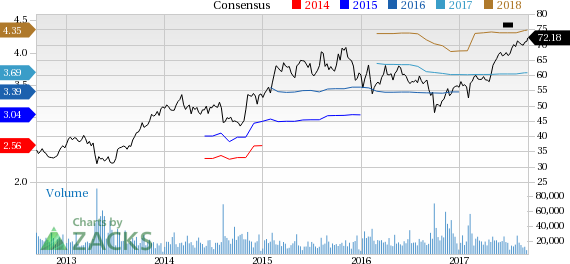

Share price of Cognizant Technology Solutions Corporation (NASDAQ:CTSH) rallied to a new 52-week high of $72.33, eventually closing a tad lower at $72.18 on Sep 11. Notably, its shares have gained 28.8% year to date, outperforming the industry’s 27% rally.

What’s Backing the Rally?

Cognizant’s domain expertise is a key catalyst. The company is consistently developing its capabilities to benefit from the ongoing digital transition, especially when it comes to integration of the new digital framework with legacy technology platforms.

Moreover, acquisitions have been a key growth driver for Cognizant. The buyouts have not only led to an increase in new customers but also expanded its capabilities in the healthcare industry and enhanced its overall digital delivery capabilities.

Recently, Cognizant announced the completion of its acquisition of TMG Health. TMG Health is a business process services provider to the Medicare Advantage, Medicare Part D and Managed Medicaid markets in the U.S. Reportedly, the integration of TMG Health and the company’s TriZetto platform reinforces its leading service provider position for the government-managed healthcare programs in U.S.

Per management, merger with TMG Health will enable Cognizant to expand its healthcare offerings and thereby cater to growing demand from its payer clients. The company’s healthcare segment has a strong growth trajectory and this acquisition will thus prove to be significant revenue driver in our view.

Strategies Paying Off

Cognizant has been witnessing continuous increase in revenues over the past several quarters, which signifies that its growth initiatives are in the right direction. In the last reported quarter, the company registered an 8.9% increase in revenues. Furthermore, its recently upbeat guidance for 2017 depicts sustained growth momentum in the year ahead.

Also, we note that the company has beaten the Zacks Consensus Estimate in three of the trailing four quarters while matching the same on one occasion, delivering an average positive surprise of 1.72%.

For full-year 2017, the Zacks Consensus Estimate for Cognizant moved up in the past 60 days, which reflects the optimistic outlook of analysts. Earnings estimates increased 54.5% to $3.69 for fiscal 2017.

Currently, Cognizant carries a Zacks Rank #3 (Hold). The company has a market capital of $42.6 billion and a long-term expected earnings growth rate of 13.7%.

Key Picks

Better-ranked stocks in the broader technology sector include Lam Research (NASDAQ:LRCX) , Micron Technology (NASDAQ:MU) and Applied Materials (NASDAQ:AMAT) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Long-term earnings growth rate for Lam Research, Micron and Applied Materials is currently projected to be 17.2%, 10% and 17.1%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Cognizant Technology Solutions Corporation (CTSH): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research