In the world of investing, Berkshire Hathaway (NYSE:BRKa) is a legend. The company’s public face and long-time chief executive, Warren Buffett, is one of the richest men in the world thanks to Berkshire’s eye-popping returns over the last several decades.

A significant part of the decision-making process at Berkshire, however, has been Charlie Munger. He is Buffett’s business partner and has helped Berkshire outperform the market by leaps and bounds for many years. He has a love of psychology that has permeated his outlook on investing in his very long career and specifically, we’ll take a look at Munger’s philosophy on what kind of companies to buy and when.

The Coca-Cola Company (NYSE:KO) Is A True Munger Stock

Coca-Cola (KO) is a stock that Berkshire has owned since 1988 and in the thirty years since the company purchased it, shares have returned roughly three times what the S&P 500 has in the same time frame. This is the mark of a great investment and it is Munger’s buying philosophy that helped guide not only the decision to own Coca-Cola, but other stocks like it.

Business Overview and Growth Prospects

Coca-Cola was founded in 1886 with just a single product but in the 130+ years since, it has grown into a global beverage powerhouse with more than 500 brands in its portfolio. The company is present in just about every country in the world and has meaningful market share in all non-alcoholic beverage categories, selling nearly 2 billion servings daily worldwide. One principle that Munger always holds to is to own businesses that are easy to understand and manage. Munger asserts that investors should focus on “a business any fool can run, because someday a fool will.” Berkshire’s portfolio is full of names with easy-to-understand business models like Coca-Cola that are also easy to manage.

This slide from a recent investor presentation shows how Coca-Cola already enjoys enormous scale globally for its beverage brands. It has high share levels in every category, including 21 brands that produce at least a billion dollars in annual revenue. This is what a great business looks like, which is also a tenet of Munger’s buying philosophy. Indeed, he says, “A great business at a fair price is superior to a fair business at a great price.” Given Coca-Cola’s long history of delivering shareholder returns and the impressive characteristics outlined above, it certainly qualifies as a great business.

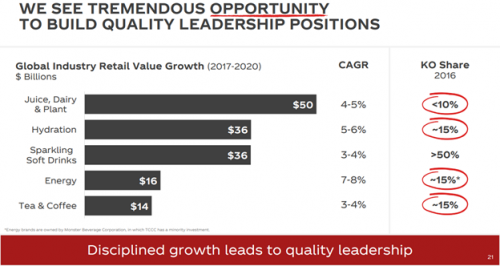

In addition to a long history of success, Coca-Cola is focused squarely on performing in the future. Indeed, it wouldn’t be a “great business” and thus, pass the Munger test, if it weren’t. Coca-Cola’s five major categories show fairly modest levels of absolute market share due to the extremely fragmented nature of the non-sparkling categories. This provides Coca-Cola with growth prospects that are impressive looking forward while it maintains its leadership position against Pepsico (NASDAQ:PEP) and others in the sparkling categories. These markets all have long-term tailwinds for category growth and as Coca-Cola goes after market share both organically and via acquisitions, it should be well-positioned to continue to grow for years to come. Indeed, analysts see high single-digit to low double-digit growth in earnings-per-share for Coca-Cola in the medium term thanks in part to this strategy of chasing growth prudently.

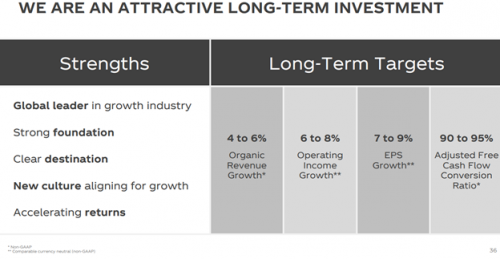

This slide highlights the company’s long-term growth objectives, which it is certainly well on its way to achieving. Indeed, its most recent earnings report, released on 7/25/18, showed strong organic revenue growth of 5%. With the company’s refranchising of the vast majority of its bottling operations, organic growth has become key to its success. The company saw roughly equal parts of volume and pricing/mix growth, respectively, as it put together another quarter of strong organic top line expansion. In addition, productivity efforts are bearing fruit as operating margins rose 300bps in Q2, allowing the company to reiterate 8% to 10% earnings-per-share guidance for the full year.

Coca-Cola’s positions in its five segments are already strong, particularly in sparkling beverages, but it is intensely focused on grabbing market share in order to keep it from other large players like Pepsico. This also assures the company will continue to grow the top line and earnings in the years to come. Recession-resistance is another key advantage for Coca-Cola as an investment as the company’s earnings may decline modestly during the next downturn, but it will certainly hold up well.

The final key component of Charlie Munger’s philosophy we’ll look at is his stance on capital returns. We know Munger would choose a great business at a fair price over a fair business at a great price, but he also favors companies that spin off a lot of cash. Coca-Cola fits both of these characteristics as it would be difficult to argue it is a great business, but it is also somewhat expensive. In addition, its enviable dividend history suggests it spins off plenty of cash, including a 3%+ yield today. Indeed, Berkshire has long favored companies that can write checks to their owners because of excess cash generation, and Coca-Cola has a very long history of doing just that.

The stock is trading for 22 times this year’s earnings estimate of $2.10 per share, which is somewhat higher than our fair value estimate of 18 times earnings. This is Munger’s principle in action; Coca-Cola may never become “cheap” on an absolute basis given it fits the bill as a great business. This has worked very well for Berkshire since it bought Coca-Cola thirty years ago and as the company creates more cash than it needs each year, it will continue to return it to shareholders via the ample dividend yield.

Final Thoughts

Coca-Cola has outperformed the S&P 500 over the long-term, although more recent years have seen the opposite. However, Coca-Cola has a strong strategy in place to foster growth in the coming years in the mold of Charlie Munger’s philosophy on which companies to buy. The company is a great business at a decent price, it produces more than enough cash each year and it is simple to understand and manage. Investors that follow this set of principles for which companies to buy can do very well over the long term and Coca-Cola certainly offers this; we rate the stock a buy for its growth prospects and high dividend yield.