Market Brief

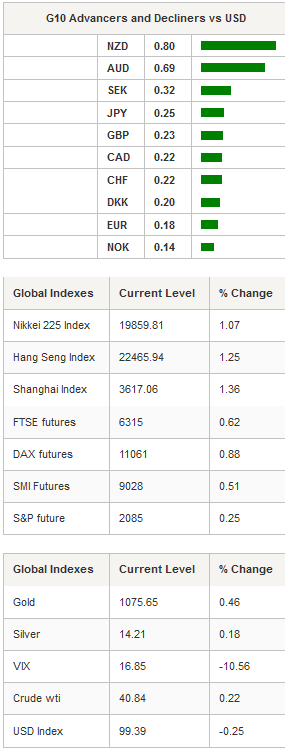

Risk appetite has come surging back as the October FOMC meeting minutes indicated strong US economic fundamentals and members more united on rate path. The clarity provided that on a gradual pace of interest-rate hikes boosted risk sentiment. The S&P 500 index rose 1.6%, the strongest rally in four weeks and US rates remained steady. The positive tone was carried into the Asian equity session as stocks are green across the board. The Shanghai led the gains up 2.13%. The positive risk sentiment caused the USD to weakness across G10 (commodity currencies seeing the largest gains) and EM currencies. USD/JPY fell to 123.10 from 123.64 after the BoJ held policy unchanged. Bullish momentum in the AUD/USD generated a short squeeze, pushing the pair up to 0.7177. With the market considerably short AUD, further forced liquidations of shorts are possible. Swiss trade balance widened to 4.1bn from revised higher 3.25bn. Exports swelled 5.4% from 0.2% prior read, while imports increased 3.5% from 2.6%. On an annual basis, both exports and imports declined by -1.5% and -5.3%, respectively in October. USDCHF fell to 1.0148 from 1.0200 and EUR/CHF dropped to 1.0861 indicating strengthening of the CHF on this positive trade results.

The FOMC meeting minutes all but finalized a 25bp rate hike in December in our view. Most policy makers anticipate that the US economic environment and outlook would support a rate hike in December. The minutes indicated that the changes in the October forward guidance were "intended to convey the sense that, while no decision has been made, it may well become appropriate to initiate the normalization process at the next meeting…". There was some disagreement on the outlook for inflations among members although the group generally agreed that inflation would gradually return to 2.0%. Elsewhere, Fed’s Lacker commented on CNBC that emphasis on global risk had been overstated. Lacker stated, "We’ve been through episodes like this before in which some disruption of a certain geopolitical or military nature affects things. For a time people can get cautious and pull back a little bit. These tend to be transitory." The clarity provided by the minutes provided reprieve to the markets allowing USD to sell-off marginally.

The BoJ held its policy strategy unchanged to increase the monetary base at an annual pace of ¥80tn. The central bank again sounded optimistic on its assessment for mild economic recovery, supported by housing investment and private consumption. Yet, in terms of inflation the BoJ admitted that "some indicators have recently shown relatively weak developments". Despite the positive front we anticipate that the economic slowdown will force the central bank to ease further in 2016.

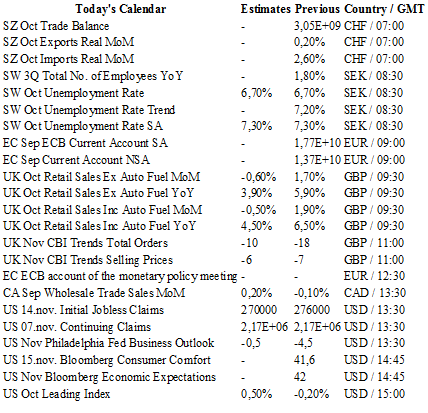

In the European session, UK retail sales are expected to fall by -0.5% m/m in October. The decrease in private consumption could trigger EUR/GBP buying as positioning is heavily short. Sweden unemployment rate should remain unchanged at 7.3%, suggesting that our bearish EUR/SEK view is stable.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0668

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5206

S 1: 1.5027

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 123.27

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0240

R 1: 1.0129

CURRENT: 1.0133

S 1: 0.9739

S 2: 0.9476