Sometimes we all get stuck in a rut - and my rut has been the Federal Reserve's decision to raise the federal funds rate in December - and their continuing publicity to support why this action was taken. It is not because the federal funds rate should not have been raised, but the timing and the rationale were far from valid.

Follow up

Last week I penned that the Fed was not looking at data, and that the Fed should have began normalizing rates two years ago. This week, John C. Williams, president of the San Francisco Fed wrote:

I get asked a lot why the Fed raised rates when inflation was not just low, but when it had been persistently below target for some time. This decision is actually a good illustration of the use of various approaches to thinking about monetary policy.

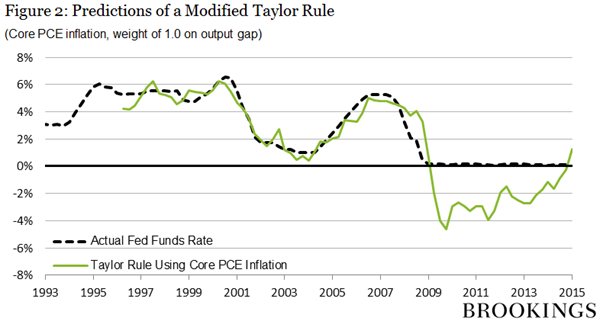

Both the basic and modified Taylor rules would call for an immediate increase in rates, mostly because we’re so close to our maximum employment goal. On the other hand, some people would call for waiting to act until we see the whites of inflation’s eyes. The far reaches of the spectrum get brought together because we’re also considering the difference rule and optimal control, which take forecasts into account in varying degrees, and because there are currently 17 voices in the room—who’ve spent the previous week debating the same issues with their own staffs of PhD economists. The fact that we raised rates when we did is an example of how ideas and instructions from all points on the playing field can come together in thoughtful, well-debated consensus.

What are the Taylor rules in simple English. From Wikipedia:

Taylor rule is a monetary-policy rule that stipulates how much the central bank should change the nominal interest rate in response to changes in inflation, output, or other economic conditions. In particular, the rule stipulates that for each one-percent increase in inflation, the central bank should raise the nominal interest rate by more than one percentage point. This aspect of the rule is often called the Taylor principle.

I find Wikipedia a good resource when you have little knowledge because it brings the conversation to basic definitions and understandable levels - but you cannot use it as a resource to disassemble and reassemble the automatic transmission in your 1958 Edsel Ranger. Here is what ex-chair of the Federal Reserve Ben Bernanke says about the Taylor Rule.

Monetary policy should be systematic, not automatic. The simplicity of the Taylor rule disguises the complexity of the underlying judgments that FOMC members must continually make if they are to make good policy decisions. Here are just a few examples (not an exhaustive list):

- The Taylor rule assumes that policymakers know, and can agree on, the size of the output gap. In fact, as current debates about the amount of slack in the labor market attest, measuring the output gap is very difficult and FOMC members typically have different judgments. It would be neither feasible nor desirable to try to force the FOMC to agree on the size of the output gap at a point in time.

- The Taylor rule also assumes that the equilibrium federal funds rate (the rate when inflation is at target and the output gap is zero) is fixed, at 2 percent in real terms (or about 4 percent in nominal terms). In principle, if that equilibrium rate were to change, then Taylor rule projections would have to be adjusted. As noted in footnote 2, both FOMC participants and the markets apparently see the equilibrium funds rate as lower than standard Taylor rules assume. But again, there is plenty of disagreement, and forcing the FOMC to agree on one value would risk closing off important debates.

- The Taylor rule provides no guidance about what to do when the predicted rate is negative, as has been the case for almost the entire period since the crisis.

- There is no agreement on what the Taylor rule weights on inflation and the output gap should be, except with respect to their signs. The optimal weights would respond not only to changes in preferences of policymakers, but also to changes in the structure of the economy and the channels of monetary policy transmission.

[footnote 2. 2. I caution against reading too much into the fact that the modified Taylor rule predicts a positive federal funds rate at the far right end of the figure. The FOMC has many factors to consider in its decisions. For example, the Taylor rule used in Figure 2, like the original Taylor rule, assumes that the long-run real funds rate is 2 percent. If the equilibrium real funds rate is lower than that, as both financial markets and FOMC participants appear to believe, then the modified Taylor rule used in Figure 2 may currently be predicting a funds rate that is too high.

San Francisco Fed's John Williams did note that using the Taylor Rule is not "absolutely fail-safe", but "will continue to be part of the discussion". Consider,

- monetary policy has manipulated the economy making "rules" based on historical data unreliable and the results unpredictable;

- there was too much data showing the economy was slowing;

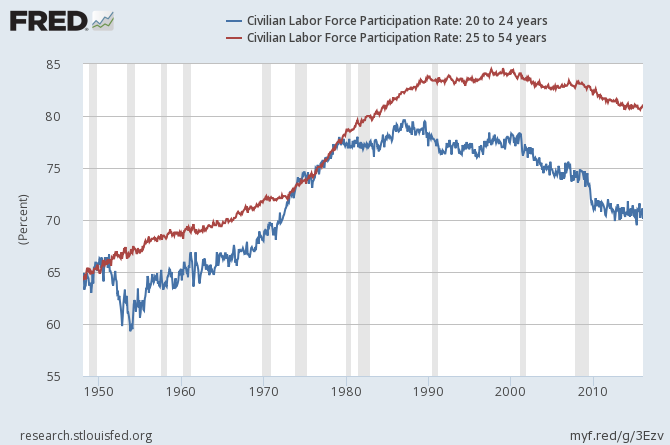

John Williams implied the economy was close to full employment. I am on record that the Fed is looking at the wrong set of data if anyone believes the USA is close to full employment. Here is how I see the prime working ages:

There may be misallocation of skill sets or people living in places without enough jobs - but nobody is going to convince me the above graph is demonstrating the USA is nearing full employment. The 20 to 24 year curve is telling me that too many people (compared to historical data) are getting a higher education because they cannot find a job.

I hope that the current subtle improvement in some trend lines in some data sets is the end of the deteriorating growth in the USA economy. If this is true, the Fed has dodged a bullet. If not, the Federal Reserve needs to find a new set of rules.

Other Economic News this Week:

The Econintersect Economic Index for March 2016 marginally improved but remains relatively weak. The index continues at one of the lowest values since the end of the Great Recession. It remains to be seen if this improvement is a reversal of the long term decline of our index since late 2014.

Current ECRI WLI Growth Index

The market expected (from Bloomberg) were 263,000 to 272,000 (consensus 270,000), and the Department of Labor reported 278,000 new claims. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 272,000 (reported last week as 272,000) to 270,250. The rolling averages generally have been equal to or under 300,000 since August 2014.

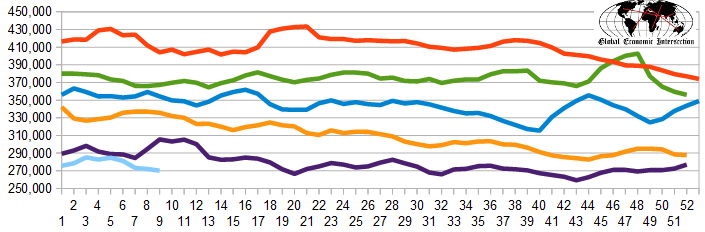

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Privately-held BH Sutton Mezz, GreenHunter Resources (NYSE:GRH) (pka GreenHunter Energy), Sports Authority Holdings, Privately-held SH 130 Concession Company [Texas toll road]

Weekly Economic Release Scorecard: