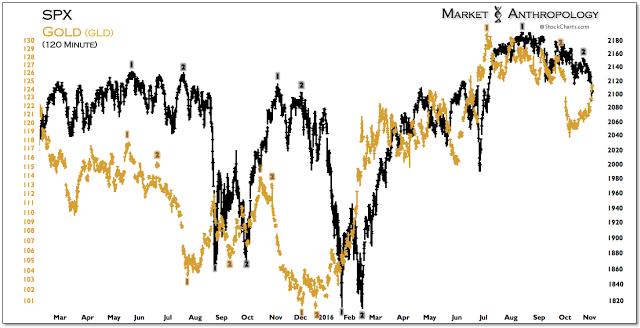

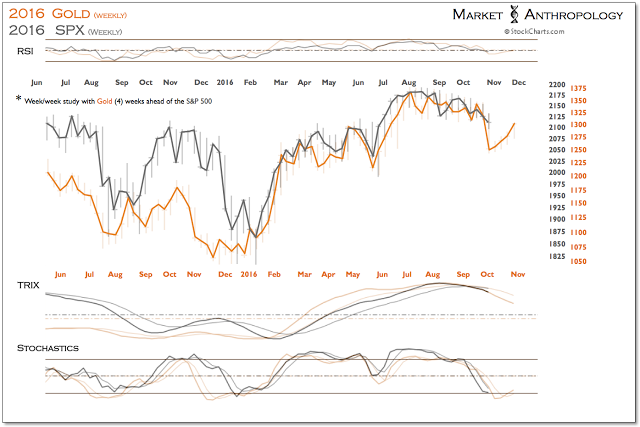

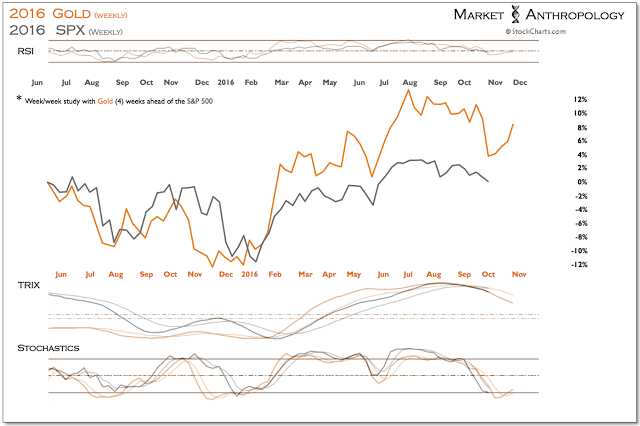

Notwithstanding the fluid polling data of the approaching US presidential election – or the outcome of yesterday’s less-anticipated November Fed meeting, the equity markets continue to wilt lower and follow gold’s leading footprints, left roughly four weeks back. Should the relationship continue to prove prescient towards stocks, we would guesstimate an initial target for the move in the S&P 500 of around 2050-2060.

