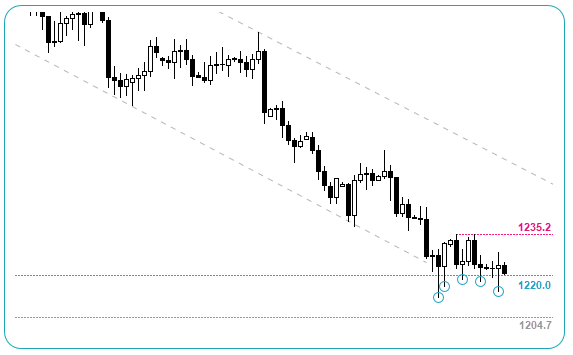

Gold Daily

- Despite 5 spikes lower, gold has failed to close beneath $1220 over the past 3 weeks.

- This leaves gold vulnerable to a deeper retracement – use a break above $1235.20 to confirm.

- Further out we expect a re-test of $1204.70 due to the bearish structure.

Silver Daily

- Compressing beneath the Dec ’17 lows and 20-day average.

- An eventual break beneath 15.17 is favoured, in line with the dominant trend.

- A break above the resistance zone could coincide with a bullish move in gold, as the two are highly correlated.

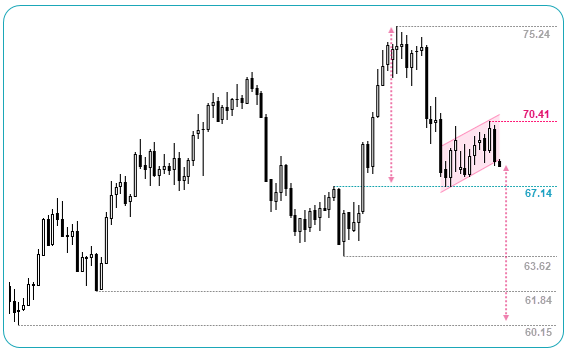

Crude Oil WTI Daily

- Potential bear flag is forming, counter to the dominant trend.

- If successful, the flag targets just above the $60.15 lows.

- Such a pattern requires a direct move – so any downside break that lacks momentum should be treated with caution.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.