The political turmoil in Washington triggered by James Comey’s firing continues. What does it mean for the gold market?

Some analysts argue that recent White House troubles may be a game-changer for the yellow metal. First, it may be a nail in the Trump-rally's coffin. The reason is simple: the political damage could make the new administration unable to enact its pro-business legislation in the near future. Second, uncertainty abounds. It’s a funny twist, since it was the initial thesis about Trump’s impact on the gold market. Gold was supposed to shine due to the uncertainty about Trump’s politics. However, the hopes of pro-growth reforms sent gold prices south in November 2016. Now, it may be the case that the uncertainty and unpredictability associated with Trump has finally reared its ugly head.

We cannot preclude this scenario. However, it may be too early to trump the end of Trump. The reason is that investors often overestimate the importance of politics. The economy goes on, in spite of of political quarrels. Let’s assume that Trump will be impeached, although there is a long way to go before that happens. If Vice President Mike Pence became president, would the economic agenda radically change? We do not believe so, since Republicans – no matter who lives in the White House – are going to introduce some tax reforms.

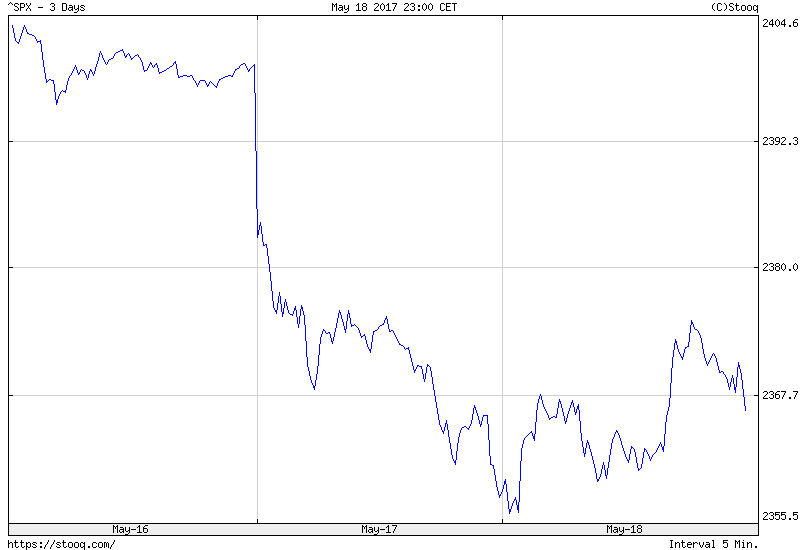

Hence, the recent turmoil may be only temporary. Indeed, the stock market rebounded Thursday a bit, as the S&P 500 chart below shows.

S&P 500: The Last Three Days

The price of gold dropped on Thursday but picked back up on Friday as the chart below shows.

Gold: The Last Three Days

Given that the EUR/USD rose on Friday, we may see further appreciation in the gold market in the short run.

Summing up, chaos in Washington continues. Based on that, some precious-metals analysts call a bull market in gold. We agree that the yellow metal may rally further in the short run, but we are skeptical about its long-term potential. It may be the case that when the current political turmoil calms down (importantly, the market odds of a Fed hike in June jumped again above 70 percent), the price of gold will drop.

Stay tuned!