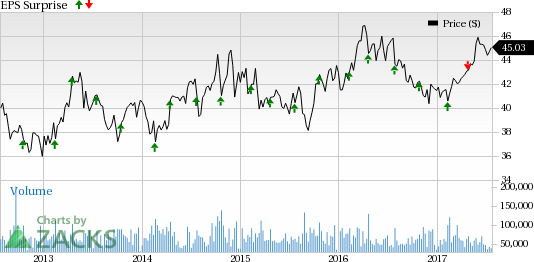

The Coca-Cola Company (NYSE:KO) is slated to report second-quarter 2017 results on Jul 26, before the opening bell. Last quarter, the cola giant delivered a negative earnings surprise of 2.27%.

However, Coca-Cola surpassed earnings estimates in three of the last four quarters, with an average surprise of 1.51%.

Let’s see how things are shaping up for this announcement.

Factors at Play

Coca-Cola’s first-quarter revenues declined 11% year over year due to currency headwinds and negative impact of structural items. Acquisitions/divestitures and structural items had a 10% impact on revenues, while currency headwinds hurt sales by 1%. The company’s soon-to-be reported quarter is also expected to be adversely impacted by 17–18% in net revenue from acquisitions, divestitures, and other structural items. The company also expects currency headwinds to hurt the quarterly net revenues by 1–2%.

The company’s revenues declined for the last eight consecutive quarters primarily due to weak volumes especially in the sparkling beverage category. Coca-Cola has been struggling to boost sales amid weak demand in certain emerging and developing markets and shift in consumer preference.

That said, Coca-Cola is taking aggressive cost-cutting and strategic measures to mitigate the impact of lower sales and weak volumes. Adjusted consolidated gross margins expanded 120 basis points (bps) year over year to 61.3% in the first quarter of 2017, as currency headwinds were offset by positive pricing and productivity gains. We expect to witness similar trends in the to-be reported quarter as well.

Coming to the company’s bottom line, i.e. EPS, Coca-Cola’s earnings decreased 4.4% in the first quarter 2017. The downside was primarily due to higher interest expenses, resulting from additional long-term debt issued in the quarter as well as in the second and third quarters of 2016. Coca-Cola’s first quarter of 2017 interest expenses were also higher due to interest rate swaps on the company’s fixed-rate debt.

As revealed earlier, Coca-Cola expects net impact of acquisitions, divestitures, and other structural items to have a headwind of 3–4% on profits before taxes in the to-be-reported quarter. Currency fluctuations are anticipated to have an adverse impact of 3% on quarterly profits before taxes. However, we feel pricing gains, cost cuts and productivity savings should continue to support bottom line to some extent.

For the second quarter, the Zacks Consensus Estimate for earnings is pegged at 58 cents, reflecting a 4.1% year-over-year decrease. Meanwhile, the projected sales growth for the current year is pegged at $9.75 billion, implying a 15.5% decrease.

Earnings Whispers

Our proven model does not conclusively show that Coca-Cola is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

That is not the case here as you will see below.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is -1.72%. This is because the Most Accurate estimate is 57 cents, while the Zacks Consensus Estimate is pegged at 58 cents.

Zacks Rank: Coca-Cola currently carries a Zacks Rank #3. Although a Zacks Rank #3 increases the predictive power of ESP, a negative ESP makes surprise prediction difficult.

We caution against Sell-rated stocks (Zacks Ranks #4 and 5) going into the earnings announcement, especially when the company is witnessing negative estimate revisions.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Peer Release

PepsiCo, Inc. (NYSE:PEP) reported better-than-expected results in second-quarter 2017 (ending Jun 17), with both earnings and revenues beating the Zacks Consensus Estimate. PepsiCo’s second-quarter core earnings per share of $1.50 beat the Zacks Consensus Estimate of $1.40 by 7.1%.

Upcoming Peer Releases

Dr Pepper Snapple Group Inc. (NYSE:DPS) is slated to report quarterly results on Jul 27.

Monster Beverage Corp. (NASDAQ:MNST) is expected to report quarterly results on Aug 3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Coca-Cola Company (The) (KO): Free Stock Analysis Report

Dr Pepper Snapple Group, Inc (DPS): Free Stock Analysis Report

Pepsico, Inc. (PEP): Free Stock Analysis Report

Monster Beverage Corporation (MNST): Free Stock Analysis Report

Original post

Zacks Investment Research