Commerce Bancshares Inc (NASDAQ:CBSH)

Commerce Bancshares, $CBSH, were running higher using the 50 day SMA as support for all of 2018 until it broke below it in September. It held just under but then dropped further continuing down through the 200 day SMA. A bounce attempted met resistance at the 200 day SMA and it retested the low before a second move higher. Friday ended over the 200 day SMA again and made a higher high. Look for continuation to participate higher…..

Edwards Lifesciences (NYSE:EW)

Edwards Lifesciences, $EW, burst higher out of consolidation in September only to fall back as quickly as it rose. The pullback found support at the 200 day SMA and bounced. A relapse to the 200 day SMA then saw a second reversal and move up to a higher high Friday. The RSI is rising towards the bullish zone with the MACD crossed up. Look for a push over resistance to participate higher…..

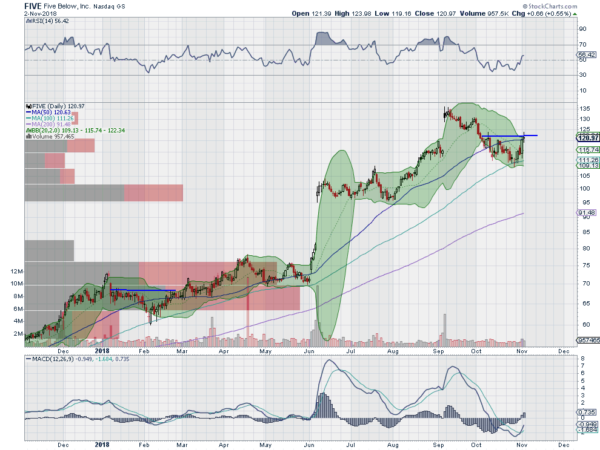

Five Below Inc (NASDAQ:FIVE)

Five Below, $FIVE, moved up out of consolidation in June and then gapped higher. It held there consolidating the move for 2 months before it started higher again and gapped to another higher in September. It has been pulling back from that high since. It found support last week at the 100 day SMA and reversed to end the week higher. The RSI is rising towards the bullish zone with the MACD crossed up. Look for continuation to participate higher…..

Illumina (NASDAQ:ILMN)

Illumina, $ILMN, drove higher out of consolidation in August of 2017, continuing to a top in September this year. Since then it has pulled back, finding support just above its 200 day SMA. It ended last week moving higher to short term resistance with the RSI breaking above the mid line and the MACD crossed up and rising. Look for a push over resistance to participate higher…..

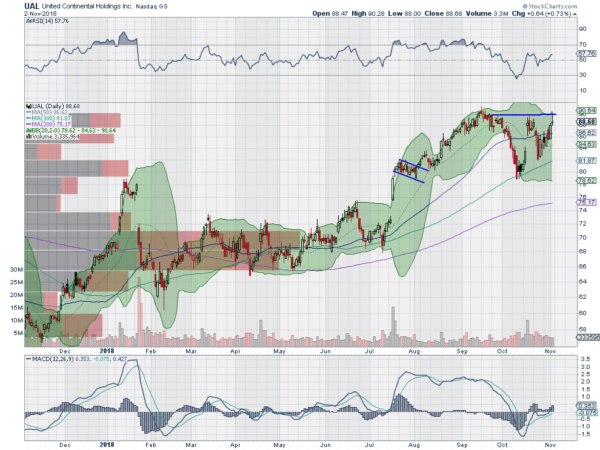

United Continental Holdings Inc (NASDAQ:UAL)

United Continental, $UAL, stared higher out of consolidation in July. it reached a peak in September and pulled back. That pullback touched the 100 day SMA and then reversed, back near the high. A second pullback to a higher low saw a reversal and ended last week back at the high. The RSI is knocking on the door of a move into the bullish zone with the MACD turning positive. Look for a push through resistance to participate higher…..

Up Next: Bonus Idea

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which as November begins sees the equity markets found support and bounced ahead of the elections Tuesday.

Elsewhere look for Gold to move higher in the short term while Crude Oil continues to pullback in its uptrend. The US Dollar Index is in a short term uptrend while US Treasuries are dropping lower. The Shanghai Composite and Emerging Markets are looking like they may be ready to reverse their downtrends.

Volatility remains elevated but has settled back into the teens keeping some pressure on equities but less than recently allowing some upward movement. The equity index ETF’s SPY (NYSE:SPY), IWM and QQQ reacted with positive weeks, the IWM the strongest. They are all showing signs they may reverse higher as well. That is good news as it was the IWM that led all markets lower. The new week should be interesting. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.