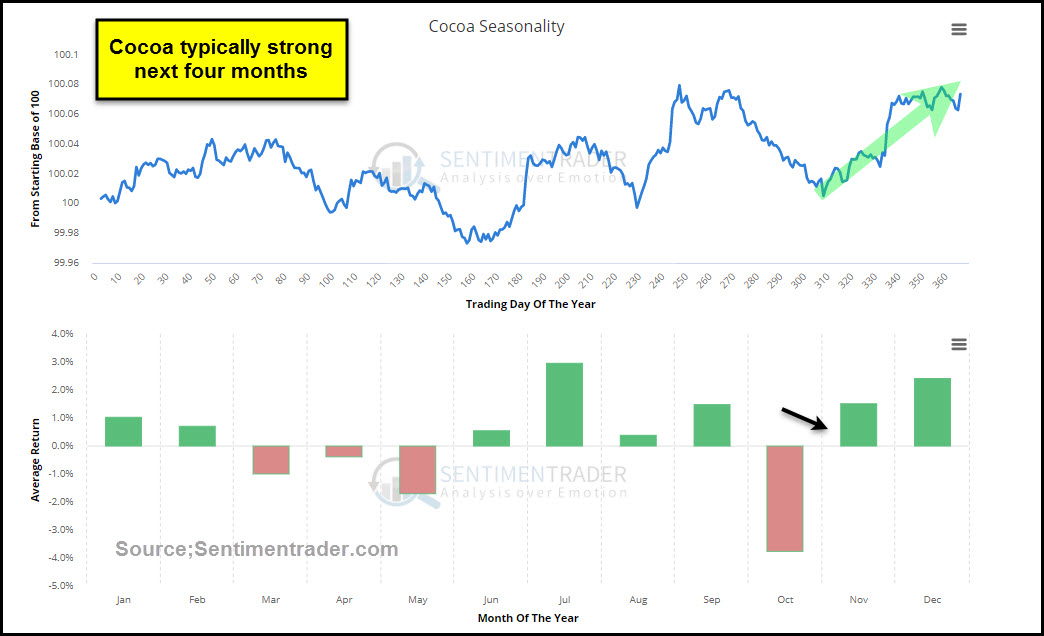

'Tis the season for Chocolate (cocoa) to do well, which begs the question – will it repeat its historical pattern again this year?

Below looks at cocoa's seasonal pattern from Sentimentrader.

Going into this period of seasonal strength, cocoa bulls have been hard to find, lately, as dumb-money traders have established one of the largest short positions in this commodity in years. The triple combo could make cocoa's price action very interesting going forward.

The commodity can be played in the futures markets or through two different ETFs: NIB and CHOC.

Cocoa ETF NIB could have built a base where seven different bullish wicks (reversals) took place just above 10-year support at (1). Recently NIB has been moving higher and looks to be breaking above highs hit earlier this week at (2).

A nice combo of pattern, as sentiment and trader positioning are in play in this asset, which is down nearly 50% in the past couple of years.

Some Perspective

Since the first of this month, NIB has gained over 7%, which is nearly half of what the S&P 500 has done year-to-date.

Full disclosure Premium and Sector members have been long NIB since the end of October. If you would like to become aware of these type of pattern and sentiment setups, we would be honored if you were a member.