Throughout my career, I have been faced with the dumbest smart people. Many times the deeper one looks at something - the more complex the analysis - the obvious is missed.

Follow up:

On 16 December 2015, the Federal Reserve raised the federal funds rate coincident to the time the economy was slowing. Their meeting statement indicated otherwise.

The Committee judges that there has been considerable improvement in labor market conditions this year, and it is reasonably confident that inflation will rise, over the medium term, to its 2 percent objective. Given the economic outlook, and recognizing the time it takes for policy actions to affect future economic outcomes, the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent.

Did the Fed mean stock market when it concluded that it was time to raise rates? [note the below graph cutoff date was 17 December 2015]

The stock market was showing signs of fatigue in December 2015. How many remember ex-Fed Chairman Bernanke statements on the relationship between the markets and monetary policy? From Fortune:

When Ben Bernanke was the head of the Fed, he used to point to the market as evidence that U.S. central bank’s policies were working. In late 2010, Bernanke wrote in an editorial in The Washington Post that a rise in stock prices was one of the signals that the central bank’s policies had worked “in the past and, so far, looks to be effective again.” In August 2012, Bernanke told interest rate policy makers at the influential Jackson Hole conference that the Fed’s bond purchases, so-called quantitative easing, had directly boosted stock prices. Bernanke said that was “potentially important because stock values affect both consumption and investment decisions.” And in October of the same year, he reiterated his belief that a higher stock market would boost consumer and business spending. All this talk of the stock market led critics to claim that Bernanke was purposefully blowing a bubble in the stock market.

Why time a monetary policy normalization coincident with market weakening as the markets would decline IF Bernanke was correct about the linkage between monetary policy and the markets. Yes, even though the market had priced in a Fed funds rate increase - it has continued to decline since 17 December 2017.

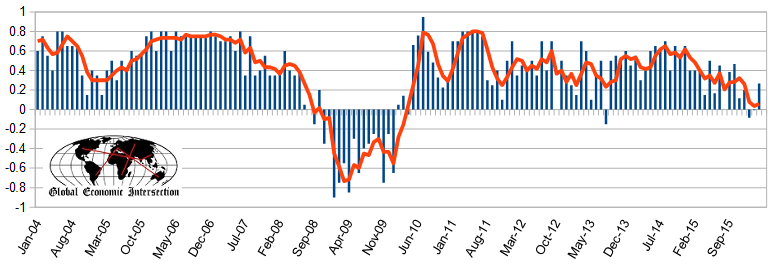

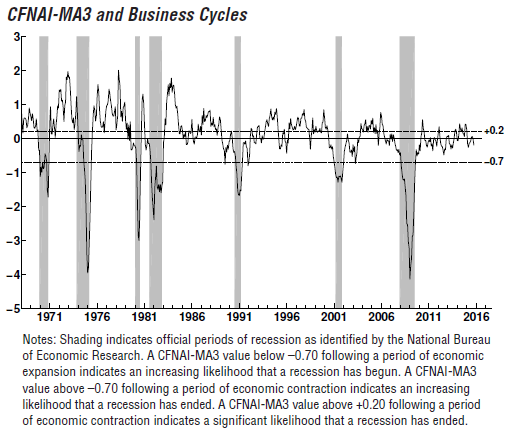

More importantly, the economy also was showing signs of deceleration. The Chicago Fed National Activity Index (CFNAI) is a composite coincident index of important economic indices - and the CFNAI-MA3 released on 23 November 2015 was trending down. The MA3 is a 3 month rolling average, and is used for economic analysis as the monthly index is too volatile.

Even the most current release (February 2016) of the CFNAI does not show much change from these low levels. And at the same time Econintersect's Economic Index was also showing deceleration of the economy. If we were seeing this economic deceleration, what was the Fed looking at?

Econintersect Economic Index (EEI) with a 3 Month Moving Average (red line)

Was the Fed was looking at something else other than economic data when it decided to raise the federal funds rate? Or more likely, were they "cherry picking" data? The Fed implies they were looking at data. This past week, John Williams, President of the San Francisco Fed. stated:

So what does all this say about monetary policy? A lot of people make jokes about economists having the only job in the world where you can constantly change your answer and not get fired - my mother, by the way, is one of them. But what we actually do is adjust our forecasts as we get more data. A few years ago, for instance, I viewed the natural rate of unemployment as about 5½%. As more data came in and as we learned more about the shape of the recovery, I reassessed. This is just to put into context that when I look at my December forecast and compare it with my outlook for unemployment and core inflation today, there's virtually no change. The shifts in my forecast amount to just one-tenth of a percentage point.

I therefore continue to see a gradual pace of policy normalization as being the best course. My preferred route is a gradual path of increases. This reflects the fact that the economy still needs a gentle shove forward from monetary policy, as we continue to navigate the headwinds from weakness abroad and their effects on the dollar and commodity prices.

