Compass Minerals International Inc (NYSE:CMP) is the world’s largest producer of salt, and they’re also a significant plant nutrition mineral producer.

Specifically, here’s the breakdown of their business:

A Wide, Impenetrable Moat

Compass Minerals owns the largest salt mine in the world- the Goderich salt mine on the coast of Lake Huron. They also own the largest salt mine in the UK.

Most of the salt produced by Compass Minerals is used for road deicing- massive quantities of cheap rock salt spread on the roads by trucks to melt ice in winter months. Some of the salt is for industrial or culinary purposes, although this isn’t the fancy salt that some people eat.

Due to these assets, especially the Goderich mine, Compass Minerals is one of the strongest examples of a wide moat business. Deicing salt is a cheap commodity, so the lowest-cost producer gets disproportionately high market share. In addition, because salt is so cheap relative to weight, transportation costs play a major role in how cheap it really is for the end-user.

As the largest salt mine in the world, Goderich produces super-cheap salt. In addition, since it’s located right on Lake Huron, they have perfect access to water transportation, which is cheaper than rail or trucking. Lastly, the regions around the Great Lakes are some of the snowiest areas in North America, meaning that Goderich is perfectly located to transport salt to the whole Midwest, Southern (NYSE:SO) Canada, and to infamously-snowy western New York.

With the Goderich mine expected to have decades of salt production left, there is literally nothing competitors can do to compete on the same level as Compass minerals when it comes to deicing salt.

Another major line of business for the company is sulfate of potash. Sulfate of potash (SOP) is a specialty fertilizer used for high-value crops that has a price premium over regular potash. Some producers of SOP make it via a chemical process, but this is a fairly expensive method.

Compass Minerals has the advantage of owning one of just a handful of naturally-occurring brine lakes in the world with both potassium and magnesium for natural SOP production. Compass Minerals owns this major SOP production region in Utah, which makes it one of the world’s lowest-cost producers of SOP, and a significant producer of SOP for North America. That’s another reasonably wide-moat business.

Historically, one of the surest ways to build wealth and reach financial freedom has been to buy and hold a diversified collection of wide-moat dividend-paying businesses.

The Benefits of Non-Correlation

The fascinating thing about companies like this is how little correlation they have with the strength of the economy.

If you look down the list of companies in the S&P 500 for example, the majority of them are strongly levered to economic growth, and suffer during recessions.

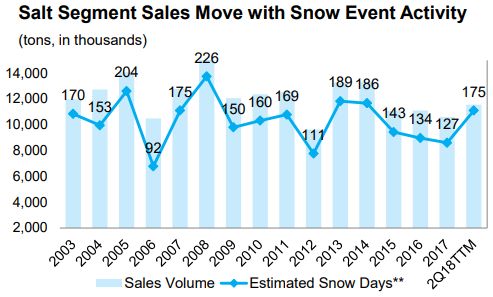

The risk of Compass Minerals, however, is more tied to weather. Snowy winters in North America mean more usage of deicing salt, as shown in the chart below:

Source: 2018 Credit Suisse (SIX:CSGN) Basic Materials Conference, CMP Presentation

Since Compass Minerals can’t control the weather, this correlation with snowy weather is a challenge for them. In addition, climate change may affect their business over time. Higher and higher levels of carbon dioxide in the atmosphere could cause a trend of warmer winters over time. Morningstar analysts, for example, are factoring this risk into their estimated fair value; they assume mildly lower usage of deicing salt and consequently weak salt prices going forward.

The good news is that their business has very little correlation with economic strength. It doesn’t matter of the United States or Canada have a severe recession; their communities will still buy inexpensive rock salt to keep ice off the roads. In addition, the results of their sulfate of potash business are mostly based on pricing of SOP, which is based on supply and demand of potash rather than being heavily reliant on economic strength. Agriculture is basically its own asset class, with its own cycles.

A Major Sell-Off, and Potential Opportunity

Compass Minerals has paid a growing dividend for 14 consecutive years and has reached a stock price of nearly $100 in the past.

