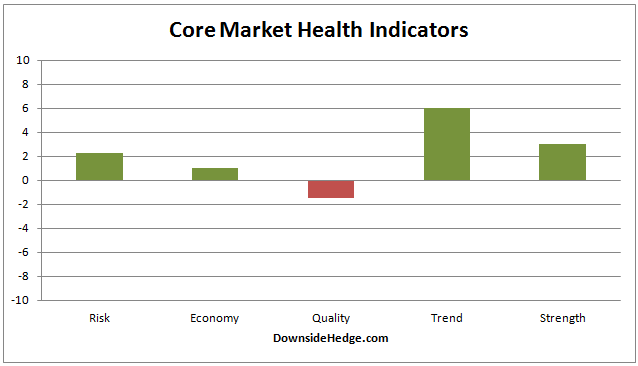

Over the past week my core market health indicators continued to fall. Most notably was the measures of market quality, which fell below zero. This changes the core portfolio allocations as follows:

Long / Cash portfolio: 80% long and 20% cash

Long / Short Hedged portfolio: 90% long high beta stocks and 10% short the S&P 500 Index (or use the ETF with symbol SH)

Volatility Hedged portfolio: 100% long (since 11/11/2016)