Comcast Corporation (NASDAQ:CMCSA) is counting on remote-controlled door locks and cameras along with its other smart-home services to speed up its budding home security business.

Notably, smart-home market embraces devices ranging from door locks to sprinkler systems that can be programmed to various schedules.

Going forward, Comcast is planning to initiate a pilot program for customers who doesn’t need a full home security system but want to ensure safety of their home. Moreover, the company will be offering a video camera for an additional $10 per month along with its Xfinity Internet. Also, up to six cameras can be purchased by customers, for $99 each, besides the monthly fee. The monthly fee covers for installation, cloud storage for video recordings and the ability to create and share video clips.

In 2012, Comcast had launched its Xfinity Home service (home automation and security business). Based on this particular service, the company currently has almost 1 million subscribers, who can easily manage, control and operate a number of key smart home functions, including energy consumption management.

In fact, Comcast wants to offer more smart-home services to increase their revenues and create more loyal customers in the near term.

Meanwhile, the company has been expanding into new lines of business as growth in selling cable-TV subscriptions has slowed down due to cord cutting. Online video streaming providers such as Netflix (NASDAQ:NFLX), Hulu.com, YouTube etc., also pose severe threat to cable-TV operators because of their extremely cheap source of programming.

Therefore, to cope up with the loss and remain competitive in the market, cable companies like Comcast and Charter Communications Inc. (NYSE:T) are jointly venturing into U.S. wireless services business, competing head to head with market incumbents like AT&T Inc. (NYSE:T) and Verizon Communications Inc. (NYSE:VZ) .

On Aug 17, Comcast completed the nationwide rollout of its wireless services under the Xfinity Mobile brand. On a broader scale, the Xfinity Mobile service is an evidence of Comcast's intentions to move beyond the home its own regional subscriber territory.

Markedly, the cable company's entry into the Internet of Things space and its licensing of the X1 platform, internationally, further implies growth at a broader scale.

Recently, the company inked a 40-month deal with Sunrun Inc. on residential solar programs. Per the agreement, Sunrun will act as the exclusive residential solar energy provider for Comcast Cable (one of the primary businesses of Comcast), which will serve as one of its strategic partners through marketing campaigns in selected markets.

Zacks Rank & Price Performance

Comcast currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

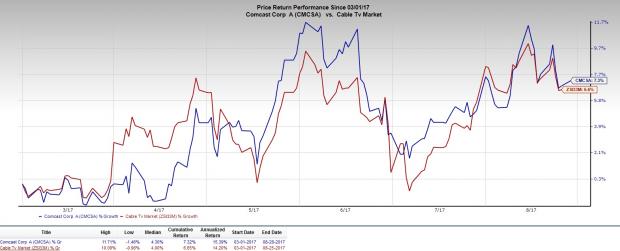

Shares of the company have rallied 7.3%, compared with 6.6% growth of the industry over the last six months.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Learn the secret >>

AT&T Inc. (T): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

Charter Communications, Inc. (CHTR): Free Stock Analysis Report

Original post

Zacks Investment Research