However, the period of 2016-2018 has been really rough for the company. Due to a series of issues discussed below, their stock price is now under $50, their earnings-per-share have evaporated, and their dividend looks to be remaining flat in 2018, which will end their 14-year streak of consecutive annual dividend raises.

Chart Source: Google (NASDAQ:GOOGL) Finance

If the company has impenetrably wide economic moats around its salt and sulfate of potash businesses, how could they have run into so much trouble?

The answer is internal issues and potential mismanagement.

As you can see on this chart, Compass Minerals used to consistently earn $4-$5 in earnings per share per year, which easily covered its dividend. They also had consistently positive free cash flow. Most importantly, they had low leverage, and their interest coverage ratio was often over 10. In other words, they made enough profit to pay for their annual debt interest ten times over.

Risky Acquisitions and Leverage

In 2016, however, the company decided to acquire a Brazilian company called Produquimica, which makes specialty fertilizers and water-treatment chemicals. The CEO of Compass Minerals stated that the reason for this is that the company wanted to reduce their risk exposure to snowy winters by having a larger plant nutrition business, and wanted to have exposure to a faster-growing industry, which makes sense.

However, Produquimica does not have nearly as wide of a moat as their rock salt mines, or even their sulfate of potash business. In addition, Compass Minerals funded the acquisition with debt. Compass Minerals now has 3x as much debt as they did just five years ago in 2013. It does make sense to increase leverage in a low-rate environment, but this was quite a lot and the company’s interest coverage ratio is now in the low single digits.

Goderich Mine Operations Issues

In 2017, the Goderich mine had a partial ceiling collapse. Fortunately nobody was injured, but it was a setback for current expansion plans for the mine. Compass Minerals is upgrading how they mine salt from Goderich. Instead of using the drill-and-blast method to push deeper into the mine, they will use heavy equipment to continuously dig deeper in. But this mine damage caused operational issues for months thereafter and delayed the benefits of this costly improvement.

In 2018, Goderich had a nearly three-month union worker’s strike. This was an even bigger blow to the company’s operations. With so much debt and interest to pay, and all the operating leverage inherent in the mining industry, even short periods of being offline result in massive losses. In addition to being mostly offline for months, the company took several more months after the strike ended to ramp production back up.

CEO Departure

Just recently on November 19, the company unexpectedly announced that their CEO would depart the company, effective immediately, with no explanation given.

Usually CEOs depart with more notice and with more of a succession plan. The company announced they will have a search committee to review internal and external people for the next CEO. This indicates that the company’s poor performance of late may have had something to do with the CEO transition, but one can never say for sure unless the company provides a reason.

Value Play or Value Trap?

After the recent sell-off, Compass Minerals may very well be worth looking at now for enterprising investors. The company pays a nearly 6% dividend yield at current prices, and has substantial upside potential.

The company reached an agreement with their worker’s union, Goderich mine is being upgraded into early 2019, and a new CEO may be the catalyst the company needs to turn their recent misfortunes around.

The consensus analyst estimate for 2019 earnings is $3.58. The current price of just over $48/share gives a forward price-to-earnings ratio of about 13.5x, which is rather low. This would be enough to support the company’s annual $2.88 dividend payout. And if the company can return to peak earnings of about $5/share in the coming years, and then hopefully exceed it thanks to the company’s acquisition-fueled growth, the current price would look like a bargain.

The key risk is debt, which was not a problem just a few years ago. The company has a debt-to-equity ratio of about 2.5x and a low interest coverage ratio. Their debt is equal to 6-7 times the company’s historical peak annual net income.

The company may have to hold the dividend flat for a while to accelerate debt reduction, and any setbacks with their key operating assets may result in a dividend cut. It’s certainly not the type of investment a conservative dividend investor can buy, hold, and forget about. At worst, if the next CEO doesn’t turn the misfortunes around this could be a value trap.

However, as a company that is uncorrelated with the global economy, and with considerable upside potential from a good management transition, Compass Minerals is worth a serious look from enterprising value investors.

Disclosure: The author has no position in any stocks mentioned and has no plans to open any positions in stocks mentioned for at least 72 hours after publication.