Bitcoin has blasted through the $10,000 barrier in record time and is now nearing $11,000 at a rapid pace, possibly even by the time you read this.

Wall Street's resident bitcoin buff Mike Novogratz has moved his target to $40,000 by the end of 2018, stating that not only is this a bubble but that the bubble is going to get a lot bigger from here due to the global nature of this unique asset.

Whether it is indeed a bubble or something else entirely remains to be seen. What I can tell you from my conversations with clients is that more and more people are starting to see bitcoin as money and the potential to replace the current fiat central banking system that has gotten out of hand.

Once we clear this hurdle the BTC exchange rate to the US Dollar might be less relevant as merchants would then fix prices in a more stable currency. One that isn't designed to lose value over time.

Market Overview

Missiles Vs Money

Closing a Deal

BTC Traffic

Please note: All data, figures & graphs are valid as of November 29th. All trading carries risk. Only risk capital you are prepared to lose.

Market Overview

Donald Trump's tax plan cleared another hurdle yesterday and the bill is now set to hit the Senate floor for an official vote, possibly by Thursday.

Concurrently, North Korea launched another missile at Japan yesterday. The projectile flew for 53 minutes before landing 210 Kilometers off the coast of Japan's Exclusive Economic Zone.

Kim Jong Un now claims that he can reach any part of the United States, Trump says everything is under control and he's handling it.

The markets were very impressed with the Tax Plan update and disregarded the missile test. The Dow Jones rose by an impressive 1.09% (yellow circle) and even the markets in Asia are firmly in the green this morning.

A quick glance at the price of gold will confirm that the markets are not feeling any sort of heat from the DPRK. Though the pattern shown in the rectangle is very bullish, gains have been gradual lately and there certainly isn't any flight to safety as of yet.

Brexit Deal

The EU and UK have cleared their own hurdle coming closer to a divorce settlement for Brexit. Negotiators have now agreed to an outline for what the framework should look like.

Theresa May is set to meet with the President of the European Commission for lunch on Monday where she will propose the deal. The ball will then be in Europe's court. Optimists believe that the final agreement may be revealed at an EU summit happening in mid-December.

Details of the deal are still scant but rumors are that one of the most tricky points to resolve remains the Irish Border. As long as the UK remains an EU member the border between Ireland and British Controlled Northern Ireland remains rather free. However, what that border will look like come March of 2019 is a huge point of contention.

The Pound Sterling is running its own marathon this morning confirming an upward trend that has been forming for the past two weeks (chart below). If this deal goes through the Pound could have lots of room to rise before reaching its pre-brexit-referendum levels.

Cryptomania

Today's highlight in the crypto-market is Litecoin, which has just reached a new all-time high.

Though it's rise has not been as impressive as bitcoin, it's protocol is better making it a more sustainable option for payments and an excellent addition to any alternative investment portfolio.

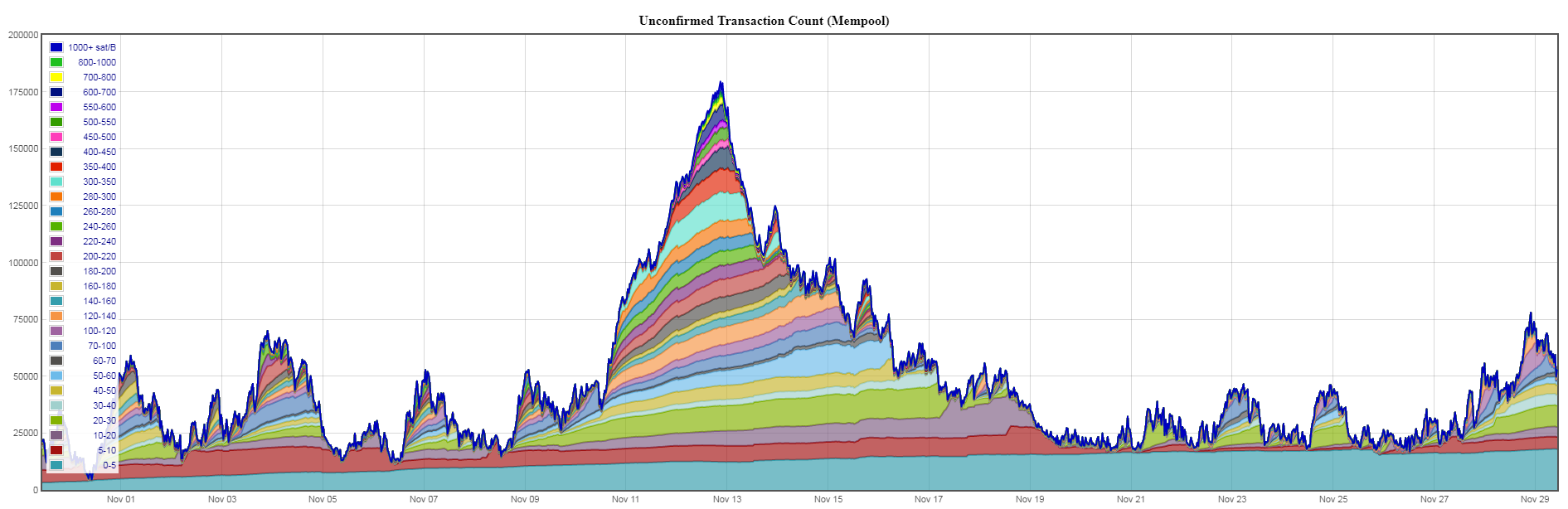

As we watch BTC's parabolic rise, one important thing to consider is the network's ability to process transactions in a timely fashion. We've seen times of congestion get in the way of price rises before so let's take a look.

At the time of this writing, there are approximately 50,000 unconfirmed transactions waiting to be processed on the bitcoin blockchain. The following chart shows the number of transactions in the queue, known as the mempool.

The large hump in the middle began on November 8th when the Segwit2x hard fork was canceled. Subsequently, some minors switched to Bitcoin Cash for quick gains.

Though 50,000 transactions is not incredibly large, given the current excitement around digital gold this number does have the potential to rise quite quickly. If that does happen, it will be interesting to see how many people are willing to buy in when they have to wait hours or days for the transaction to go through.

Perhaps they'll be patient and continue to buy in, but there's a real chance that IF we do see congestion and IF it is seen as a weakness it could possibly spark the pullback that many seem to be waiting for.

Just keep your eyes on the mempool chart, which as my 4 year old daughter pointed out, oddly resembles the cover of a Dr. Seuss book.

As always, social trading is all about sharing information so please continue sending me your insight by Email, chat, and your favorite social network.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.