’s bearish gap is history, and the buyers created their own bullish gap yesterday. Stock prices have been adding to their gains, overcoming last week’s highs.

Thanks to this price action, the daily indicators gave up their bearish positioning, and they’re now supporting continuation of the move higher. As another supportive indicator, the volume of yesterday’s upswing has matched the highest daily volume of arguably the most bearish session of the preceding week.

So, does that mean that the local bottom is in?

We could have asked whether the bottom is in, but let’s stick with this minimalistic question.

In the search for clues, we’ll examine two debt markets – one that the Fed intervenes on, and one where it doesn’t.

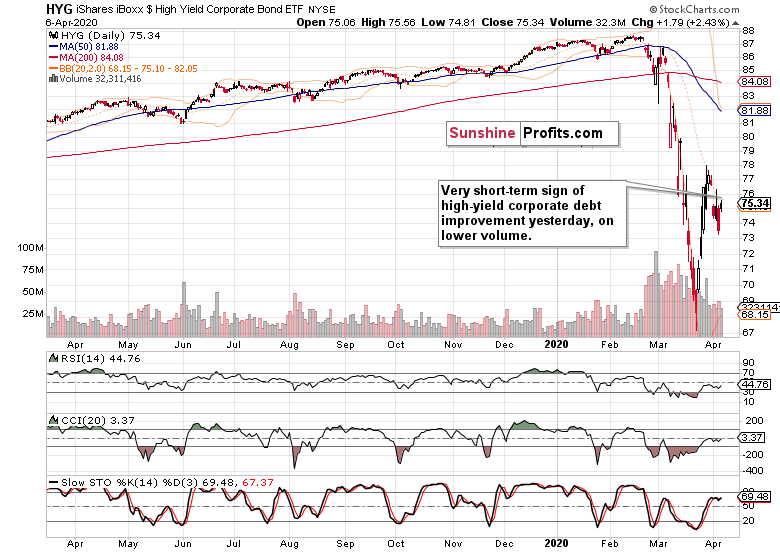

The high-yield corporate debt (HYG ETF) is the unsupported one.

Friday’s slide was erased on yesterday’s open, and the market hasn’t moved much since. Overall though, it sent a bullish hint yesterday.

What about municipal bonds that are on the Fed’s shopping list?

They too have opened higher, but erased all of their gains to close below their Friday’s closing prices. That’s a bearish message sent. But their daily indicators remain positioned still somewhat constructively – they have not yet flipped bearish.

Overall, both markets are sending a mixed picture, but the bullish bias is starting to prevail in the debt markets.

Let’s come back to stocks and have a look at two important metrics – the daily Force index (as it connects the price move with the volume behind it into one indicator) and daily volatility measure (examined from the perspective of Bollinger Bands Width).

Thanks to yesterday’s upswing, Force index moved to its positive territory, and has done so in a way that appears that it can last (today’s premarket upswing in stock futures notwithstanding).

In conclusion, it appears that a local bottom is indeed in, and the short-term bias has flipped from down-to-sideways instead to bullish.

These were our yesterday’s parting observations:

As a result, stocks aren’t out of the woods yet, not by a long shot. We expect the return of the bears despite the improvement in coronavirus death counts over the weekend that came in from NYC, Spain or Italy. The pain, its recognition and economy restart will be a time-consuming process and not a one-way road.

Despite the short-term bullish S&P 500 move, the fluid coronavirus impact situation will facilitate the return of the bears. For the coming days though, it appears that the bulls have the reins.

Summing up, the bulls seized the short-term momentum, and a short-term bottom looks very likely to be in. Despite the upswing though, stocks aren't out of the woods just yet. While bidding their time, the sellers are highly likely to become active at the nearest opportunity, which however doesn't appear to be at hand. The bulls enjoy the benefit of the doubt.