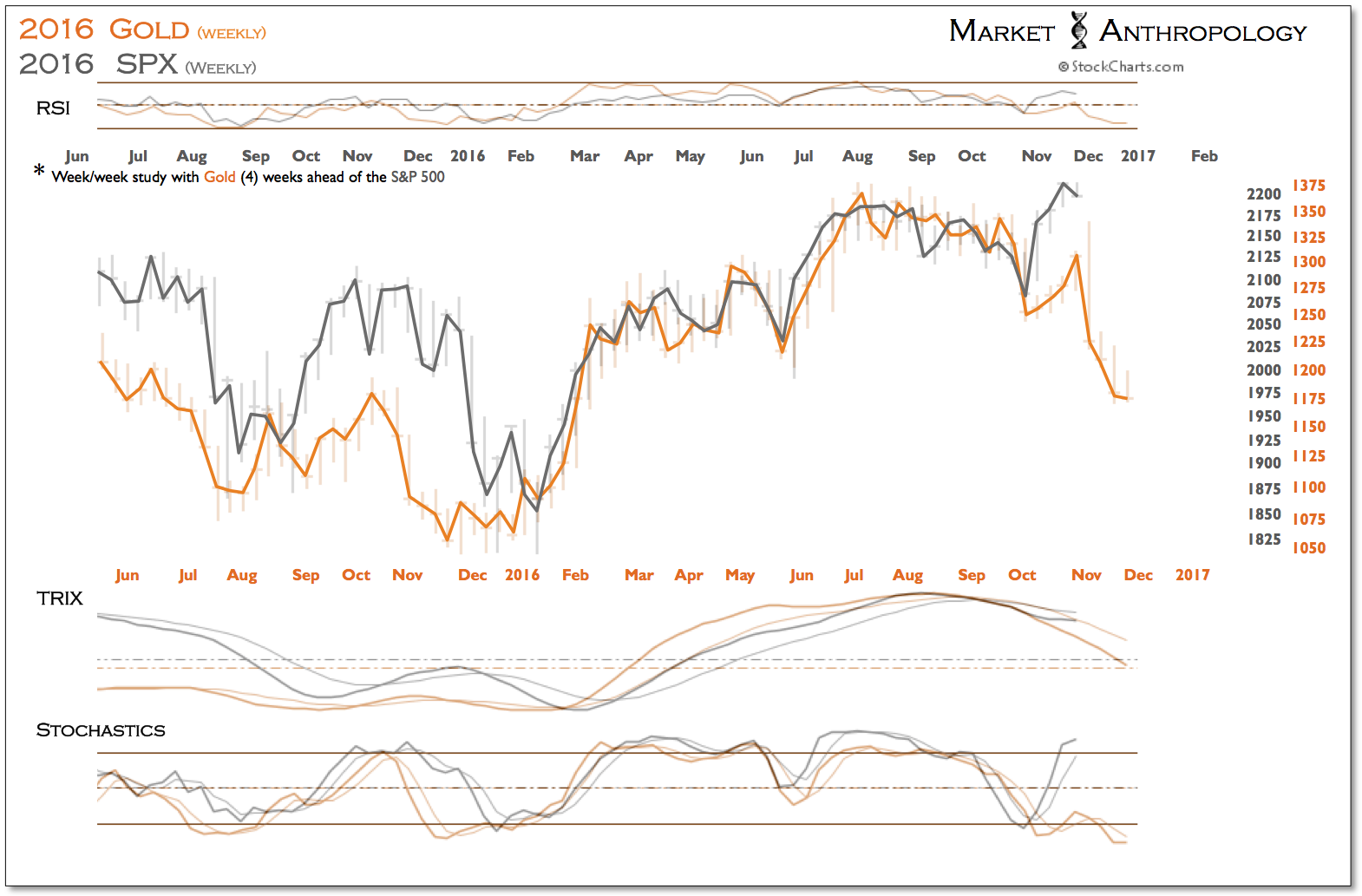

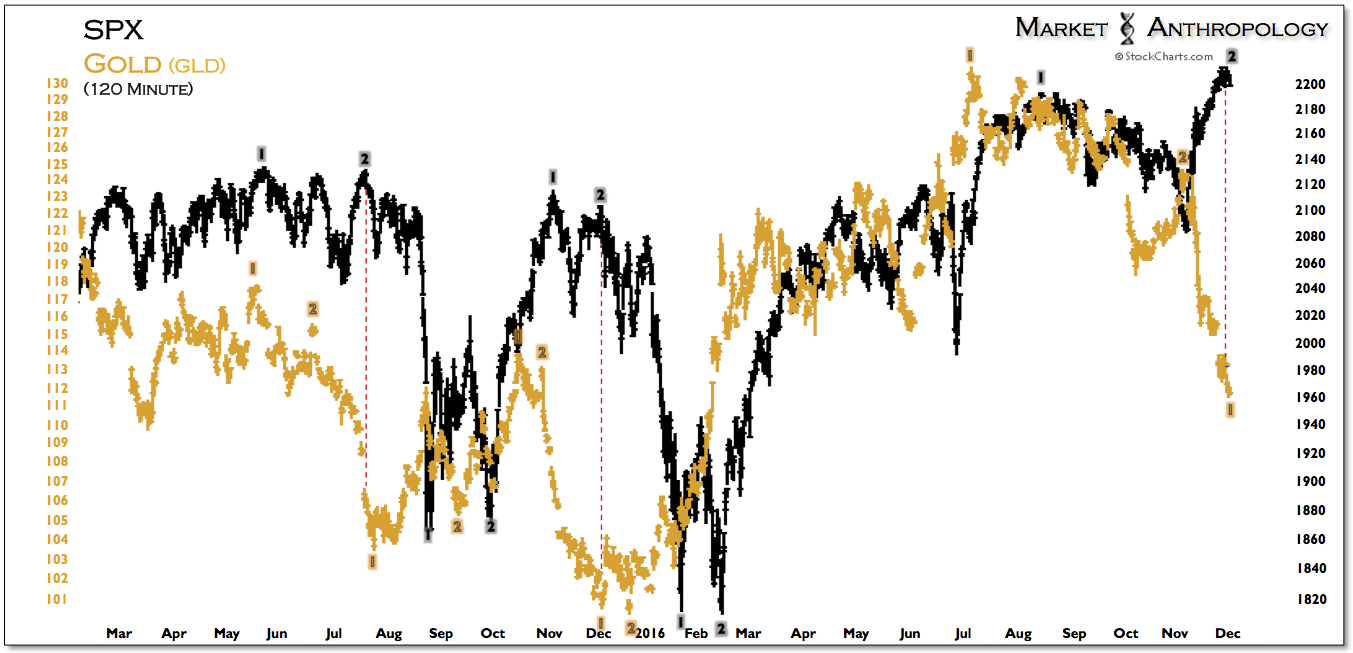

Despite the enduring enthusiasm in equities following the US presidential election, we continue to follow the proxy pivots in gold that have broadly led the trend in equities by approximately four weeks over the past two years. Should the relationship persist, we would guesstimate a pivot lower in equities approaches over the coming week.

