Brent crude prices remain in a tight range this week as bears and bulls jostle for supremacy. The back and forth between bulls and bears continued today as a larger-than-expected drop in U.S. fuel supplies and rising tensions in the Middle East offset the impact of a stronger dollar.

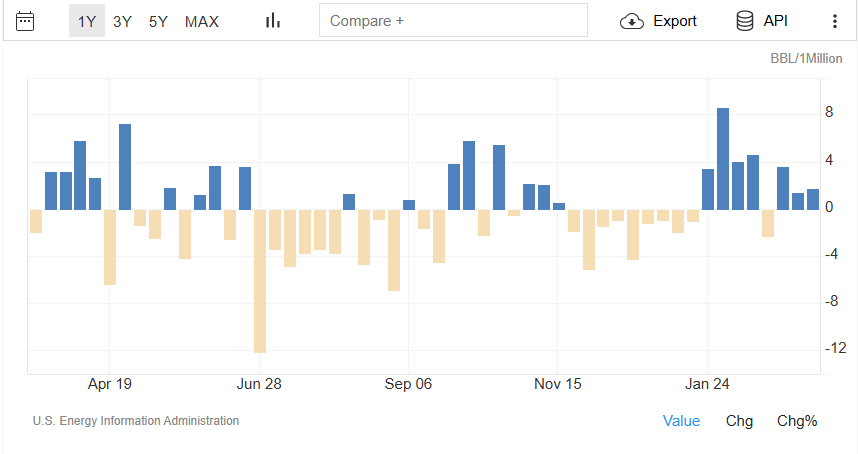

U.S. government data revealed that distillate inventories, like diesel and heating oil, dropped by 2.8 million barrels last week, much more than the 300,000-barrel drop predicted in a Reuters poll.

Meanwhile, U.S. crude inventories increased by 1.7 million barrels, surpassing the expected rise of 512,000 barrels.

Chevron Venezuela Licence to be Extended?

President Donald Trump is thinking about allowing Chevron Corp (NYSE:CVX)to continue operating in Venezuela, despite previously letting their sanction waiver expire earlier this year, according to the Wall Street Journal.

The idea of extending the waiver came up during Trump’s meeting with oil and gas executives at the White House on Wednesday. The president and his team are also discussing the option of placing tariffs on countries that buy Venezuelan oil. This move would aim to make it harder for China to expand its role in Venezuela’s oil industry.

Chevron has warned that if they leave Venezuela, China might step in to take their place. This argument appeals to Trump’s concerns about China’s growing influence.

Chevron has been sending about 240,000 barrels of Venezuelan oil to the U.S. every day under the waiver. This makes up a quarter of Venezuela’s total oil production.

Chevron also had big plans to increase exports from one of its projects, Petropiar, by 50% this year, reaching 143,000 barrels a day. These plans could move forward if President Trump agrees to replace some sanctions with tariffs and extends Chevron’s license.

Should this go ahead it will only add to concerns of oversupply which are already prevalent among many analysts and market participants.

Final Thoughts

Personally, I think this may be a bit premature. Oil inventory data shows the market is slightly under supplied in the early part of 2025. I think despite all the warning signs, there is a real possibility that supply and demand may remain balanced this year which could lead to long periods of Oil price consolidation moving forward.

Technical Analysis - Brent Crude

From a technical analysis standpoint, Brent has remained confined to the range between 72.39 and 70.18 since March 12.

Oil continues to exhibit choppy price action with a bullish day usually followed up by a bearish day or an indecisive one.

Looking for signs of Oils next move and the RSI may be useful in this regard.

On the chart below, the period 14 RSI on a daily chart is approaching the neutral 50 level. A break above this level is usually a sign that momentum is shifting and this could help bulls push price out of the current range.

Immediate resistance at 72.39 before the 74.00 and 74.53 come into focus.

On the downside, support may be found at 70.18 before the 69.52 and 68.70 come into focus.

Brent Crude Oil Daily Chart, March 20, 2025