An interesting twist this past week came from St. Louis Fed's President James Bullard who noted:

..... that market-based inflation expectations have fallen further and that the risk of asset price bubbles over the medium term appears to have diminished. “These data-dependent changes likely give the FOMC more leeway in its normalization program.”

Bullard stated that monetary policy needed to be more data dependent.

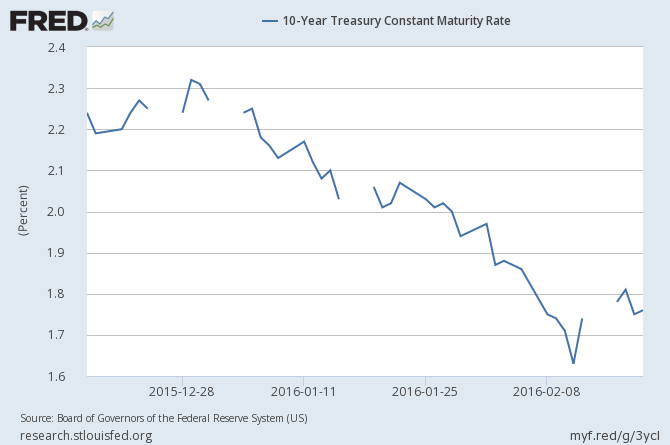

As I have previously stated, a small increase in the federal funds rate from a theoretical standpoint should have little impact to the economy. Yet what has happened since the raising of the rates is an opposite affect on the Treasury bond market where the increase in the federal funds rate caused long term treasuries to decline (opposite effect of what should have happen IF the economy REALLY was strengthening in December 2015).

Does the federal funds rate (or many other elements of monetary policy) have much direct affect on the USA economy? The dollar is a global currency - and USA monetary policy actions radiate around the world. The beginning of the normalization of USA monetary policy was ill-timed and negatively impacted the global economy while it was slowing. It does not take a Ph.D. in economics to have warning bells ringing when you raise federal funds rates just as other nations were lowering theirs into negative territory.

Did the Fed have any other choice but to raise rates? There is some evidence that low federal funds rate was restraining the USA economy.

The trick was to time the federal funds increase to periods where the economy is growing fast enough where the change would not be noticed - say anytime in 2012 and 2013. The Federal Reserve may have been asleep and missed the correct time to raise the federal funds rate. In this respect, the Fed is not smarter than a fifth grader. The tea leaves were saying the USA economic trends were decelerating coincident with the Fed beginning to normalize monetary policy. The Fed cannot say in one meeting the economy is humming along, and the next meeting say:

Information received since the Federal Open Market Committee met in December [when the federal funds rate was increased] suggests that labor market conditions improved further even as economic growth slowed late last year.

The Fed's current economic view has not been proven to be credible. When the Fed says the economy is going up when it is really going down - why trust they did the correct thing in raising the federal funds rate. They have not shown they are smarter than you or I.

Scary.

Other Economic News this Week:

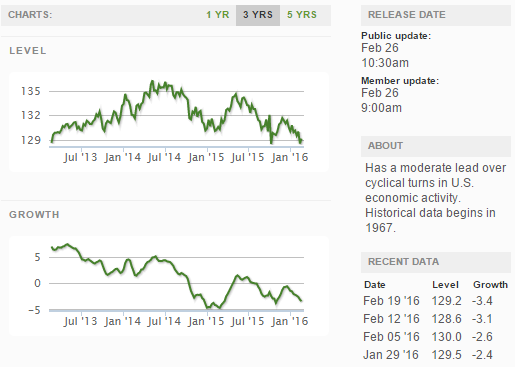

The Econintersect Economic Index for February 2016 declined again, and is barely positive - and still remains at the lowest value since the end of the Great Recession. The tracked sectors of the economy which showed growth were mostly offset by the sectors in contraction. Our economic index remains in a long term decline since late 2014.

Current ECRI WLI Growth Index

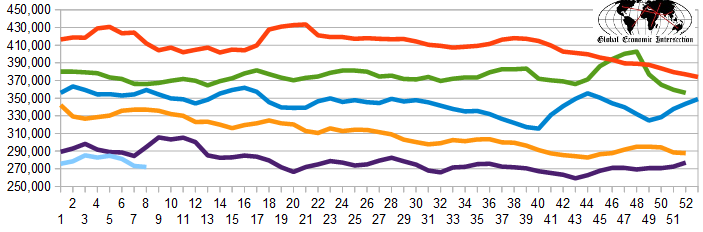

The market expected (from Bloomberg) were 265,000 to 284,000 (consensus 270,000), and the Department of Labor reported 272,000 new claims. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 273,250 (reported last week as 273,250) to 272,000. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Abengoa Bioenergy, Pacific WebWorks, Republic Airways Holdings

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: