Opening and closing imbalances have always been part of our daily trading toolbox. We didn’t just wake up one day and say, “Hey, you should look at this.” We have been looking at different opening and closing imbalances since 1980. Reading imbalance is a great way to read the markets on the opens and closes and the only way a trader can follow the money.

Before electronic trading, the big banks that made up most of the S&P program arbitrage space and OTC desk used the 4:00 pm ET cash close as to buy and sell futures to hedge their positions, similar to the way a S&P proprietary trader in the CME’s S&P 500 option pit would take the other side of an option trade and buy or sell futures to hedge his positions. The 4:00 pm ET cash close is the “net” of all buying and selling in the stock market.

So why is that important? With the S&P up from this time last year following the money is always key to the direction of the S&P. Keeping a daily digest of the size and direction of the imbalance is a hint at the direction of cash, either in or out of the market. It is the best way to stay on track of the direction and a great way to see what the institutions are doing.

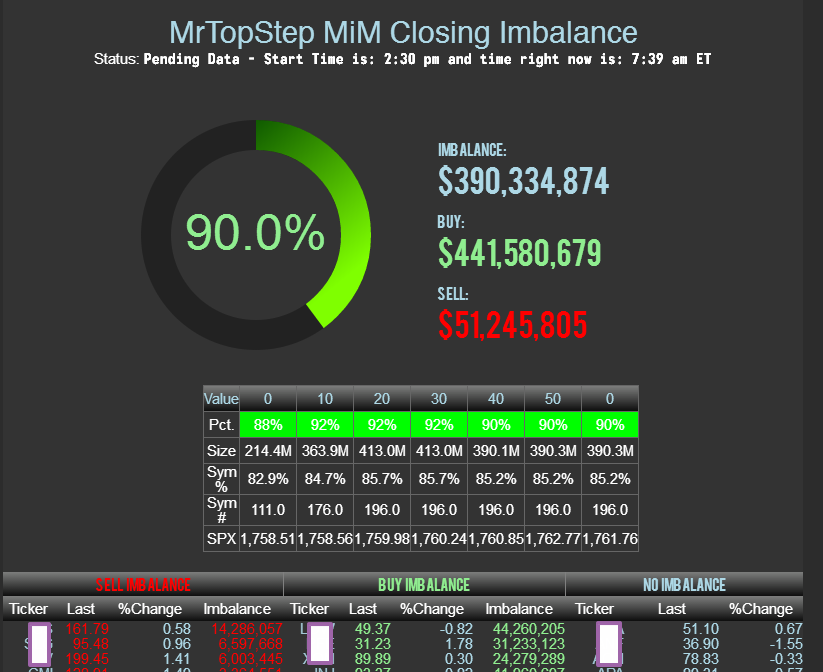

Our market imbalance meter product (MiM) is both an early indicator of how the closing auction is shaping up and at 3:45 pm ET is a real-time indicator on the success of pairing going into the final second of computer matching. Using early data disseminated to the NYSE floor brokers, we aggregate them and paint a predicting size of the pending imbalance. This starts with us around 2 PM ET. While the absolute numbers might not align, that is the dollar size of the imbalance it is really the breadth of the commitment that we are most interested in. If the number of symbols aligns 2:1 on one side or the other, buy or sell, then we begin to look at the size of the imbalance as directional indication of a move starting at 3:45 PM ET.

The above example is a good look where we had $441M shares to buy, but only $51M to sell. That left 90% of all the imbalance dollars on the buy-side. That is dollar breadth all in one direction. Equally the symbols were 87% to buy. Big money coming into the market to buy.

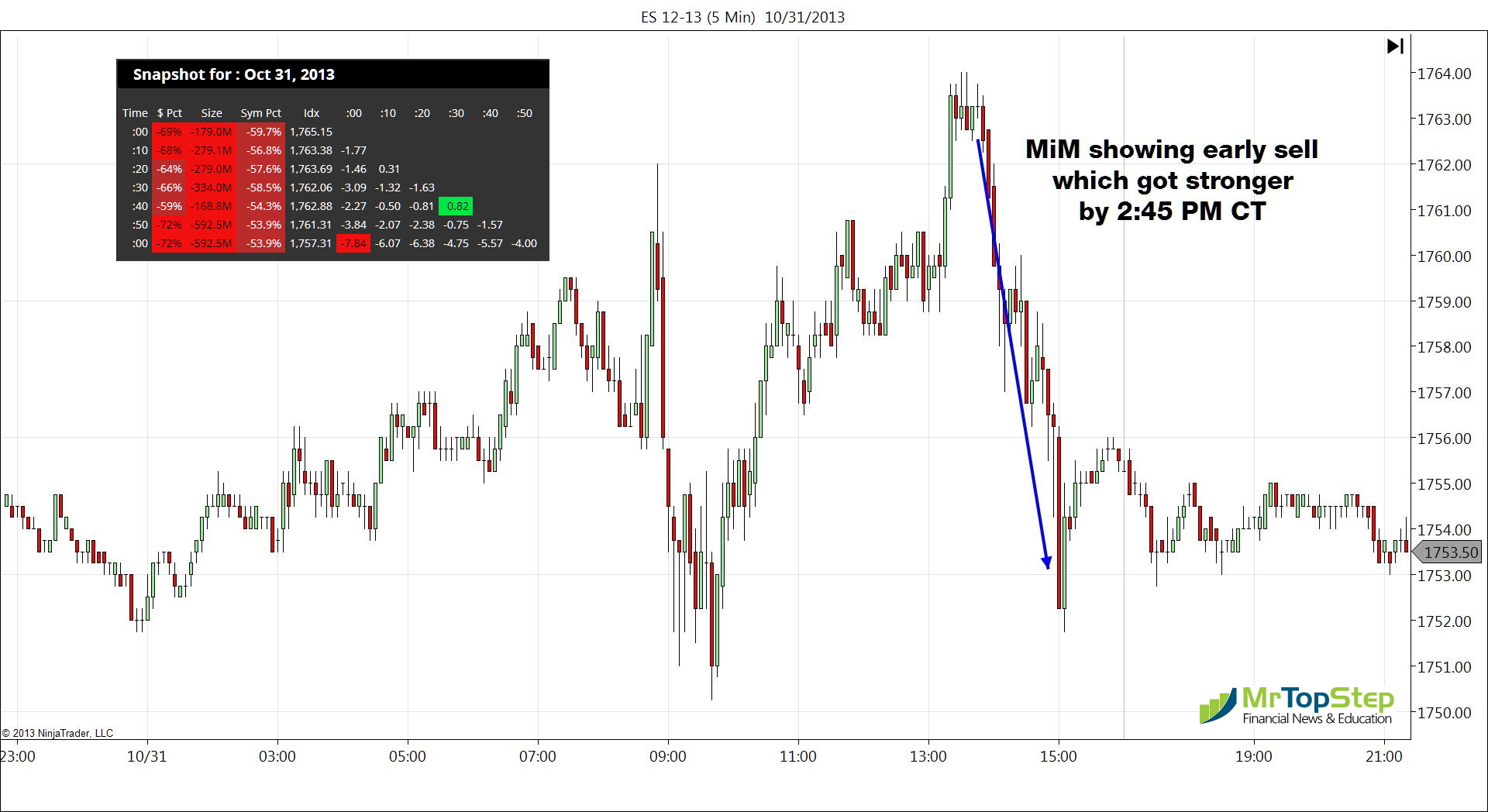

Another example of how the MiM works

On this particular close the MiM came out big to the sell side and continued to that way into the 3:00 cash close. As you can see the ES did exactly the same thing. As the MrTopStep Imbalance meter moved further to the sell side the S&P’s went straight down.

If you were on top of the trade you could have sold 1763.00 to 1763.00 and by the close the ES was trading nearly 11 handles from where the first MiM reading came in at.

If you trade the last hour of the close blindly, without knowing if there is a brewing storm to come out at 3:45 PM ET, you best watch out. The close is a mechanical thing in some ways. A large volume of equity is going to transfer in the final 15 minutes of the cash market. Large buy imbalances are going to have to find sellers, and sellers live higher up the bid/ask ladder. Large sell imbalances and where do they live? Lower on the bid/ask ladder.

MrTopStep has a couple trading rules we want to share with you:

- Get in, get out, don’t fall in love with your position

- A profit is a profit no matter how small it is !!

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.