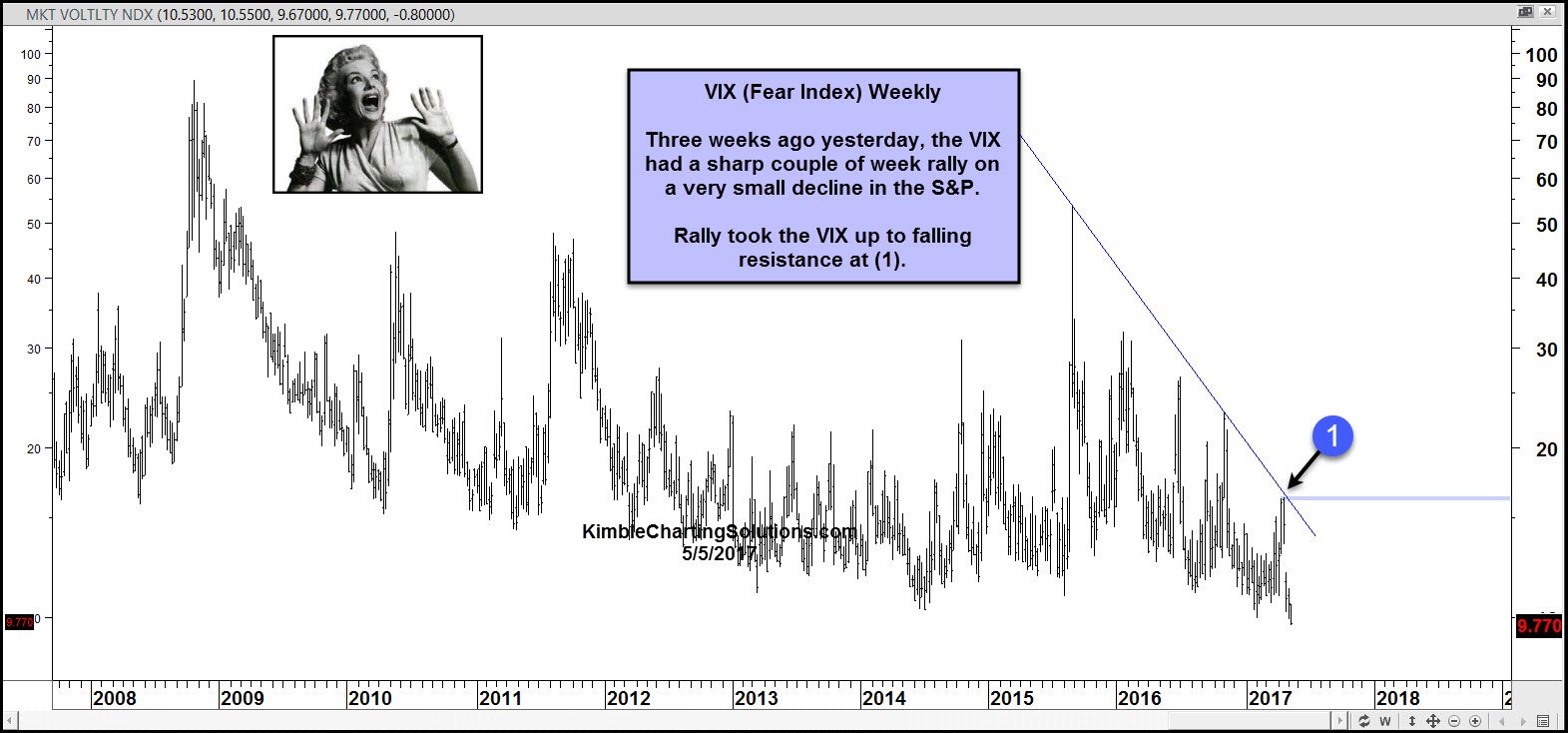

Three weeks ago, yesterday, the 'fear index' (VIX), was pushing sharply higher on a very small decline in the S&P 500. When that happened, I was advising traders to go against the crowd. Below looks at the VIX index over the past 10 years.

The rally pushed the VIX to the underside of falling resistance at (1) and a key Fibonacci retracement level (not shown). Three weeks ago I suggested shorting the VIX at (1), with a tight stop.

Premium and Sector members shorted the VIX by purchasing XIV (see chart below).

Since hitting a cluster of support at (1), XIV has blasted off. In a matter of 3 weeks, XIV, which was testing rising channel (A) support, is now nearing the top of rising channel at (2).

XIV has made as much in the past 3 weeks as the S&P 500 has since January 1 of 2016. Members are now selling into strength and raising stops at the position, which is up over 25% in 15 business days.