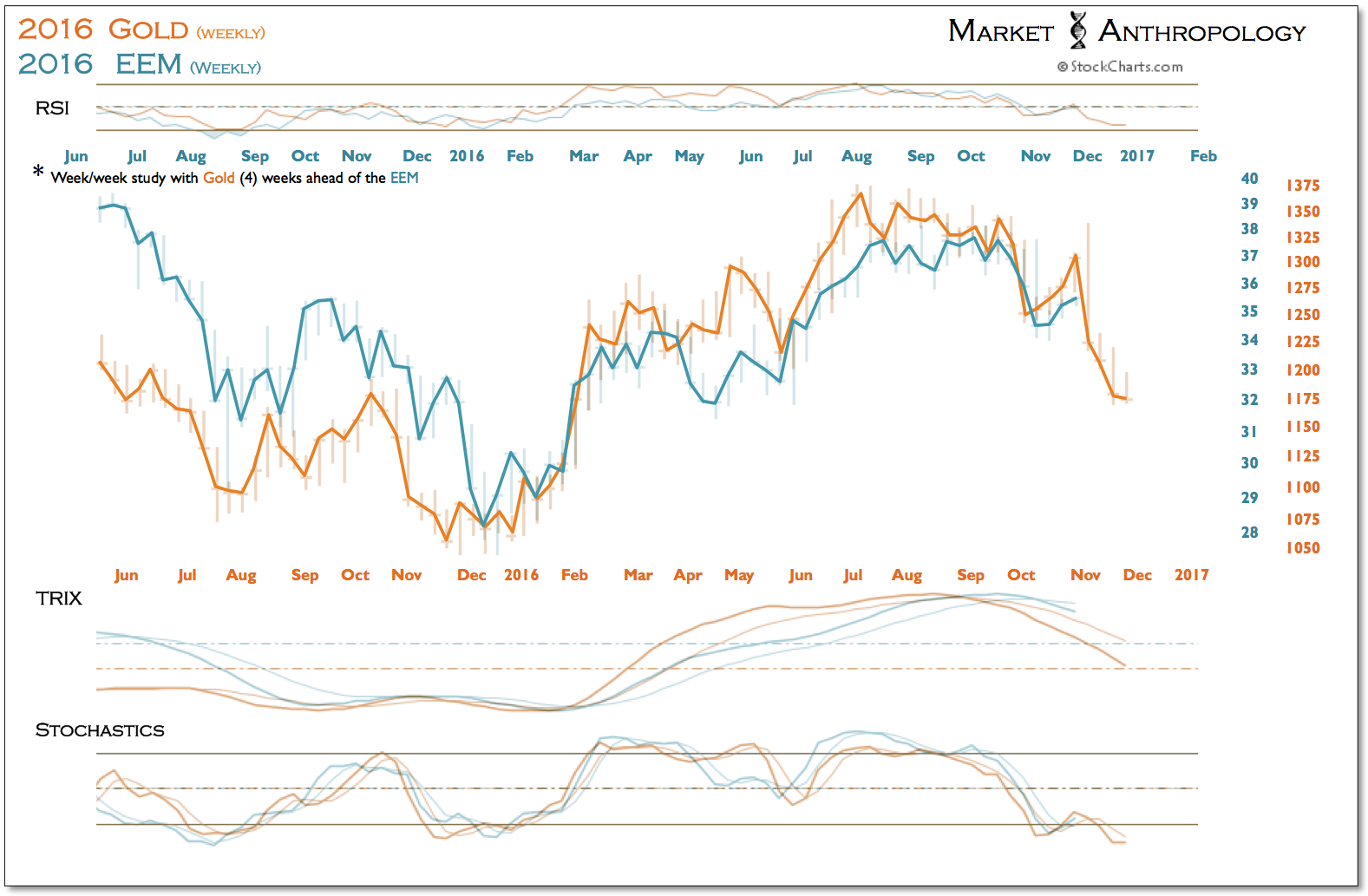

And while the S&P 500 has fully benefited from the unbridled capital outflows from Treasuries and safe haven assets that helped inspire fresh all-time highs across most indexes over the past two weeks, emerging market equities remain in lock step with gold’s leading structure that points towards another leg down after the current retracement rally exhausts.

That said, it would not surprise us to see US equities underperform (on a relative performance basis to the iShares MSCI Emerging Markets (NYSE:EEM)) on the downside, as we expect similar to last year’s dynamics going into and after the December Fed meeting, when it's possible another sell-the-news reaction in the dollar manifests. A good leading indication that the dollar rally has run its course would be for gold and silver to find their respective lows over the coming week or so as the equity markets begin to turn down.

We indicated below the two previous examples over the past two years where a similar dynamic had developed.