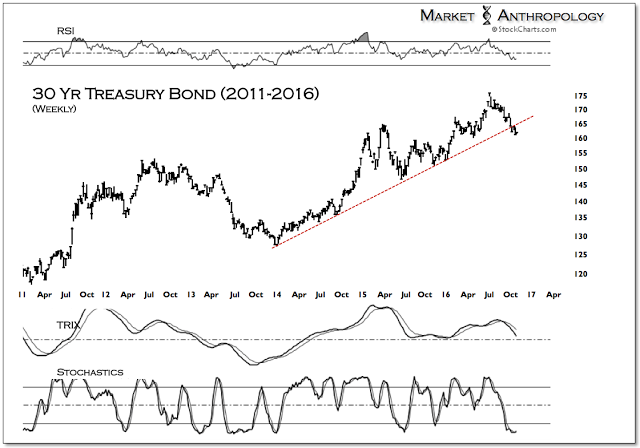

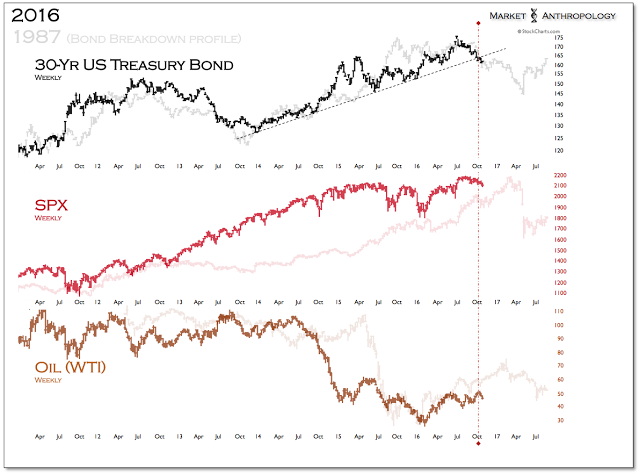

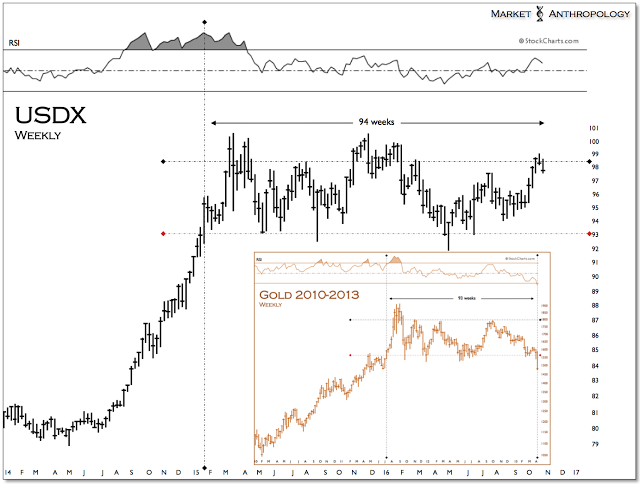

That said, there are potentially short-term positive developments working against a broader market dislocation that had raised concerns a few weeks back (see here), as gold has nearly retraced the entire decline from last month; long-term Treasuries have found a bid within the current equity market weakness and the breakdown in the US dollar rally this week.

As described in that note, from our perspective the magnified risk of negative feedback pressures building across asset markets would be greatly heightened with a restrengthening US dollar and higher yields. As such, should the equity markets take another leg down as we suspect they will and upside momentum continue to bleed from the dollar, the utility of maintaining a reflationary hedge – such as the aforementioned EEM short, would diminish considerably in the wake of further equity market weakness. Long story short, a window to cover approaches.

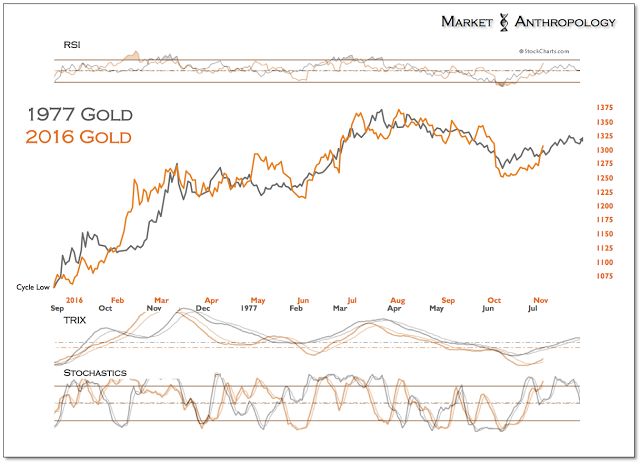

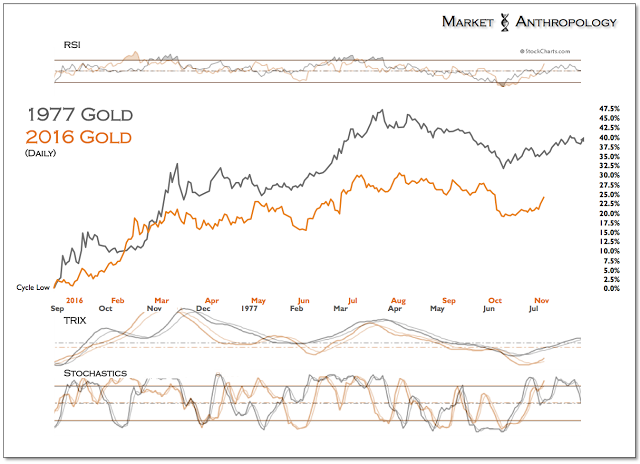

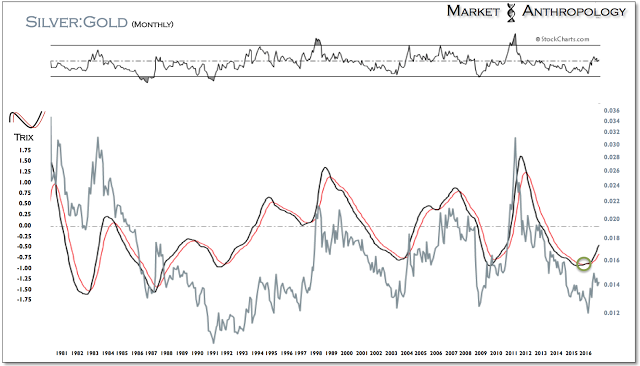

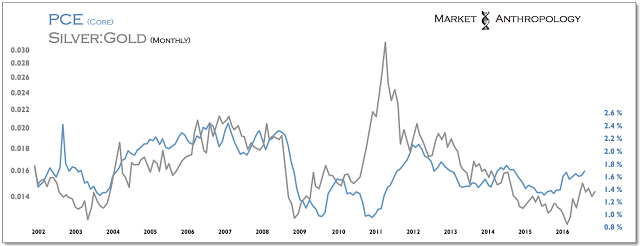

Overall, while it wouldn't surprise us to see the recovery rally in gold cool a bit if and when the equity markets stabilize, we're encouraged by the recent break in the US dollar and action in the silver:gold ratio that continues to bode bullish towards higher prices in the precious metals sector. Moreover, drawing on the historical parallels in real yields and the dollar from the mid to late 1970s, gold continues to walk the line – regardless of the buildup to the US presidential election.