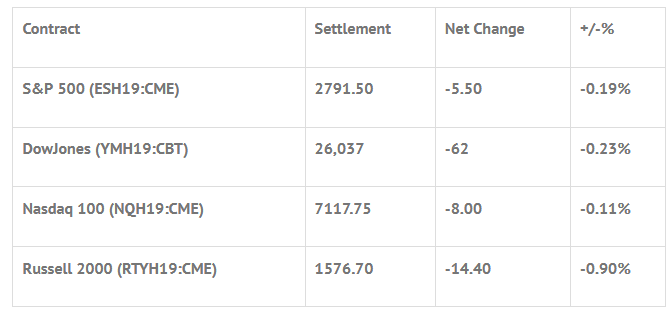

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed higher: Shanghai Comp +0.42%, Hang Seng -0.05%, Nikkei +0.50%

- In Europe 10 out of 13 markets are trading lower: CAC -0.15%, DAX -0.40%, FTSE -0.73%

- Fair Value: S&P +0.27, NASDAQ +3.90, Dow -1.74

- Total Volume: 1.19mil ESH & 296 SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, International Trade in Goods 8:30 AM ET, Factory Orders 8:30 AM ET, Retail Inventories 8:30 AM ET, Wholesale Inventories 8:30 AM ET, Jerome Powell Speaks 10:00 AM ET, Pending Home Sales Index 10:00 AM ET, State Street (NYSE:STT) Investor Confidence Index 10:00 AM ET, and the EIA Petroleum Status Report 10:30 AM ET.

S&P 500 Futures: Choppy Session With Lots Of Headlines

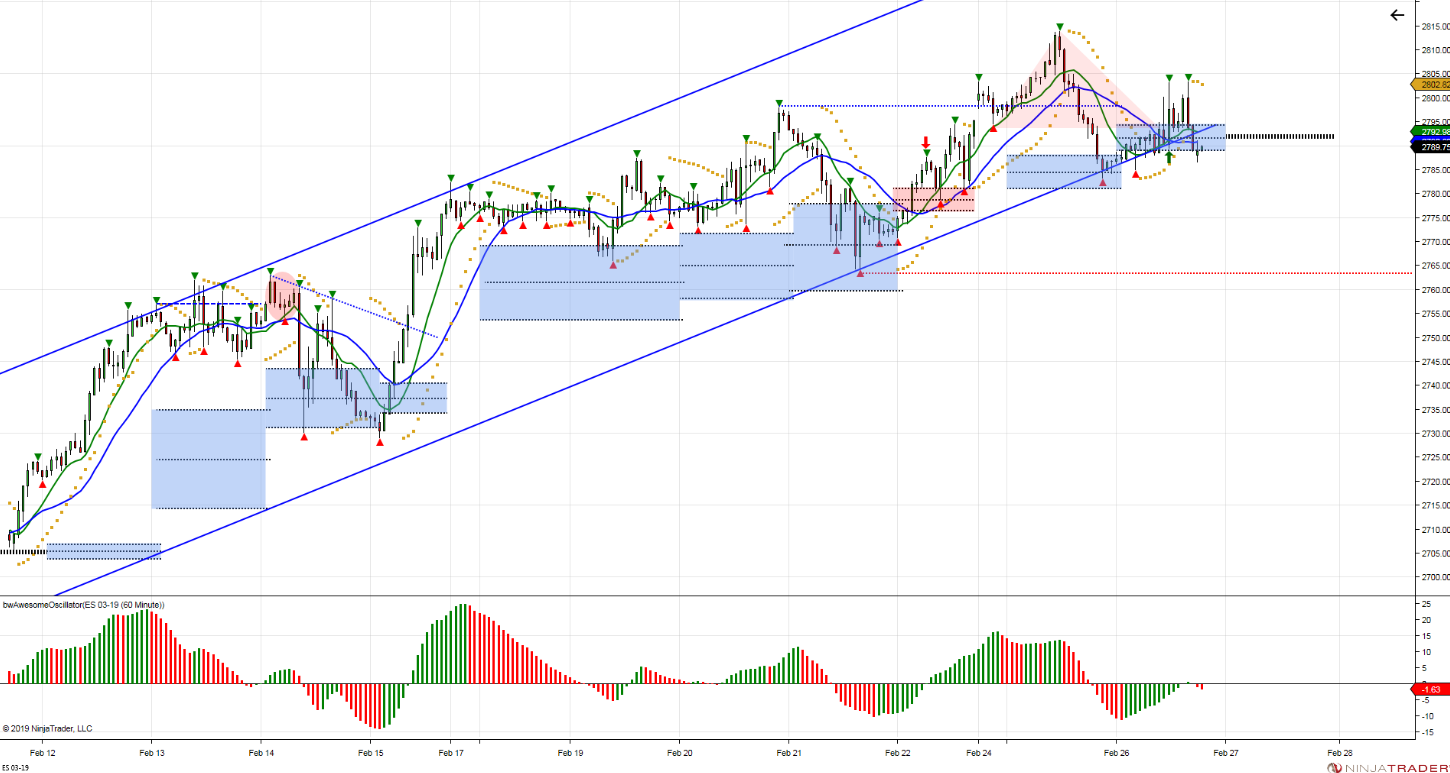

Chart courtesy of @Chicagostock – $ES_F Wednesday’s 3D pivot range is less then 1 handle wide, 279175-279225. Bulls walking a tight rope. Not a great time for futures to be halted.

While the President of the United States was landing in Vietnam for nuclear arms negotiations with North Korea, his former lawyer Michael Cohen said he will testify in front of the house committee that he witnessed Trump’s ‘lies, racism and cheating.’ He claims to also have knowledge of hush money payments, and will make public some of Mr. Trump’s private financial statements.

During Monday nights Globex session, the S&P 500 futures (ESH19:CME) traded down to 2783.50, down -13.50 handles, rallied before the 8:30 CT bell, and traded 2790.50 on Tuesdays open. After the open the ES traded up to the 2796 area, pulled back down to 2790.00, and then got hit by several small buy programs that pushed the futures back up to the 2800.00 level.

After some sideways price action, and a small drop down to the 2796 area, the ES made a new high by 1 tick at 2800.25. Then, at 9:30 CT, in came a few sell programs that helped pull the futures back down to 2789.50. At 10:30 the ES rallied 14 handles up to a new high at 2803.25. The next move was back down below the vwap, to 2793.00 (double bottom), followed by some sideways price action, and then a rally up to another new high by 1 tick at 2803.50.

Going into the final hour of the day the futures began to break, and went on to trade 2797.00 on the 2:45 cash imbalance reveal, with the MiM showing close to $1.5 billion to buy, then printed 2793.75 on the 3:00 cash close, and settled the day at 2791.50 on the 3:15 futures close, down -6.5 handles, or -0.23%, and then continued to sell off down to 2789.00 in the after market.

In the end, it was a big day of rips and dips, but the #ES got crushed in the final hour of the day. In terms of the days overall trade, total volume was on the low side again, with less than 1.2 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.