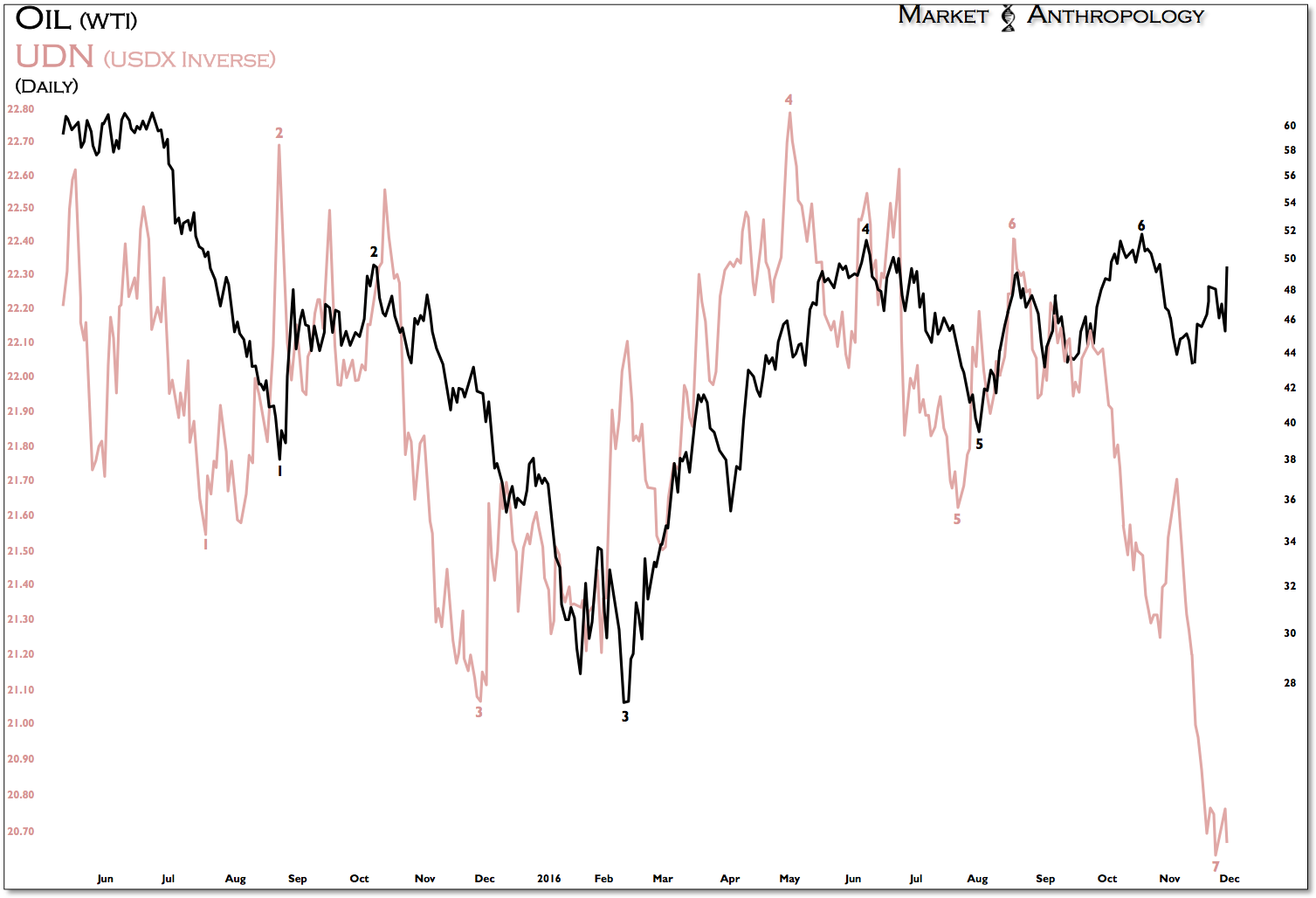

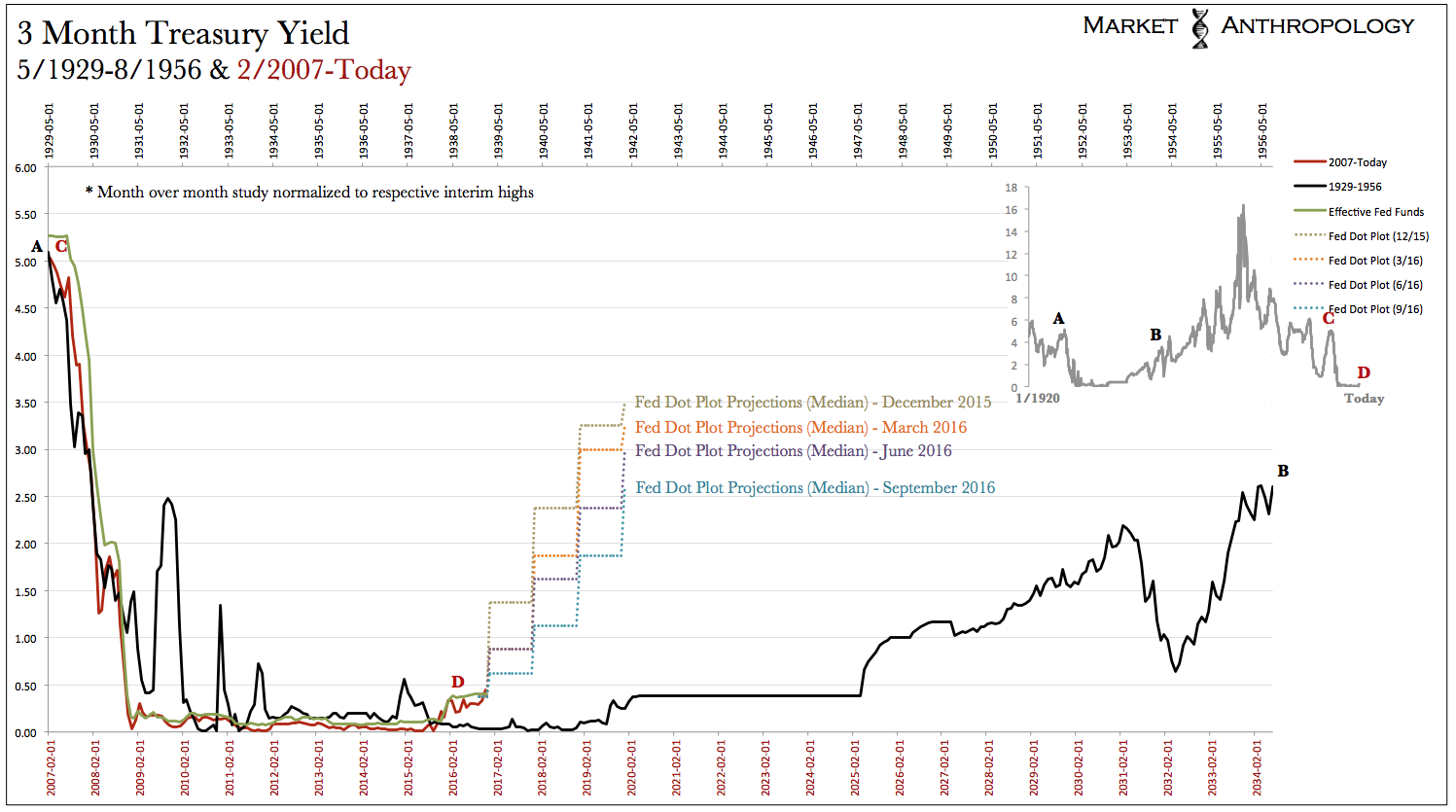

The US dollar index has again broken above 100 for the fourth time in the past two years, which has closely correlated with cresting rate hike expectations by the Fed. The last time the CME Group’s Fed Fund Futures probability for this December meeting rose above 90 percent was the first week in January of this year – before global market pressures significantly reduced expectations, which very likely had a negative feedback effect on the near-term outlook for growth and hence the economic data downstream in the following months.

Despite participants mood in yields and rate hikes pivoting 180 degrees since the lows in July and some marquee money managers becoming increasingly more bullish on US economic growth in the wake of a Trump victory, US markets are still at the mercy of a fragile global equilibrium that is invariably adversely affected by a much stronger US dollar and tighter financial conditions worldwide – not to mention a domestic economic expansion already historically long in the tooth.

