Commodities are getting a boost since the US Dollar Index started to break down last week. Note that this is a tactical breakdown in the dollar, not a secular one.

Crude oil rose 6% since last week. Gold gained 2.5% on the week. Copper went 4.8% higher. Wheat went up 3%.

There is clearly a ‘relief rally’ in the commodities space, says our research team, because of the dollar breaking through key support levels.

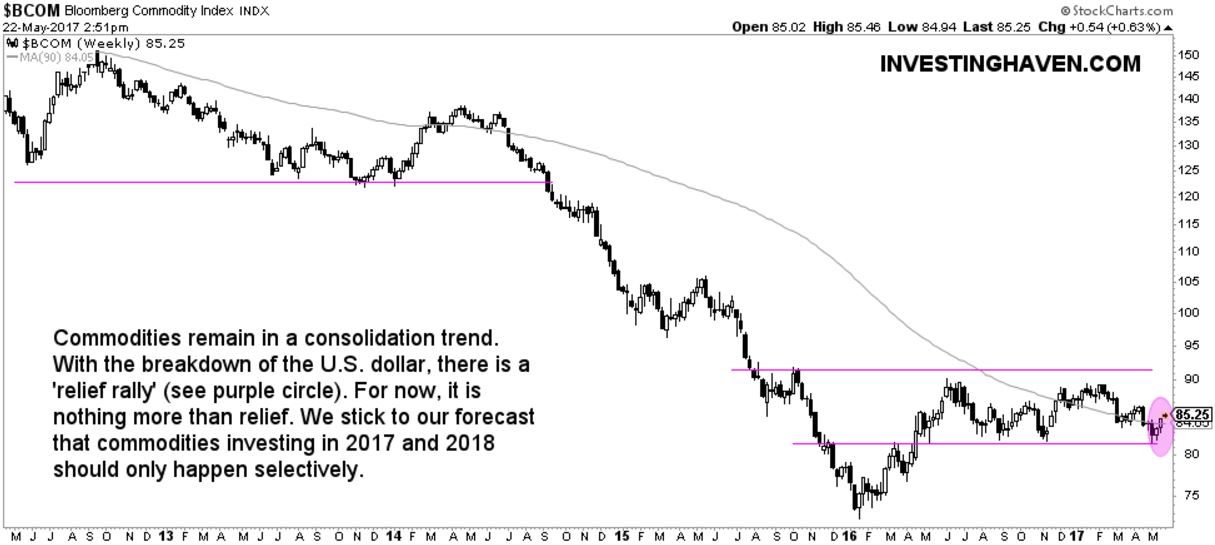

The commodities chart below shows the Bloomberg Commodity Index, symbol BCOM. Note how commodities bounced higher from their support levels as seen on the purple annotated circle. That happened right at the same time when the U.S. dollar was breaking down. “That is no coincidence as both markets are inversely correlated.”

Are investors going aggressively long commodities right now? Not yet, the commodities space is simply going through a relief rally, which means that it bounces off support. That is not the same as a bull market. A relief rally will unleash the pressure of a breakdown.

The five year commodities chart below makes the point that it is going through a consolidation period. If, and that is a big IF, the dollar breaks down big-time, then commodities could get a serious boost. But it seems unlikely that the dollar will become so bearish this year.

The most likely scenario is that the dollar will continue its correction but stop soon. Hence, commodities are likely to continue their consolidation.

We stick to our forecast that only select commodities can do well this year, so being selective will be imperative.