Only in few days, Americans will choose their new president. In my opinion, this election is one of the most important events in decades. Since Kennedy, you can see that the choice of candidates represented only the interests of the establishment. This time it may be different due to Trump’s promises to limit the dominance of the wealthiest 0.01% part of society. I do not believe he is the ‘saviour’ of the middle-class as he pretends to be. It is rather strategic of him to use growing discontent in the ever divided society. The drastic difference between 90% of American workers and top bracket is the main reason for dissatisfaction.

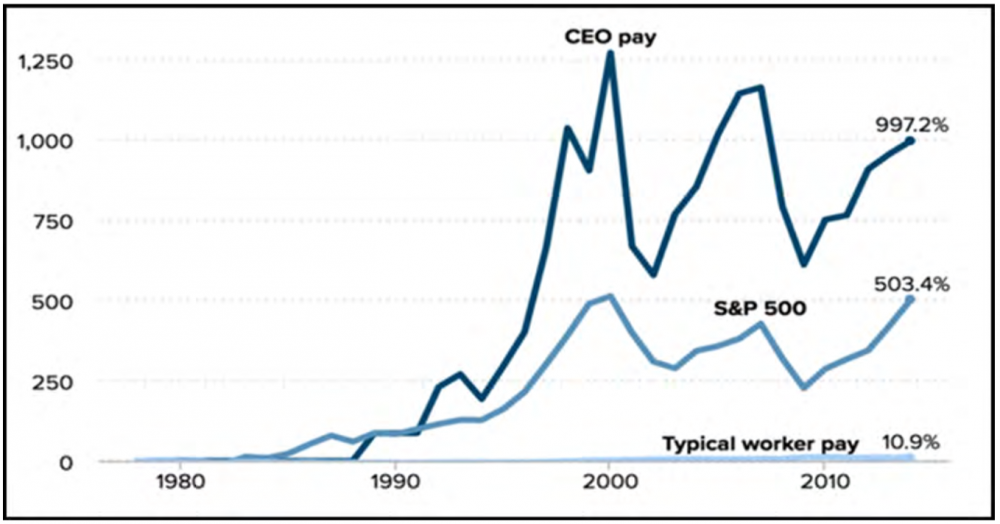

The chart below shows how big the chasm is between average Joe and S&P 500 workers.

Source: Economic Policy Institute

During the 1978 – 2015 period, the pay of the employee of the biggest corporations skyrocketed from 500 to 1000%. Most Americans barely saw any difference during this 37 year period!

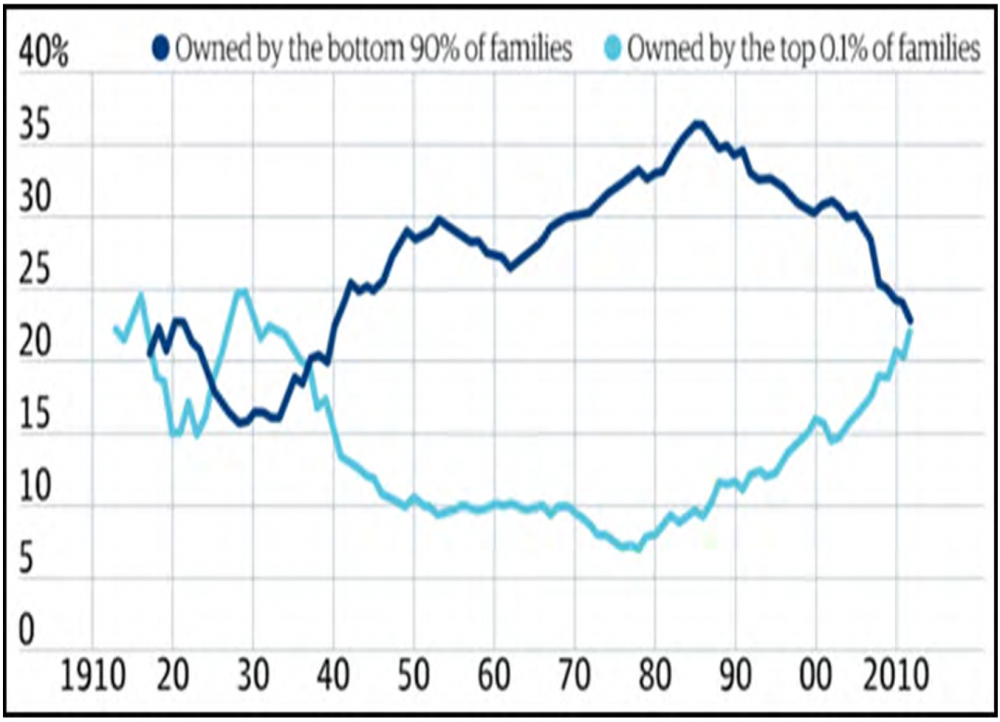

This pay chasm quickly translated into wealth disproportions, see below:

Source: Washington Center for Equitable Growth

As a result of disproportions in earnings, wealth distribution and active attempts to save big banks and conglomerates we see something emerging for the first time since decades. Someone from outside of the establishment who does not represent the interest of said establishment has a chance to win the election.

This situation presents a threat to the power elite and the deep state and naturally the reaction is to discredit and stop non-establishment challenger.

All mainstream media uncritically chose to side with Clinton resembling propaganda machines working overtime just like in Third Reich rather than applying the same standards for both presidential nominees. Clinton and Trump are going head to head in this race, but you will not know this from the polls because practically every single one of them tells you that Clinton is leading. These polls are published by third parties which already made headlines during the referendum in the UK in July when they were unequivocally showing Remain camp as a winner. Soon after Brexit won.

Independently of who wins we should be ready for both scenarios and policies they represent:

Clinton wins

a) Geopolitics:

In case next president of the US will be a Democrat, we shall see a dangerous continuation of what we experience today. The US will continue fulfilling their role so characteristic for falling empires: provoke conflicts with potential enemies as long as there is a chance to hold onto the status of the only superpower in the world. The conflict resembles the Cold War - NATO on one side and Russia with China on the other. A destruction of the Middle East will continue.

The war in Syria is about two things. Firstly, it serves a purpose of cutting Russia from the Mediterranean Sea (Russian naval base in Tartus – Syria). Secondly, a takeover of Syria enables the US to build a pipeline from Qatar to Europe pushing aside Russian Gazprom as a monopolistic seller of energy to Europe. This battle will shape future of Europe and will continue until one side decidedly wins.

Similar battlegrounds are in India, Brazil, RSA and Iran. We should not expect military conflict there but rather an attempt of the US to dismantle the alliance of BRICS emerging as a significant threat on the international stage. Replacing democratically elected president of Brazil with a puppet selected by Washington is only a prologue.

In terms of trade, the Clinton administration has to push for more deals like TTIP or CETA. In general, they do not improve the situation of most signatories and definitely not their citizens but prioritise lobbied interest of international corporations and those who contributed millions to the Clinton campaign.

Citizens of the United States should see a continuation of a slow decay around them. The degradation of the middle-class is going to advance with big banks and corporations with privileged with access to politicians will enjoy a passive administration ready to help them go unpunished if necessary. A huge budget deficit of 1.3 trillion USD for 2016 Clinton has to raise taxes. This will affect the middle-class and poorer people.

In the US, one of the top corporate tax brackets is at 35%. However, the biggest institutions from Wall Street pay an average of 1.8% thanks to their international structure. One of the biggest factor that limits the development of SMEs are overregulation and high taxes.

After so many scandals, Clinton has to clean up several federal agencies to continue her presidency. The FBI has enough material to lock Clinton in prison for years. I am thinking about the Clinton Foundation, private servers and mysterious deaths of people who were close to testifying against Clinton. The CIA has no warm feeling towards Hillary due to her private servers, resulting in several operations and a number of agents being burnt or eliminated.

If not for Hillary's privileged status she would have already enjoyed charges of treason – and punishment they entail. All in all, those two agencies must be reshuffled unless another Clinton presidency will end in impeachment.

b) Financial markets – the coming weeks

Clinton win leads to preservation of the status quo also in the financial market. Investors hate changes and uncertainty. Recently equities have fallen because chances of both candidates are tied. After possible Clinton win equities should react positively and give an additional few percent. The price of gold will fall below 1300 USD. I do not expect big changes because the financial markets have already discounted future turmoil based on the polls giving the win to Clinton.

Trump wins

In the beginning, I want to say that Trump is unpredictable. With that being said, he is a businessman who built an empire and knows how the economy works. Understanding that the resistance from privileged groups will be gigantic, will he have enough resolve to introduce at least one of his big changes he campaigns for?

One of the Trump’s flagship is to revoke deals which lead to de-industrialisation of the US in the last 20 years. While shipping off well-paid jobs to Mexico or China the middle-class was hit the worst.

