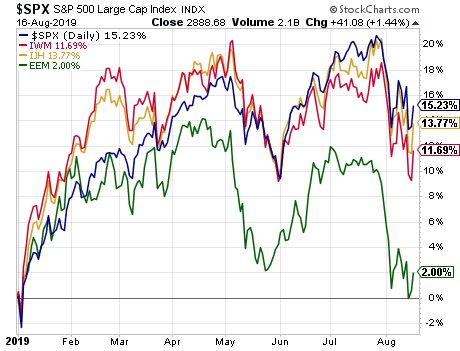

The market lost ground for the third consecutive week last week, down 2.93%. In spite of the recent weakness, equities continue to show respectable returns this year with the S&P 500 Index up 15.23%. Foreign stocks have not held up nearly as well and the emerging market index (green line) is only up 2% year to date so far in 2019.

Maybe in part due to the decent U.S. returns, consumers continue to express strong confidence. I touched on this in a post earlier this month. Additionally, this past week we saw some retail sales and compensation data that point to a strong consumer as well.

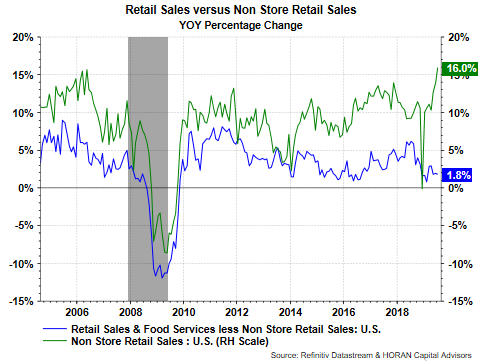

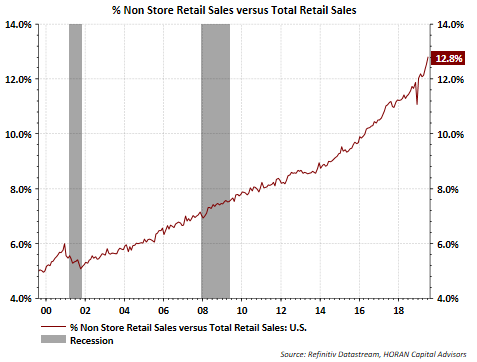

Overall retail sales were up .7% for the month of July and this exceeded the consensus estimate of .3%. Non store retail sales (e-commerce) continue to be impressive. Non-store sales were up 16% on a year over year basis as seen in the first chart below. In the second chart, the non store retail sales continue to represent a larger percentage of overall sales, now accounting for 12.8% of total sales. This increasingly larger percentage of non-store sales sheds insight into some of the difficulties experienced by brick and mortar retailers.

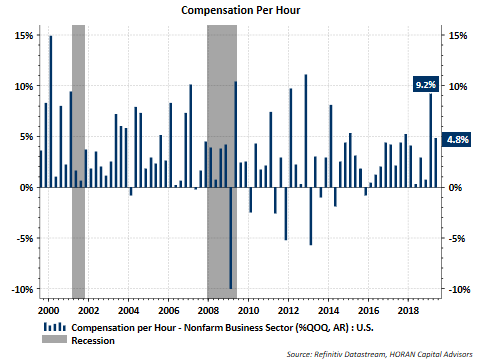

Also, late last week the Bureau of Labor Statistics reported data on productivity and compensation. As the below chart shows, compensation was up 4.8% in the second quarter and this follows a revised higher first quarter compensation increase of 9.2%.

Based on the strength of retail sales, the increase in wage growth is supporting the retail sector of the economy. As consumers account for 70% of GDP, this data is positive for continued economic growth.