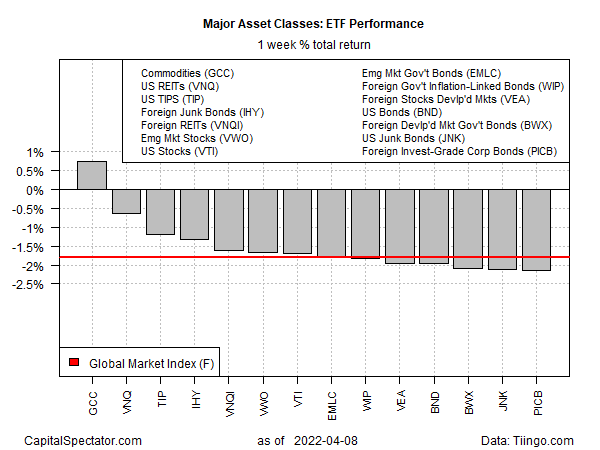

The opening week of April was rough on the major asset classes, with the exception of commodities, based on a set of proxy ETFs through the close of trading on Friday, Mar. 8.

WisdomTree Continuous Commodity Index Fund (NYSE:GCC) rose 0.75% last week, providing the only weekly gain for the major asset classes.

“You should absolutely have commodities in your portfolio,” advises Rebecca Patterson, chief investment strategist for Bridgewater Associates, in an interview Friday with Bloomberg.

“We don’t know if bonds as a diversifier are dead or in a coma. I think they’re probably in a coma.”

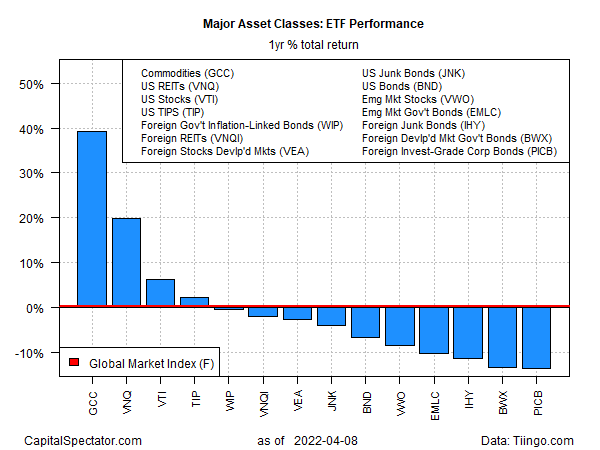

Year to date, GCC is up more than 23%, far outpacing the rest of the primary risk markets this year. By some accounts, there’s still a long road ahead for higher prices of raw materials. “We’re still only at the first inning of a multi-year, potentially decade-long commodities supercycle,” predicts Goldman Sachs.

For the rest of the field, red ink splashed across global markets last week. The deepest setback: foreign corporate bonds, which fell 2.2%. Invesco International Corporate Bond ETF (NYSE:PICB) closed on Friday at its lowest level in nearly two years.

The Global Market Index (GMI.F) fell for the first time in a month last week, tumbling 1.8%. This unmanaged benchmark, maintained by CapitalSpectator.com, holds all the major asset classes (except cash) in market-value weights via ETF proxies.

For the one-year trailing window, commodities (GCC) lead by a wide margin with a nearly 40% surge. US real estate investment trusts via Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) and US stocks via Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) are in distant second- and third-place performers, respectively.

The biggest one-year loser at the moment: foreign corporate bonds via PICB, which has shed nearly 14% over the past 12 months through Friday’s close.

GMI.F is holding on to a fractional gain for the trailing one-year window – a thin 0.3% increase.

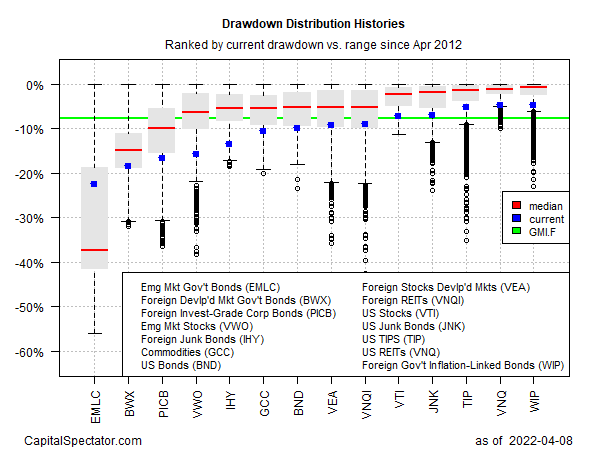

Most of the major asset classes are posting deeper drawdowns than GMI.F. The steepest peak-to-trough decline at last week’s close: government bonds issued in emerging markets via VanEck J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC), which closed more than 20% below its previous peak.

The smallest drawdown at the moment: inflation-indexed bonds issued by governments ex-US: SPDR® FTSE International Government Inflation-Protected Bond ETF's (NYSE:WIP) peak-to-trough decline is a relatively mild 4.8%, just fractionally better than the slide for US REITs (VNQ).

GMI.F’s current drawdown: -7.8%.