Trump wants to cut taxes and increase competition among SMEs. It sounds very good, but I have to be sceptical because it sounds too good to be true. The real deficit is equal to 1.3 trillion USD (7% of GDP) and Donald wants to simultaneously increase infrastructure by spending another 250 billion USD.

Win of Trump increases the chances to end the conflict with Russia. In my opinion, this is one of the most important factors. This is not about the US or Russia but rather a possibility of a World War during which use of nuclear weapons is probable and not only possible.

One of the first steps to de-escalate the situation is to remove Western sanctions on Russia.This improves the situation in Europe with the biggest beneficiaries – Germany and France. Both of them will again take the dominant role in Europe and improve relations with Russia at the expense of smaller players like Middle and Eastern European countries.

Potential improvement of relations between Russia and the US will hurt China which only gains from the situation today. This may be the reason why China sees Trump as a negative factor for them.

Trump is openly anti-globalist and his win can speed up trends set by Brexit. A few months ago Europeans realised that corrupt and bureaucratised EU may not last forever. Another clear signal from the US may improve the standings of anti-establishment parties in Europe like German AfD or Italian M5S resulting in Italy leaving the EU.

A big unknown is the case of the Fed’s independence. Trump is a big critic of the central bank’s policy, but I doubt he has what it takes to introduce groundbreaking changes in the monetary policy in the US. Today’s situation is indeed catastrophic, the dollar is holding its value only thanks to backroom dealings of the Exchange Stabilization Fund and massive QE in Europe, Japan, and China. Trump is not stupid and knows how attempts of previous presidents that challenged the Fed ended.

Undoubtedly, he will push for a purge in the banking sector. Banks and their CEOs buying their freedom with fines now will have to go to jail. This is going to score a lot of points for Trump. President Trump means a lot of troubles for Clinton as the circle of people above the law is already quite big.

Financial markets – the coming weeks

As mentioned before, investors believe Clinton will win tomorrow and they prepare for this scenario. If Trump wins market will be hit by uncertainty and no definitive answers.

This will result in red colour in all stock exchanges around the world and climbing gold price. We can draw parallels with the Brexit referendum. The biggest loser apart from equities will be Mexican Peso. Trump already announced canceling the trade deal from which the South neighbour benefits a lot.

Medical and insurance sector are going to be hit the most in the United States. Sectors that made a huge profit off Obamacare now will face - another flagship project of Trump - the repeal of the ACA.

Soon, I will write about the prospective increase of the interest rate by the Fed as the chances for that are rising also if Trump wins. Throughout 2016, I was betting that even after the Fed announced to hike rates 4 times this year, there will not be even one. For 10 months, the Fed failed to raise rates.

The situation in the market changed dramatically and now Yellen may not have any other choice but to ‘pull the trigger’ in December and add another 0.25%. This move would start a wave of equity sales all over the world. The one to blame? Trump and his unpredictable, chaotic plans regarding the financial sector.

Summary

Prices of equities and precious metals indicate Clinton win. Trump is a mystery for everyone. His chances to win increased in the recent weeks but according to the polls, he is still in the red. The establishment does everything it can not let go of power it holds. Media aligned themselves with Clinton, the voting system is prone to fraud as many people can vote in different states without showing their ID and even deceased people sometimes contribute to elections.

In contrast to Europe, in many states there is no requirement to identify voters. If you are on the list, all you have to do is say your name and the voting booth is all yours. There have been instances where the machines counting votes showed thousands of votes in favour of one candidate and ZERO cast for his opponent. Stalin’s saying seems to be a description of modern US:

It's not the people who vote that count. It's the people who count the votes.

On the one hand, we have the system promoting Clinton, but there are also different kind of powers on the opposite side. For some unknown reason, the FBI was allowed to roll out their biggest guns against Hillary. There seems to be a big struggle behind the curtain that will affect the future of the USA and the globe.

Investors believe in Clinton’s win. If she wins and election are deemed legal, markets will not experience any shocks. In case of Trump winning the election shorting equities and going long on gold and miners is a good idea. There are a lot of methods, but I prefer to use options which are relatively cheap and safeguard me against the market consensus in that Clinton wins tomorrow.

Tomorrow we will know everything. Although I consider myself apolitical, I would vote for Trump as I cannot imagine more dangerous and corrupted president - a puppet catering to the needs of central planners - than Clinton. I am far from being a fan of Donald Trump, but within the choice of two candidates having the highest likelihood to win I prefer someone who actually can identify sources of problems and at least look for a solution rather than initiate military conflicts to turn society’s attention from the tragic economic situation.