So by all means, buy the dip now that the VIX soared in full-blown panic from 12 to 17.

One of the more remarkable features of the Bull market in stocks is the ascendancy of complacency and the

banishing of fear. Take a look at this chart of the "fear index," the VIX--more properly, a measure of volatility:

The VIX popping up to 17 from 12 now qualifies as an extreme of fear which gives the Bulls the go-ahead to buy the dip once again.

Even more striking is the daily chart of iPath S&P 500 Vix Short-Term Futures (ARCA:VXX), a short-term VIX-based ETN: A tiny blip up from 24 to 26 now qualifies as an extreme of panic.

Equally remarkable is the steady decline in both VIX and VXX: complacency now reigns supreme.

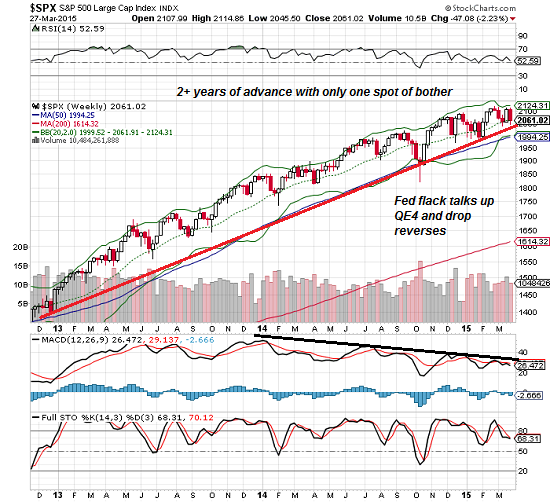

The complacency is the result of stocks' steady rise for over two years--9 quarters of advances with only one spike down in October 2014--a spot of bother that was quickly reversed by a Federal Reserve flunky talking up QE4 (another round of quantitative easing to boost stocks).

No wonder complacency reigns supreme: any time the stock market tumbles by more than 3%, a Federal Reserve flack runs to a microphone and starts talking about how the Fed stands ready to launch QE4 or "whatever it takes" to push stocks back into rally mode.

For context, recall that both VIX and VXX tend to reach 40 in real moments of panic/fear. That the VXX "soaring" 2 points from 24 to 26 now qualifies as an extreme of fear is absurd.

Yet this is the logical result of central banks constantly "saving" equities every time they swoon the slightest bit: traders and punters know that the Fed making reassuring sounds is all that's needed to reverse any decline and restart the Bull advance.

But a couple of things have changed recently. The QE baton has been passed from the Fed to the European Central Bank (ECB), famously ready to do "whatever it takes," but the ECB's QE bond-buying hasn't triggered the global rally that many expected.

Secondly, China is rolling over the first time in six years. The engines that pulled the global economy out of the hole in 2009--the Federal Reserve and China--have stopped, and there are no equivalent engines warming up.

So by all means, buy the dip now that the VIX soared in full-blown panic from 12 to 17. Nothing can possibly go wrong as long as a Fed flack stands ready to spew the same old assurances of "whatever it takes" into a microphone.