Americans love their pets. The percentage of US households that own a pet has grown from 56% in 1988 to 67% in 2019, according to the American Pet Products Association (APPA) National Pet Owners Survey. US sales of pet products and services hit a record $95.7 billion last year as it is estimated sales will grow to $99 billion this year, according to the APPA.

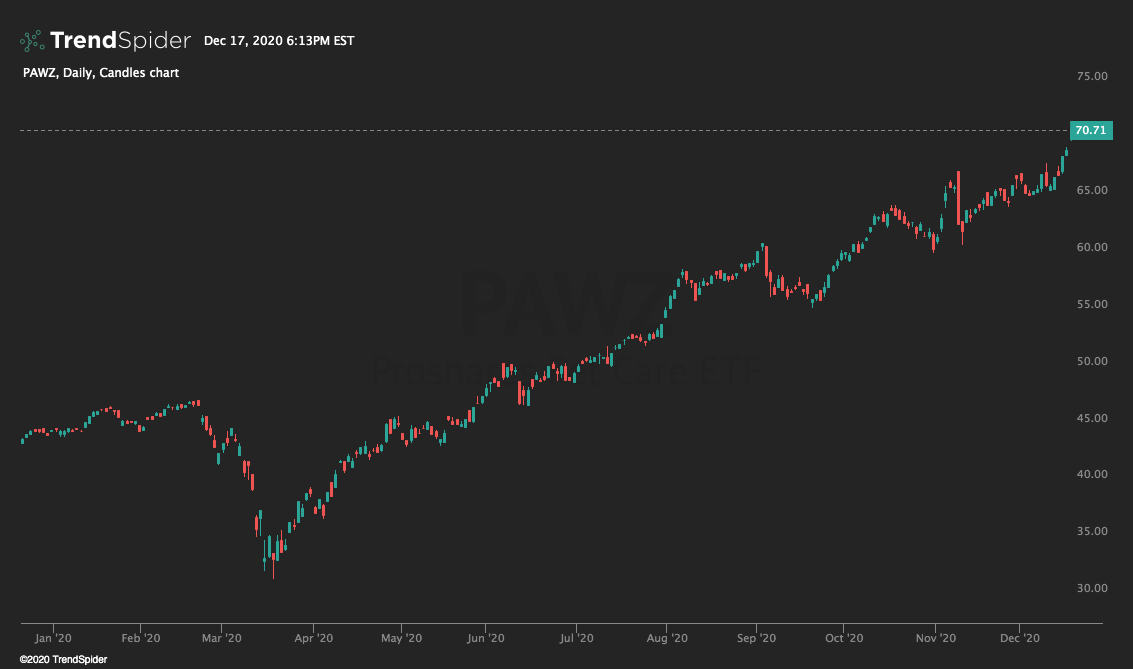

Given the amount of money spent on pets each year in the U., it's not surprising to see pet-related investments doing well. The ProShares Pet Care (NYSE:PAWZ), which is an ETF that "allows investors to capitalize on people's passion for their pets," is up well over 100% from its March low and continues to make fresh all-time highs.

With the pet industry booming, the last month has seen a little bit of everything as companies rush to capitalize on the trend.

Walmart (NYSE:WMT) launched Walmart Pet Care last month to expand its Pet offerings and give customers a single place to shop for more than 1,800 pet products. Through a partnership with pet insurance provider Petplan, Walmart offers comprehensive pet insurance, while a partnership with Rover allows Walmart customers to book pet care services such as dog-walking and pet sitting.

"We're on a mission to help families live better – and that goes for pets, too," Walmart Pets vice president of merchandising Melody Richard said. "Especially as adoption rates soar as a result of the pandemic, and more people become pet owners, this was the perfect time to launch expanded services in Walmart Pet Care for our customers."

Earlier this month Petco filed an S-1 with the US Securities and Exchange Commission to come back to the public markets and trade on the NASDAQ under the ticker WOOF. Petco was previously publicly traded before being acquired by CVC Capital Partners and the Canadian Pension Plan Investment Board in 2015. Petco has invested $300 million over the last three years to build a veterinary hospital network and an e-commerce site.

Through October of this year, Petco has seen its sales jump by 9% from the same period last year to $3.58 billion. Despite the pandemic, Petco has still managed to see same-store sales increase by nearly 10% this year. The company's turnaround has helped it shrink its net loss by 77% from last year to just over $20 million through October.

The Wall Street Journal reported earlier this week that popular pet subscription service BarkBox will go public through a merger with Northern Star Acquisitions Corp. in a $1.6 billion deal.

BarkBox, which was founded in 2012 and has more than one million active subscribers, expects $365 million in revenues for its latest fiscal year ending March 31. BarkBox will use the anticipated proceeds of $454 million to expand internationally and enhance products.

The flood of money into the sector and moves by retailers to expand their pet offerings should continue as pet ownership is unlikely to decline anytime soon.