USD/JPY has posted slight gains on Friday, as the pair trades at the 116 line. On the economic front, there are no Japanese releases to wrap up the week. In the US, the spotlight is on employment numbers, with three key events – Nonfarm Payrolls, Average Hourly Earnings and Unemployment Rate. Traders should be prepared for possible volatility in the currency markets in the North American session.

The US dollar retreated in the Thursday session, following the release of the Federal minutes from the December meeting. The Japanese yen joined the bandwagon, gaining 1.5% on Thursday. The Federal Reserve minutes were cautious in tone, with Fed policymakers essentially saying that monetary policy in the coming months will be dictated in large part by the economic platform of the incoming Trump administration. FOMC members are concerned about higher inflation levels, given the “prospects for more expansionary fiscal policies in the coming years”. This is a clear reference to president-elect Trump’s plans to increase fiscal spending and cut taxes, which would likely result in higher inflation, something the US hasn’t had to deal with for years. Still, policymakers appear unchanged in their view that gradual rate hikes remains an appropriate monetary policy. The Fed members acknowledged that there is “considerable uncertainty” regarding future fiscal and economic programs. Many analysts are predicting another rate hike in June, but this could of course change, depending on the performance of the US economy in the first half of 2017.

Friday (January 6)

- 8:30 US Average Hourly Earnings. Estimate 0.3%

- 8:30 US Nonfarm Employment Change. Estimate 175K

- 8:30 US Unemployment Change. Estimate 4.7%

- 8:30 US Trade Balance. Estimate -42.2B

- 10:00 US Factory Orders. Estimate -2.1%

- 12:15 US FOMC Charles Evans Speech

*All release times are GMT

*Key events are in bold

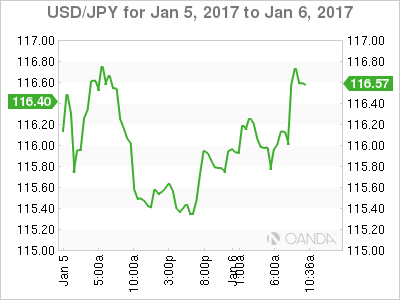

USD/JPY for Friday, January 6, 2017

USD/JPY January 6 at 6:00 EST

Open: 115.34 High: 116.39 Low: 115.23 Close: 115.96

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 113.80 | 114.83 | 115.88 | 116.88 | 118.05 | 118.85 |

- USD/JPY posted gains in the Asian session. In European trade, the pair posted gains but has retracted

- 115.88 is a weak support

- 116.88 is the next resistance line

- Current range: 115.88 to 116.88

Further levels in both directions:

- Below: 115.88, 114.83 and 113.80

- Above: 116.88, 118.05, 118.85 and 119.83

OANDA’s Open Positions Ratio

USD/JPY ratio is unchanged in the Friday session. Currently, short positions have a majority (54%), indicative of slight trader bias towards USD/JPY continuing to move to lower ground.