Shares of Coinbase Global (NASDAQ:COIN) have been on a downward trend for much longer than the broader NASDAQ index. Since peaking in November last year, the stock lost 47% of its market value.

But after this sharp correction, COIN's valuation has become more reasonable, offering investors an opportunity to gain exposure to the largest cryptocurrency exchange in the US and the first major cryptocurrency-focused company to go public.

In line with the broad market rebound, San Francisco-based COIN gained more than 8% during the past five days after hitting its lowest level since its IPO in April. The stock closed on Thursday at $180.96.

Despite the recent crypto market volatility, Goldman Sachs told clients to buy shares of Coinbase to get exposure to a publicly-traded proxy for crypto. In a note, the investment bank said:

“We continue to believe that COIN represents the blue-chip way to gain exposure to the continued development of the crypto ecosystem and believe further progress on new revenue initiatives could lead shares to outperform its ‘beta’ to crypto prices.”

All Things Crypto

In a note last week, Piper Sandler named Coinbase as one of its top ideas, saying it sees an attractive entry point to the growing cryptocurrency and digital asset space. Mainstream adoption of digital assets remains strong, and Coinbase is likely to be the “on ramp” for all things crypto, its note said.

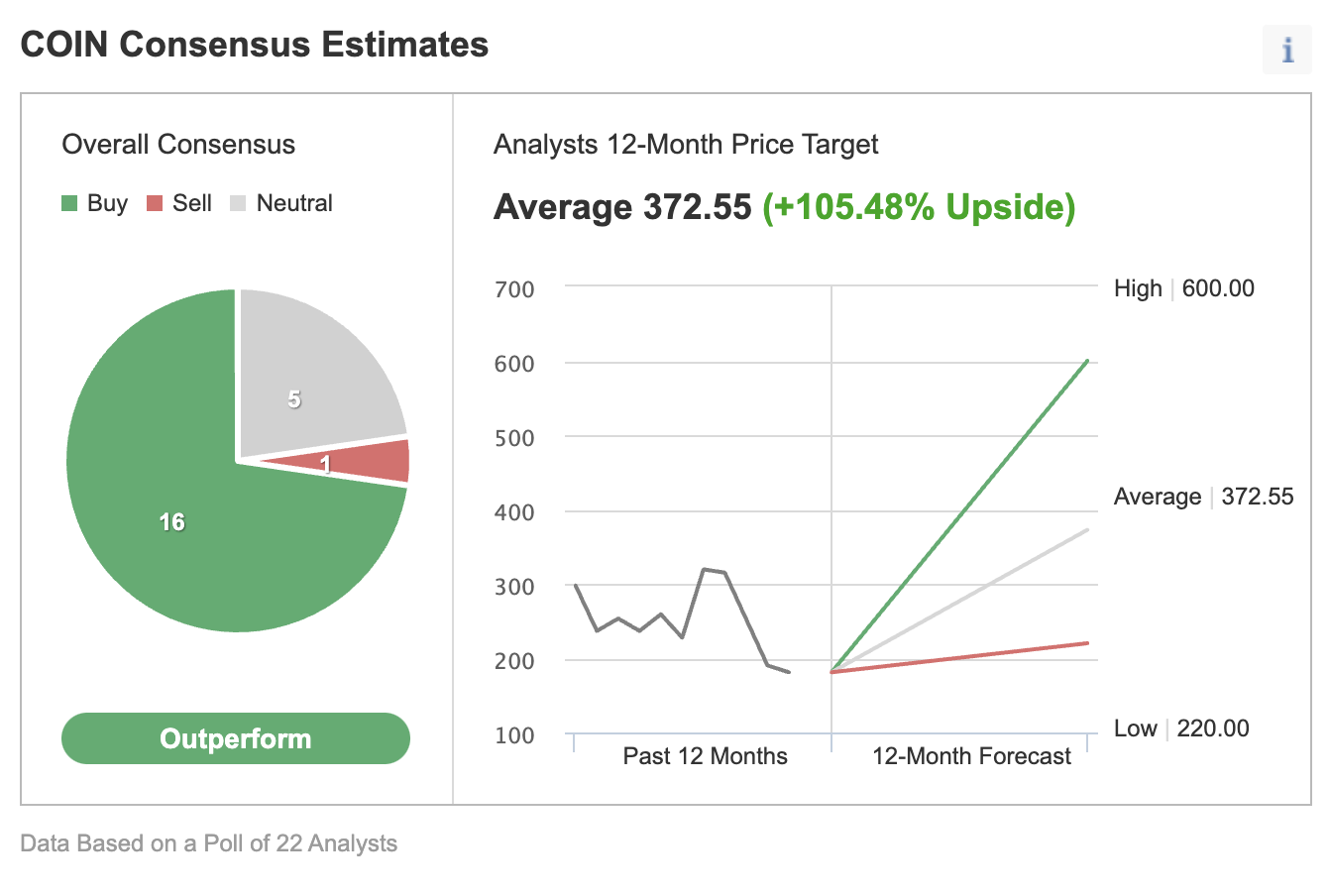

These sentiments are also reflected in an Investing.com poll of analysts in which the majority of forecasters recommend buying the stock. Their consensus price target implies about 98% upside potential for the next 12 months.

Source: Investing.com

However, with this bullish outlook, we must highlight that COIN isn’t a stock that suits investors with a short-term horizon due to the highly volatile nature of the crypto market.

As crypto-assets take a plunge in the current market route, COIN is bound to face the impact on its trading volumes. Bitcoin, the largest cryptocurrency, dipped to as low as $33,000 in January from a record of almost $69,000 less than three months ago. Other digital assets have also suffered, with No. 2 token Ethereum down roughly 30% since the end of December.

To deal with the uncertainties associated with the crypto market, Coinbase has built a $4-billion cash stockpile. The company stress-tests its balance sheet to ensure it has adequate funds on hand to prepare for a stricter regulatory regime, possible cyber-attacks, or potential trading declines.

Oppenheimer said in a recent note that the company would play a crucial role in developing the crypto ecosystem:

“Longer term, whether we are in crypto winter or summer, we favor the crypto adoption trend and disruptive nature of digital assets. To us, Coinbase is an enabler of crypto innovation and will have a strong voice in the direction of digital asset development.”

Bottom Line

Coinbase has a solid appeal for investors who want exposure to cryptocurrency in their portfolios. In our view, the current weakness in COIN shares offers a good entry point for such investors.