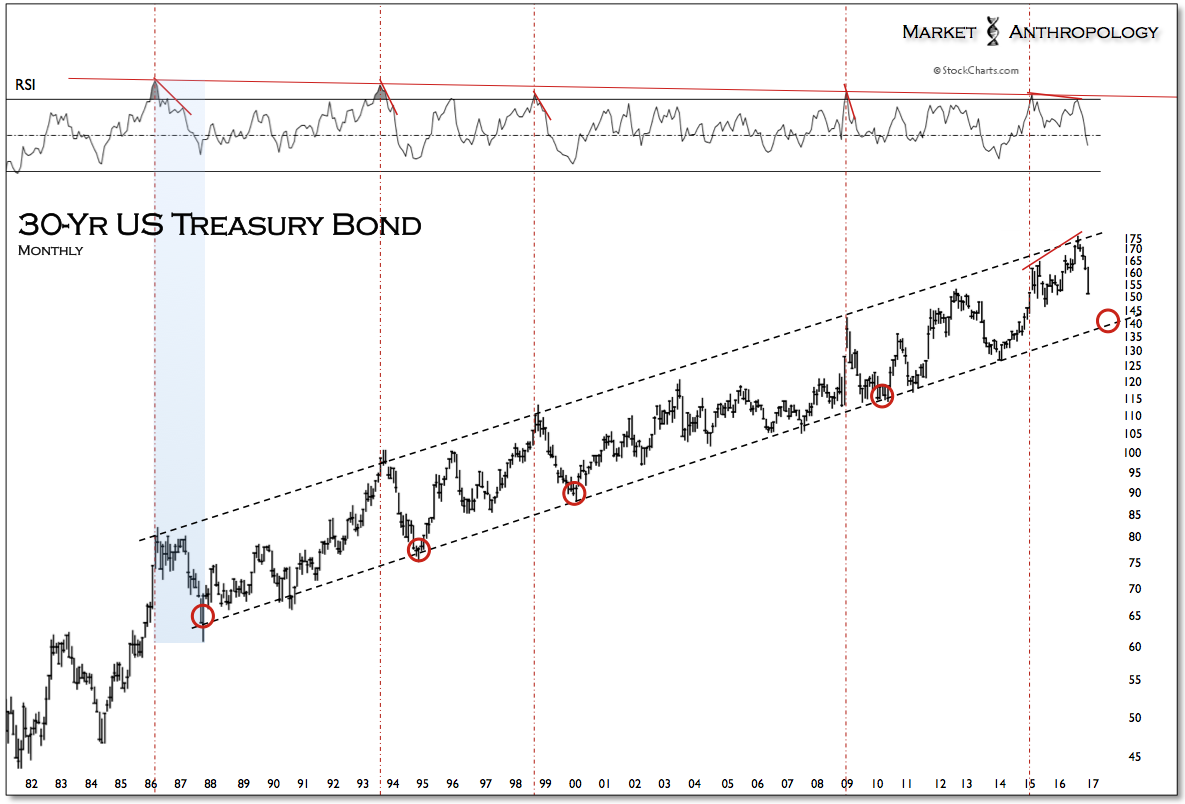

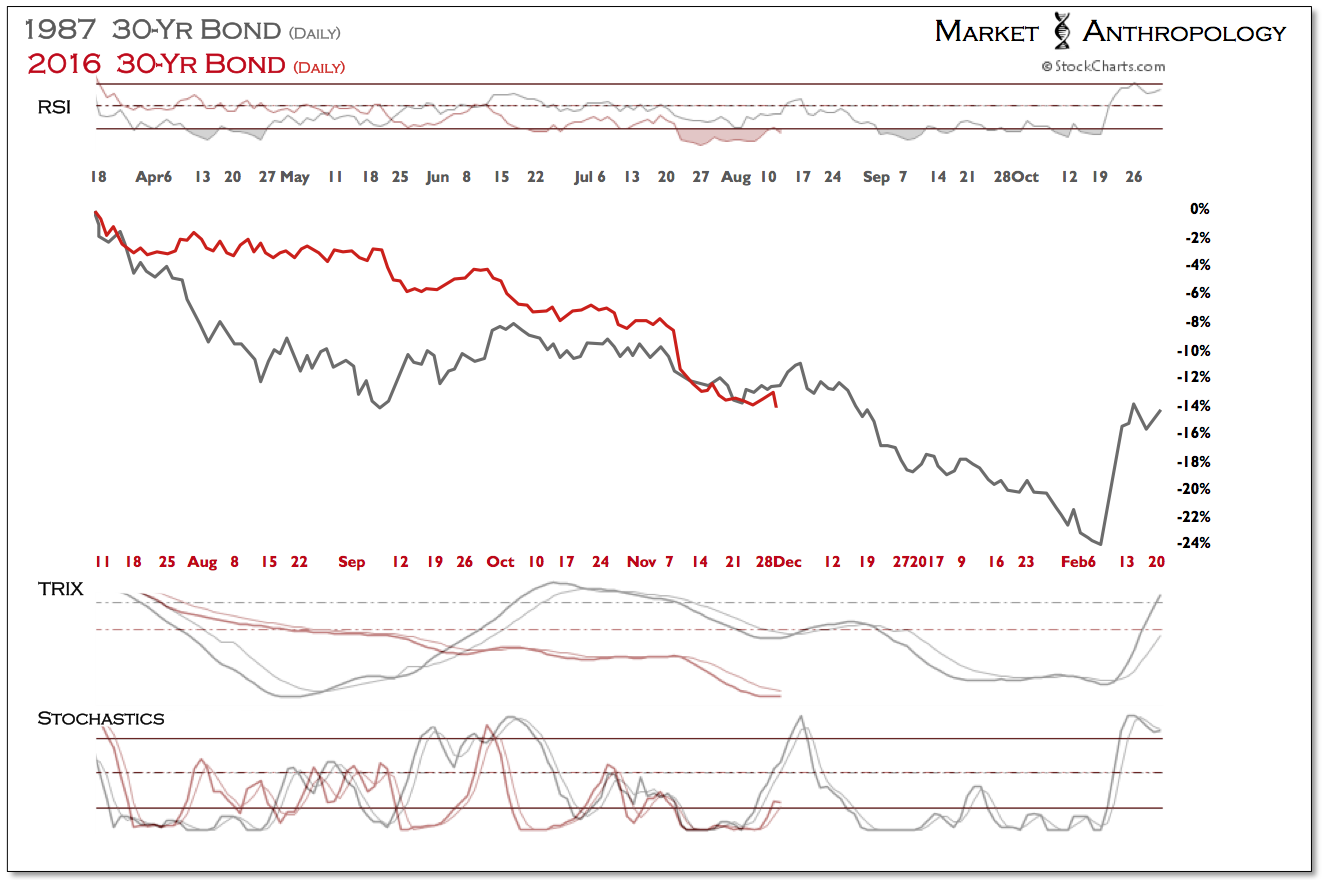

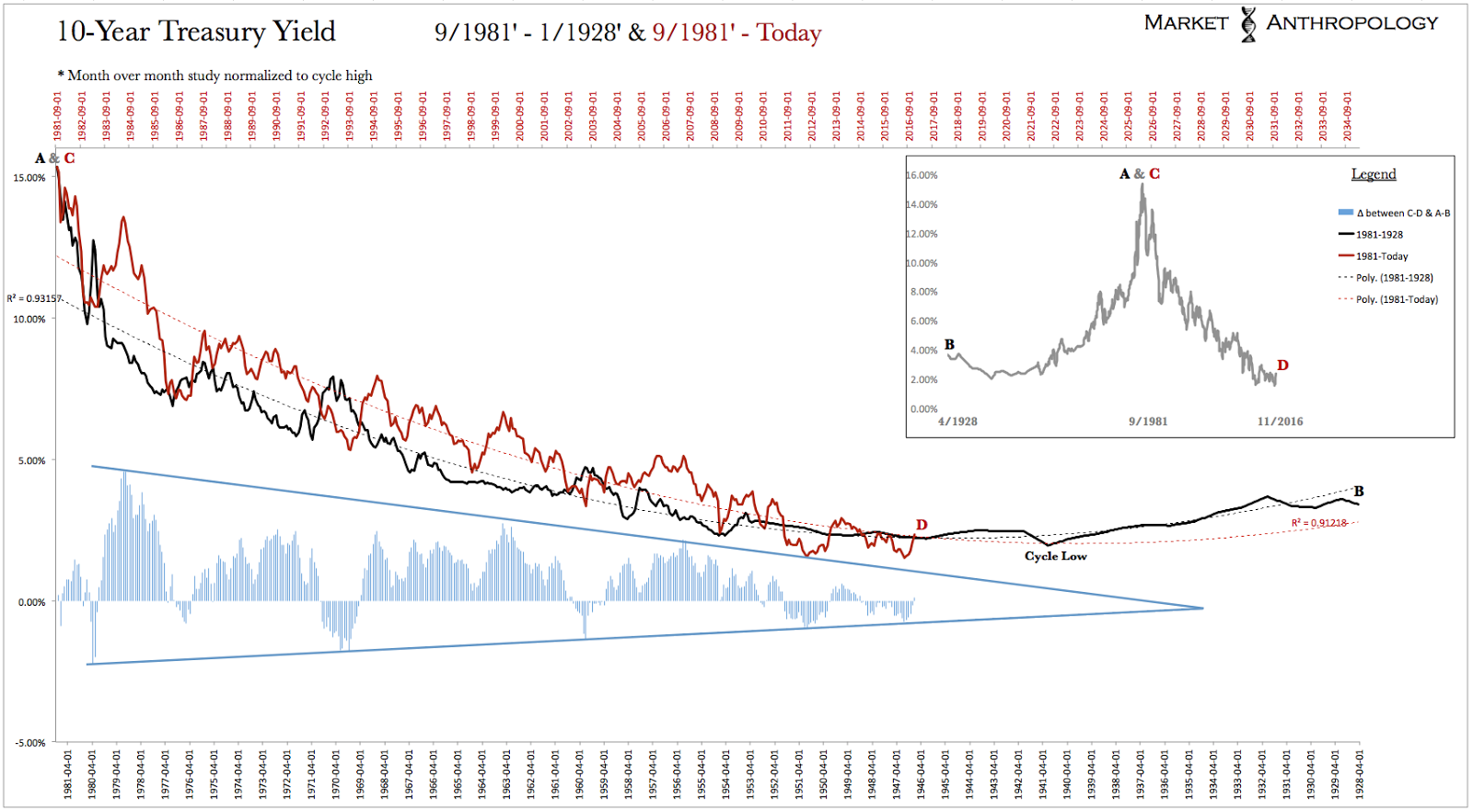

Consequently, we tend to defer to much longer-term perspectives on yields and growth that despite what the interim rally might suggest, continues to point towards a lower-for-longer market environment well into the next decade.

