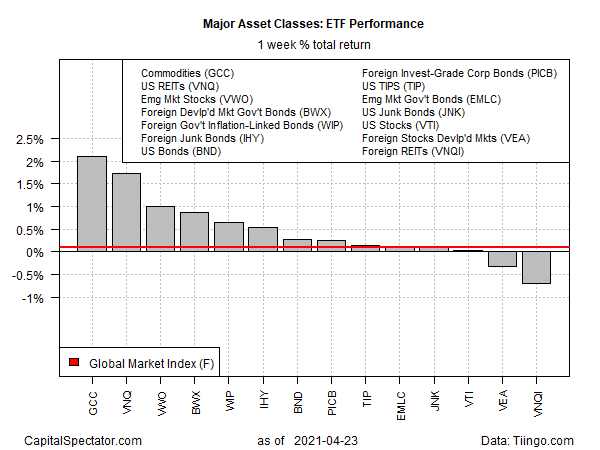

Commodities rallied last week, posting a fourth straight weekly gain. The rise led mostly positive returns for the major asset classes for the trading week through Apr. 23, based on a set of exchange traded funds.

WisdomTree Continuous Commodity Index Fund (NYSE:GCC), which equal weights a broad set of commodities, rose 2.1% last week. The increase lifted the ETF to a six-year high.

US real estate investment trusts were a close second in last week’s market action for the major asset classes. Vanguard Real Estate Index Fund ETF Shares (NYSE:VNQ) rose 1.7%, marking the fifth straight weekly advance and the second weekly close above its pre-pandemic high.

The deepest loss last week: foreign property shares. After surging the previous week to a pandemic high, Vanguard Global ex-U.S. Real Estate Index Fund ETF Shares (NASDAQ:{{45461|VNQI}) fell 0.7%.

The Global Markets Index (GMI.F) posted a slight 0.1% gain last week. The increase marks the fifth straight weekly advance for this unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETF proxies.

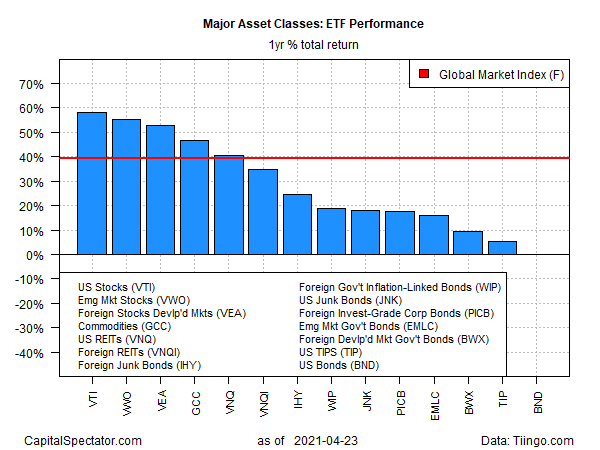

For the one-year trend, US stocks continue to hold the top spot for the major asset classes. Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) is up 58.1% on a total return basis over the past 12 months. That’s modestly ahead of the one-year gain for Vanguard FTSE Emerging Markets (NYSE:VWO), the second-best one-year performer.

Note that one-year returns for some corners of the global markets are unusually high at the moment because year-ago prices were dramatically depressed due to the coronavirus crash. Accordingly, trailing one-year results will remain temporarily elevated due to extreme year-over-year comparisons until last year’s markets collapse washes out of the annual comparisons.

The weakest one-year performer: investment-grade US bonds via Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND), which is essentially flat over the past 12 months on a total return basis.

GMI.F is currently posting a 39.3% rise for the past year.