It has not been a great year so far for commodities. Most commodities have been in a consolidation phase throughout 2017. What does this mean for investing in commodities during the remainder of 2017 and into 2018? Is it time to invest in commodities or not?

According to our research team, the commodities sector is in a consolidation phase and is likely to remain in its sideways trading range for the remainder of 2017. That is not consistent with Goldman Sachs) which remains bullish commodities, and recommends to investing in commodoties in 2017 and 2018, according to an article published on Investopedia.

Last year, precious metals and base metals did extraordinarily well. Both groups fell very hard in the year(s) before, so a relief rally was certainly in the cards. Moreover, crude oil recovered last year from a catastrophic crash.

That's not going to take place for other commodities, as most, apart from some softs and grains, are pretty well recovered.

Moreover, as stock markets are likely to start a process of topping in the months ahead, this will not provide an ideal environment for commodities to surge higher.

That viewpoint is in line with Marc Faber who says:

“each commodity has to be looked at individually and some have rebounded and some have gone up dramatically”.

The chart below visualizes the point we made before. The consolidation phase started last July, after a strong rally in the first months of that year.

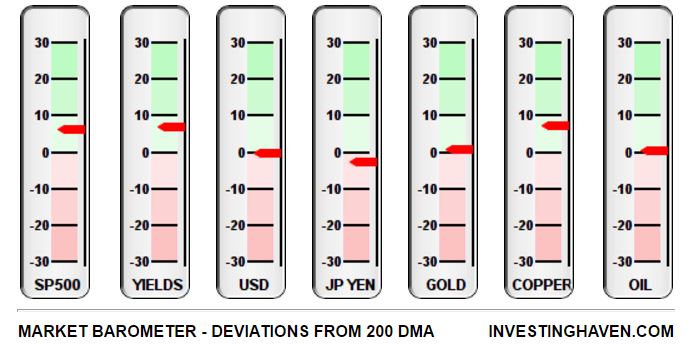

The market barometer shown below provides another viewpoint. Currently, the long-term trend for leading commodities is neutral. Other leading markets are also neutral, as seen below, which does not really provide solid ground for raging commodities bull.

This also suggests that in 2017 and presumably 2018 choosing very specific commodities which outperform their peers—according to the barometer, possibly copper—will be the way to invest in the commodities space.