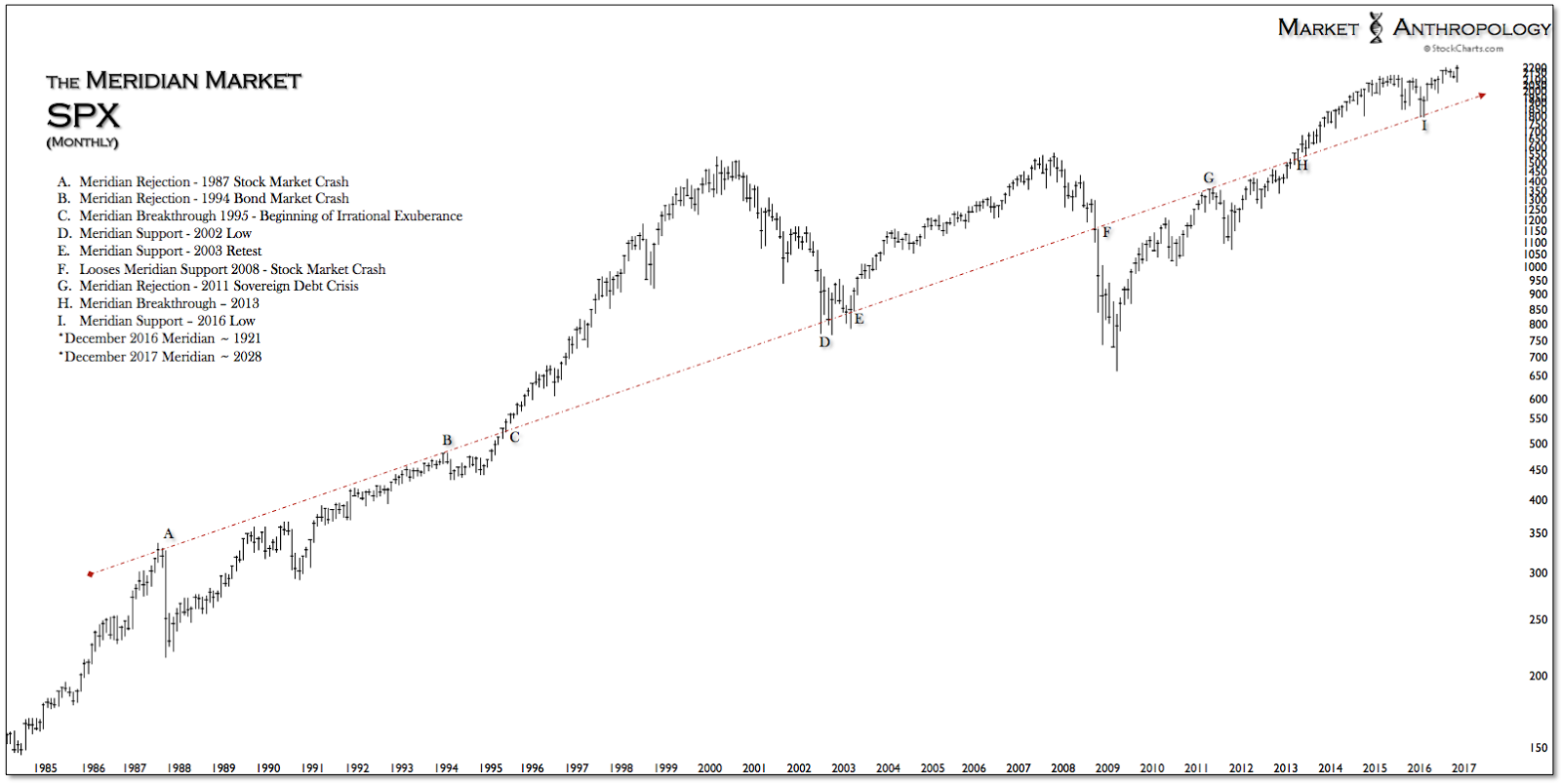

While we do expect the current weakness in Treasuries to extend into early next year, and that yields would be more supported than the dollar over the coming years as we foresee the uptrend in inflation continuing, both markets are confined by a much broader construct that we believe is not yet under a more secular persuasion or has digested and crossed the transitional divide to the next major growth cycle. This long-term outlook remains for equities as well, as 2200 on the S&P 500 was our secondary target back in January, if the market found support at the Meridian – as it did a few weeks later.

And although it wasn't our base case scenario back then, we still hold the respective extremes (both bullish and bearish) as outlier probabilities, with now considerable less upside opportunity today from a long-term historical perspective.

Expecting US growth will now resume a trajectory last seen during the halcyon days of the 1990’s, or that yields on the 10-year will again rise above 4 percent, is putting the cart well out in front of this horse, regardless of whether it was the Fed—or now Trump—holding out the carrot or waiving a large stick.

Lest we forget, we've been whacked plenty and have eaten billions of bushels of carrots over the past decade with little to show for it in terms of growth. Sticks and carrots may have helped repair it, but only time will heal these wounds.

Although the US equity markets have enjoyed recent strength since the election, the honeymoon appears to be ending and we expect the new members of the bull brigade to have their gilded growth thesis tested as the equity markets could again become the sharp tip of the sword prodding at the sides of the Fed next year.