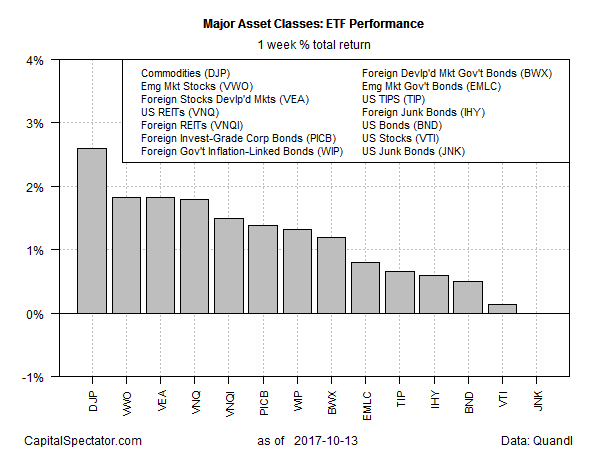

Broadly defined commodities rebounded last week, posting the strongest gain for the major asset classes.

The iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) popped 2.6% over the five trading days through Oct. 13. The rise marks the first weekly gain in four weeks, lifting the exchange-traded note to its highest close since April.

Nearly all corners of the major asset classes posted gains last week. The lone exception: junk bonds in the US via SPDR Barclays (LON:BARC) High Yield Bond (NYSE:JNK). The ETF was unchanged on Friday vs. the week-earlier close.

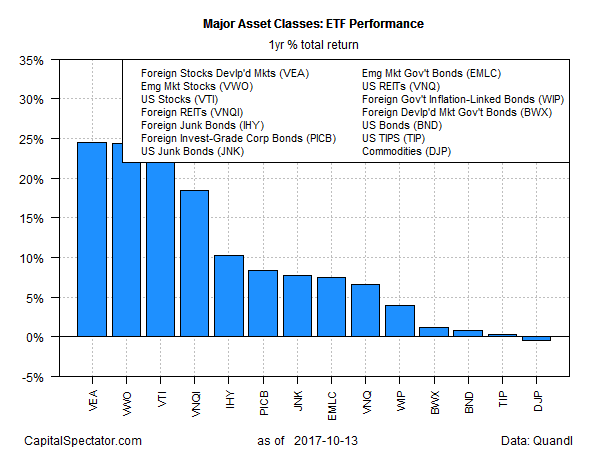

For one-year results, foreign stock markets are in the lead. Vanguard FTSE Developed Markets (NYSE:VEA) is up 24.5% on a total-return basis over the 12 months through Friday. The gain is fractionally ahead of the second-place performer in the one-year column: Vanguard FTSE Emerging Markets (NYSE:VWO), which is currently posting a 24.4% total return.

Meanwhile, commodities – despite last week’s gain – remain in last place for one-year changes through Friday. DJP is down slightly, dipping 0.4% vs. its year-earlier price.